Crypto Taxes: Bitcoin Investors Get An Additional Month To File From IRS

Bitcoin and other crypto assets are in a bull market, and anyone who bought in during 2020 is in some serious profit for the tax year. Lucky for them, however, is that the IRS has extended the tax filing deadline in the United States, giving investors a bit more time to get their statements reconciled, and reporting organized.

Here’s all crypto investors need to know about the tax deadline extension, and what that they need to report.

Breaking Down The Bitcoin Tax Burden You Might Not Be Aware Of

Investing in cryptocurrencies like Bitcoin, Ethereum, and altcoins is so simple, anyone can do it by downloading Coinbase or Cash App and making a few swipes and clicks.

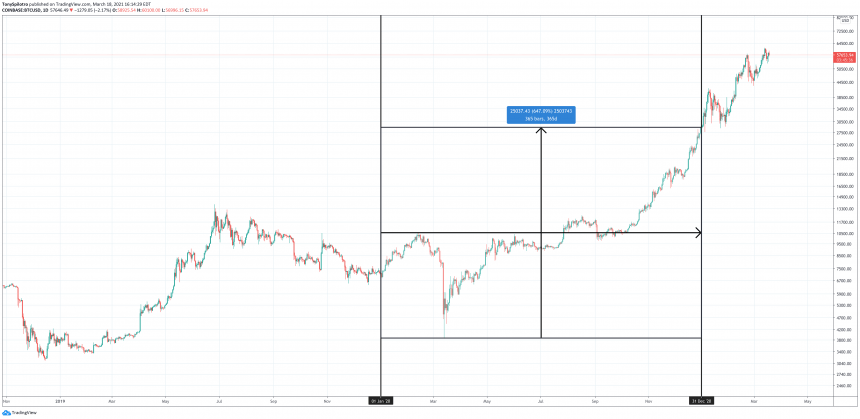

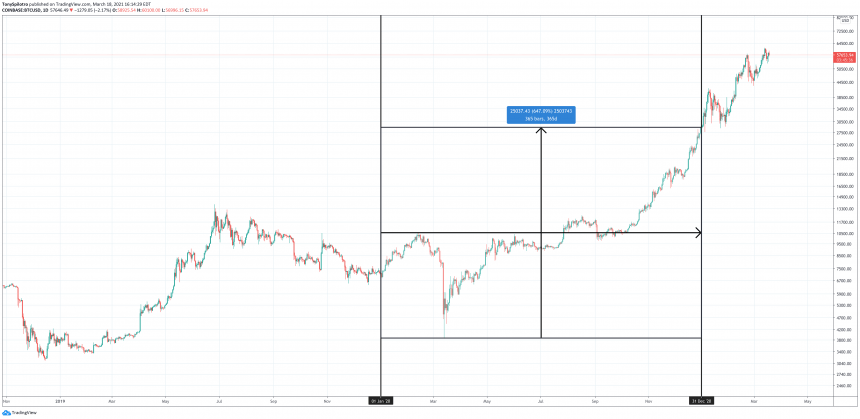

Despite the accessibility, these are assets that are serious business when it comes to accounting and taxes. Any return on investment earned on cryptocurrencies by cashing out, is immediately a taxable event involving capital gains.

Related Reading | Why US Crypto Investors May Need To Consider Amending Past Tax Returns

Each trade made between one type of coin to another, every time BTC is spent on goods, and even some wallet transfers can be considered taxable events. Airdrops, if and when sold, are an entirely taxable capital gain.

The rate at which capital gains are taxed also vary based on a variety of factors, such as short or long-term.

If you bought coins between the two lines, then you could owe capital gains taxes | Source: BTCUSD on TradingView.com

Simply put, the laws and processes surrounding cryptocurrencies are a real sore spot on the technology currently, and are confusing at best. Congress members have blasted the IRS in the past, but tax code has yet to be updated to match the emerging technology, even though filing documents now require you to disclose if you hold such “virtual” assets.

Failing to disclose, or disclosing improperly, can lead to fines, or worse. Luckily, the IRS has extended the tax filing deadline in the United States until May 17, 2021, from the normal April 15 deadline.

The IRS commissioner claims that the move was done to “help taxpayers navigate the unusual circumstances related to the pandemic, while also working on important tax-administration responsibilities.”

This gives crypto investors another month to get their statements in order.

What To Do If You Still Haven’t Prepared Your Crypto Taxes

Procrastinators sighing in relief and wondering where to now begin can turn to tax prep services like Bitcoin.tax, or can consult with any certified CPA for guidance. Bitcoin.tax plugs into popular exchange APIs like Coinbase and Binance, doing some of the footwork and accounting for you, however, you’ll need to track any airdrops and other transactions manually using the software.

Related Reading | If This Is You, You May Not Need to Report Crypto Tax Gains to the IRS

For those that have bought Bitcoin, but done nothing but hold, you’ve got nothing to worry about right now. Simply buying and holding crypto isn’t a taxable event itself.

But if and when you do sell your coins of any kind, whether its into Bitcoin or altcoins, or back into cash, you’ll have some reporting to do at the end of the tax year, in which you’ll still want to hold onto the above intel for when you eventually need it.

We’ve done our very best to provide some guidance on who needs to report what, but there’s no substitute for advice from a certified CPA who understands crypto tax law. Be certain you understand all reporting requirements, as only you are ultimately responsible for your taxes.

Featured image from Deposit Photos, Charts from TradingView.com