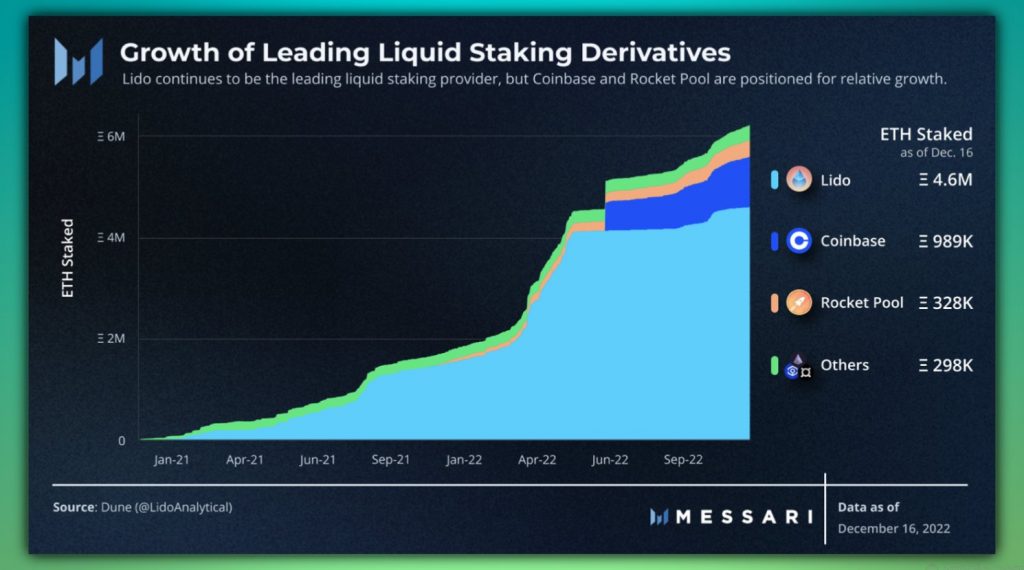

A look at the top performers over the past 24 hours reveals a trend that could trigger a boom among certain altcoins in 2023. We’re talking about Lido Finance (LDO), which has risen 7% in the past 24 hours and 17% over the past seven days, making it the 37th largest cryptocurrency by market cap. Lido Finance is a decentralized liquid staking application that allows users to generate additional yield for staking their assets. The application currently offers support for five cryptocurrencies: Ethereum (ETH), Polygon (MATIC), Solana (SOL), Kusama (KSM), and Polkadot (DOT). Of particular interest, however, is the first-mentioned altcoin, Ethereum. As Thor Hartvigsen, blockchain and defi researcher, explained, Liquid Staking Derivatives (LSD) altcoins could see a boom in 2023 as the second largest cryptocurrency by market cap implements the Shanghai upgrade. Of all major layer-1 blockchains, Ethereum has the lowest staking ratio of only 14%. In contrast, 90% of all BNB, 72% of all ADA, 68% of all SOL, and 62% of all AVAX are staked. The huge gap is likely related to the fact that ETH cannot yet be de-staked. However, the Shanghai hard fork planned for March will change that. Related Reading: These Altcoins Will Be Hit The Hardest If DCG And Grayscale Fall While the analyst expects a major unstaking initially, the upgrade could trigger massive growth for liquid staking solutions in the long run. And Lido Finance (LDO) is currently the undisputed leader in the liquid staking of ETH, providing further rocket fuel for the LDO token. Altcoins Poised To Skyrocket Based On The Narrative However, not only the LDO but rather small LSD altcoins could benefit from the new narrative. As anonymous analyst “Karl” says, numerous LSD solutions are poised to wobble at the throne of Lido Finance. Currently, LDO’s market share is about 65.62%, followed by Rocket Pool (3.10%), StakeWise (0.9%), Ankr (0.81%), Frax Finance (0.67%), and Stafi (0.25%). As the analyst assesses, the market caps of the altcoins Stakewise (SWISE) and Stafi (FIS) are still below $20 million, despite the fact that they control significant market share. “[T]heir tokenomics aren’t the best though, as there is still a considerable portion of the supply to be unlocked as team/investors’ allocation and liquidity mining rewards,” the analyst added. A look at the market share/market cap ratio also shows that both SWISE and FIS tokens are close behind the market leader, poised for future gains. Also remarkable is Frax Finance, which recently entered the LSD landscape of altcoins and has already managed to capture a significant market share. Hartvigsen stated that in less than 2 months, Frax has managed to attract more than 45,000 ETH (about $55 million TVL). According to the analyst, there are “no signs of slowing down” as APRs are consistently at 9-10%, far outperforming any competitor. Frax Finance accomplishes this by giving users frxETH when they are either liquidity pooled on Curve (frxETH/ETH) or staked on Frax Finance (sfrxETH). Related Reading: Craziest Bitcoin Price Predictions For 2023, 1,400% Rally Possible? “Only sfrxETH receives the ETH staking yield. This results in a higher APR as not all of the staked ETH is receiving the rewards as they are in the curve pool instead,” the analyst explained. But Rocket Pool is also a prime candidate to grow from the new narrative due to its relative size, recent popularity growth, and several differentiators, Hartvigsen added. Two Potential Spoilers For LDO However, in the near term, there could be two spoilers in particular for the price of the Lido Finance token, LDO. Both Nansen and Chain EDGE on-chain data shows that “smart money” has been selling LDO rather than buying it, Twitter user @AvaxGems pointed out. I guess not all of us are bullish on LSD coins. Both @nansen_ai and @ChainEDGE_io(by @OnChainWizard) showing “smart money” been selling $LDO rather than buying. pic.twitter.com/9k0nt0tHpG — rektGEMS🔺 (@AvaxGems) January 3, 2023 A second factor for LDO could be Alameda. The ex-company of Sam Bankman-Fried sold 719,498 LDO on December 28, worth about $717,451, for 601 ETH, and currently still has 1.86 million LDO left, the equivalent of about $1.81 million. Featured image from Nasa / Unsplash, Charts from Messari, Twitter, TradingView.com