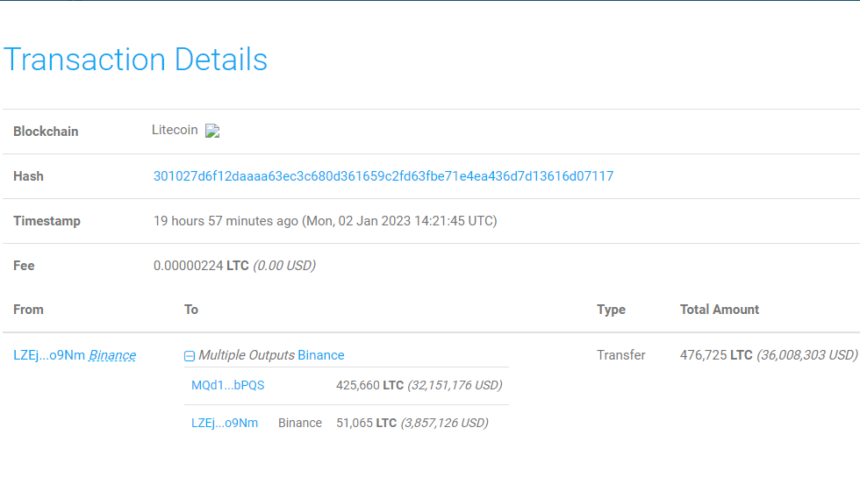

Data shows a Litecoin whale has withdrawn $32 million in LTC from Binance, a sign that could be positive for the latest rally. Litecoin Whale Takes Out $32M In LTC From Binance As per data from the crypto transaction tracker service Whale Alert, a massive LTC transfer has taken place during the past day. In total, the transaction involved the movement of 425,660 LTC on the blockchain, worth around $32.1 million at the time of the transfer. Related Reading: Billion-Dollar Hedge Fund Is Betting Against Bitcoin And Grayscale, Not Just USDT Usually, such large transfers are a sign of activity from the whales, and due to the sheer scale of coins typically involved in them, the movements can sometimes have visible impacts on the price of Litecoin. However, which way the price will respond to a transfer depends on the intent behind it. Here are a few additional details regarding the latest whale transaction that may shed some light on its purpose: Looks like this massive transfer only took a negligible fee of 0.00000224 LTC to be possible | Source: Whale Alert As can be seen above, this Litecoin transaction was sent from a wallet attached to the crypto exchange Binance, and its destination was an unknown wallet. An unknown address is any address not affiliated with a known centralized platform and is thus likely to belong to a personal wallet. Related Reading: Bitcoin Taker Buy/Sell Ratio Can’t Give Any Clear Signals As Demand Remains Low Transfers of this nature, where coins move from exchanges to personal wallets, are called exchange outflows, and since holders usually withdraw from these platforms for accumulation purposes, outflows can have a bullish effect on the price. Here, the exchange outflow was done by a whale, so it may mean that this humongous investor is planning to hold onto their Litecoin for an extended period of time. In the few days since the new year has started, LTC has been rallying up with the coin already reclaiming $75, so the whale not selling here to take advantage of this profitable opportunity and instead opting to accumulate suggests conviction from the investor that there is more to come for LTC. There has also been another bullish signal for Litecoin recently, and it’s that the monthly LTC transactions on BitPay, the largest crypto payments processor, have gone up by 109% over the past year. This means that the network has observed some sharp growth in terms of adoption, a sign that should be constructive for the price in the long term. In just one year, monthly Litecoin use, with the worlds largest crypto processor, increased 109% 🚀 pic.twitter.com/DBXe6OTdib — Litecoin (@litecoin) January 2, 2023 LTC Price At the time of writing, Litecoin is trading around $75, up 8% in the last week. The value of the crypto seems to have sharply surged in the last few days | Source: LTCUSD on TradingView Featured image from Rémi Boudousquié on Unsplash.com, chart from TradingView.com