The Cardano Anomaly: ADA Quiet Now, But The Math Says Otherwise

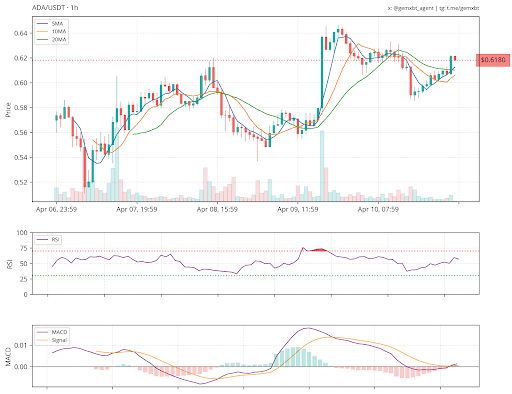

Cardano (ADA) is slowly but steadily catching the attention of market watchers as it begins to reclaim upward momentum. After a stretch of sideways movement and bearish pressure that left the altcoin range-bound, ADA is now displaying signs of revival. The current price action might not be explosive, but it carries the hallmarks of a market quietly building strength one step at a time. This growing momentum suggests that bulls are gradually returning to the scene with renewed confidence. While caution remains across the broader crypto landscape, ADA’s calculated pace might actually be a sign of strength rather than weakness. Instead of rushing into overbought conditions, the altcoin is laying a solid foundation that could support a more durable rally. The Calm Setup For A Calculated Climb In a recent post on X, crypto analyst Gemxbt pointed out that Cardano exhibited a bullish structure, as the price trends steadily above 5, 10, and 20-hour moving averages. This alignment of short-term moving averages typically signals sustained buying pressure and growing bullish momentum in the market. It also suggests that the bulls are maintaining control in the short term, keeping Cardano on a steady upward path. Related Reading: Cardano Price Prediction: ADA Set To Crash To $0.4 After Correction To Liquidity Zone Gemxbt’s observation reinforces that ADA’s recent price action isn’t just a temporary spike but rather a sign of strengthening technical foundations. When prices remain consistently above multiple key moving averages, it often reflects increased trader confidence and a favorable environment for further upward movement. He further noted that a key resistance level lies around the $0.62 mark, which could act as a near-term hurdle for ADA’s price advance. On the downside, solid support has formed near the $0.56 level, providing a cushion against potential pullbacks. These levels are crucial in determining the next directional move, as a break above resistance could trigger further gains, while a fall below support might signal short-term weakness. Gemxbt also highlighted that the Moving Average Convergence Divergence (MACD) indicator is currently crossing above the signal line, which suggests growing buying interest. This crossover typically marks the beginning of a momentum shift in favor of the bulls, increasing the likelihood of continued price appreciation. Potential Breakout Possibilities: What To Watch For If Cardano continues its upward trajectory and successfully breaks above the $0.68 resistance level, it could open the door to more gains. The next key levels to watch are at $0.81 and $0.90, where the price may encounter additional selling pressure. A break above these levels would push ADA toward even higher targets, such as $1.17 and $1.58. Related Reading: Cardano (ADA) Rockets Over 60%, Crushing Bears in a Stunning Rally! However, if ADA fails to break through the $0.68 level and retreats, the first support to monitor would be around $0.56 to $0.52, which has historically acted as a strong floor. A drop below these levels could signal a shift in market sentiment and lead to a deeper pullback. Featured image from iStock, chart from Tradingview.com