Ethereum Faces ‘Hyperinflation Hellscape’—Analyst Reveals Key On-Chain Insights

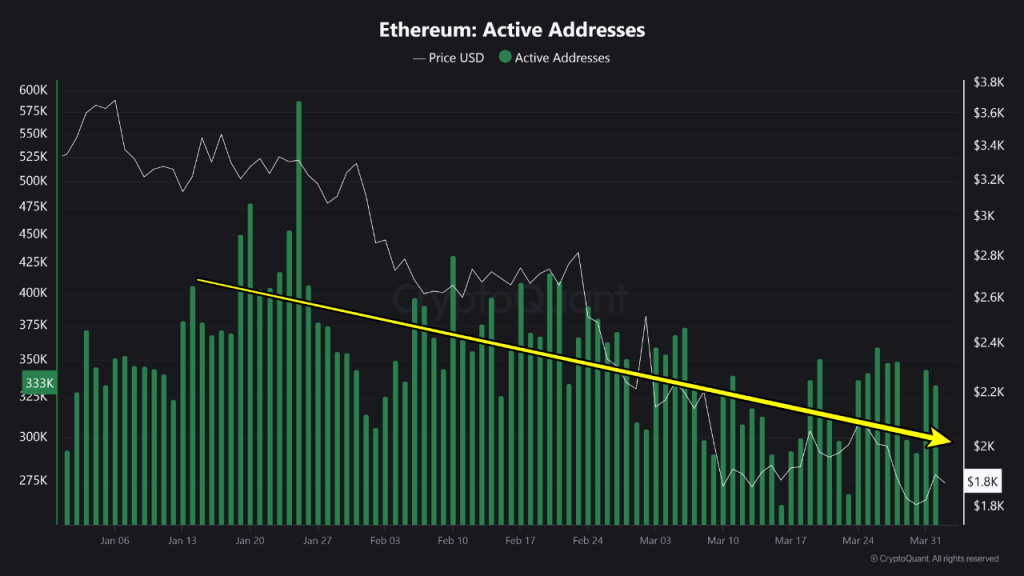

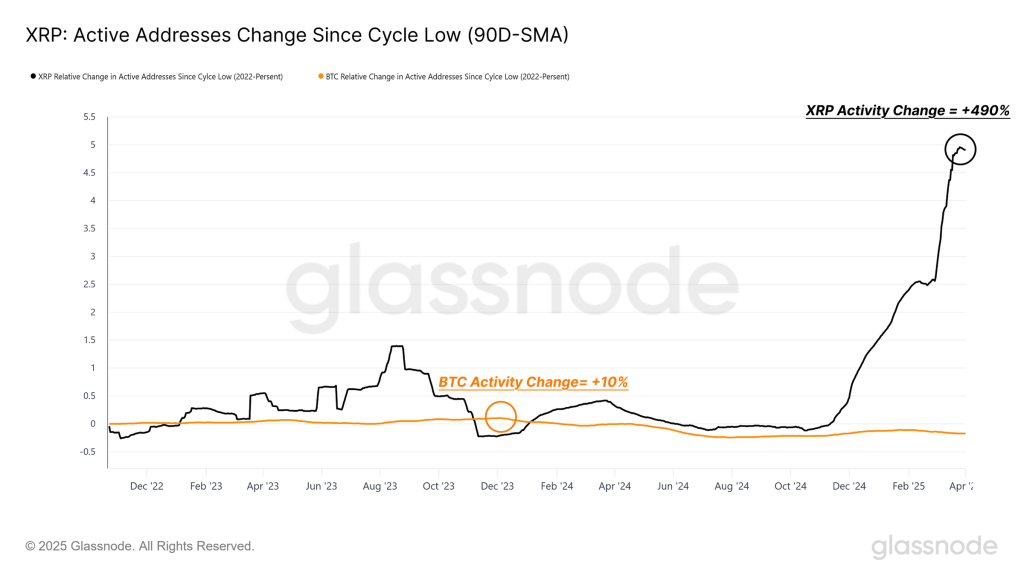

Ethereum (ETH) continues to underperform in the broader cryptocurrency market, currently trading just below $1,800 after falling 4% in the past 24 hours. Despite a strong start to the year, where the crypto market experienced bullish momentum, ETH has failed to sustain its upward trajectory. Since slipping below the $3,000 level, the asset has largely ranged downward and has now breached the $2,000 support zone, signaling weakening demand and sentiment. While Bitcoin and other major digital assets still managed to see some recovery efforts in recent weeks, Ethereum’s price decline has been accompanied by decreasing network activity and weakening on-chain fundamentals. This divergence has raised concerns over ETH’s short-term outlook and prompted a fresh analysis of the underlying causes driving the asset’s performance. Related Reading: Whales Dump 760,000 Ethereum in Two Weeks — Is More Selling Ahead? Fee Decline and Network Inactivity Fuel Inflationary Pressures CryptoQuant analyst EgyHash recently published a report highlighting key on-chain metrics that suggest Ethereum’s current market weakness is closely tied to its declining fee economy and user activity. According to the report titled: “Why Ethereum Is Bleeding Value: Fee Crash Meets Hyperinflation Hellscape.” Ethereum’s network is experiencing its lowest levels of activity since 2020. Daily active addresses have declined steadily since early 2025, and average transaction fees have dropped to record lows. This reduction in activity has led to a sharp fall in Ethereum’s burn rate, a metric crucial in offsetting inflationary pressures following the network’s transition to proof-of-stake. Related Reading: Ethereum Price Approaches Resistance—Will It Smash Through? The Dencun upgrade, which was expected to enhance network efficiency, has coincided with an extended period of low transaction volumes, further reducing fee income and contributing to higher net ETH issuance. EgyHash concludes that the confluence of weak network engagement, reduced burn rate, and high token inflation is central to Ethereum’s declining valuation. Why Ethereum Is Bleeding Value “Ethereum’s recent underperformance can be largely attributed to diminished network activity, as evidenced by declining active addresses and reduced transaction fees.” – By @EgyHashX pic.twitter.com/fgQJYCrOIn — CryptoQuant.com (@cryptoquant_com) April 3, 2025 Ethereum Technical Outlook Signals Potential Support Despite on-chain headwinds, some technical analysts maintain a cautiously optimistic view. Trader Courage, a technical analyst on X, noted that Ethereum is currently testing a major support zone and could rebound toward the upper resistance of its current trading range. $ETH / #ETH 1H chart 📊 Back at the green support line. Looks like we could be heading towards the top of the range. Key levels are on the chart.#Ethereum pic.twitter.com/rRX8b3b6nW — Trader Courage 🐾 (@CryptoCourage1) April 3, 2025 Another market analyst, CryptoElite, shared a long-term ascending trendline that ETH has respected historically. Based on this trend, the analyst believes ETH could still have the potential to rally to $10,000 later in the year, provided broader market conditions improve. Featured image created with DALL-E, Chart from TradingView