Tether Makes Bold Reserve Pivot Toward Bitcoin And Gold As Treasury Holdings Decline

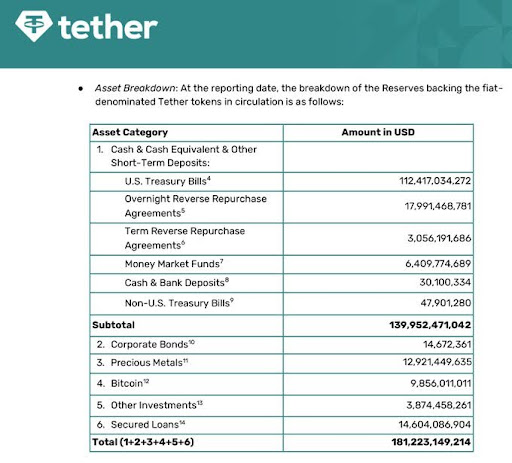

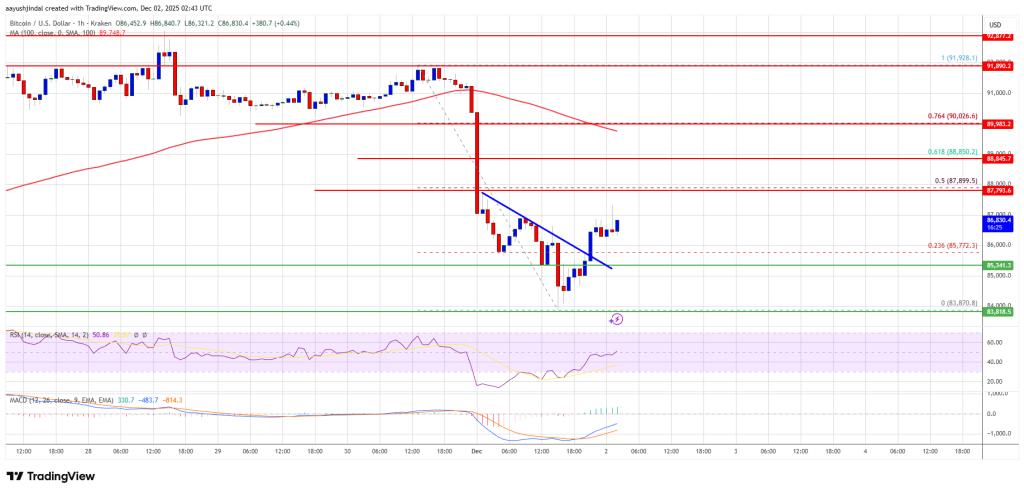

In a strategic move, Tether has shifted its reserve strategy, reducing its exposure to treasuries while increasing allocations to Bitcoin and gold. The USDT issuer has shown a notable reduction in government debt exposure, paired with an expanded position in hard assets known for durability and independence from traditional financial systems. Treasury Exposure Drops Amid Changing Macro And Regulatory Landscape Stablecoin giant, Tether, has reduced its US Treasury holdings and increased its Gold and Bitcoin reserves. CryptosRus reported on X that Tether is quietly repositioning itself for what the company expects to be the Federal Reserve’s (FED) next round of rate cuts. Related Reading: Rumble At The Core: How Tether Plans To Dominate The US Stablecoin Market According to BitMex founder Arthur Hayes, Tether’s latest reserve update shows a clear shift away from the US treasuries and deeper into BTC and gold, a sign that the company is positioning for a changing macro environment. Furthermore, the Standard & Poor (S&P) Global noted that Tether is now leaning more heavily into assets with larger price swings in value, warning that this mix could expose USDT if markets turn volatile. Meanwhile, the current S&P Global rating on Tether remains weak. Thus, Tether CEO Paolo Ardoino has pushed back, saying that the company holds no toxic assets. He claims that its rapid growth reflects a broader shift towards new financial systems that operate outside the traditional banking world. Why Attempts To Break Tether Are Difficult In Practice Crypto analyst Ted Pillows has also offered insight into the Tether Fear Uncertainty and Doubt (FUD) as it is making its usual rounds again. The narrative is latching onto the company’s latest attestation, showing a notable shift into Gold and Bitcoin to offset declining interest income. Meanwhile, if these risk assets drop by 30%, Tether’s equity buffer could evaporate, creating an environment where Tether will be insolvent, and panic will kick in. Related Reading: Tether Targets $500 Billion Valuation In New Equity Offering Amid US Expansion Plans However, Ted is steadfast and believes that Tether has been through a decade of this same FUD, and USDT is still sitting at $1.00. They’re fully liquid, but they operate on a fractional-reserve model, much like traditional banks. As long as redemptions remain normal, everything will work smoothly. A problem will only arise if there’s an irrational panic, and then liquidity stress could hit quickly. According to Ted, the USDT isn’t fully backed by cash, but it’s backed by a diverse portfolio that includes the US treasuries, yield-generating assets, and some risk assets. This is all scaled to a massive $174 billion stablecoin. “If someone wants to kill USDT, it’s possible, but I highly doubt it,” Ted noted. Featured image from Pixabay, chart from Tradingview.com