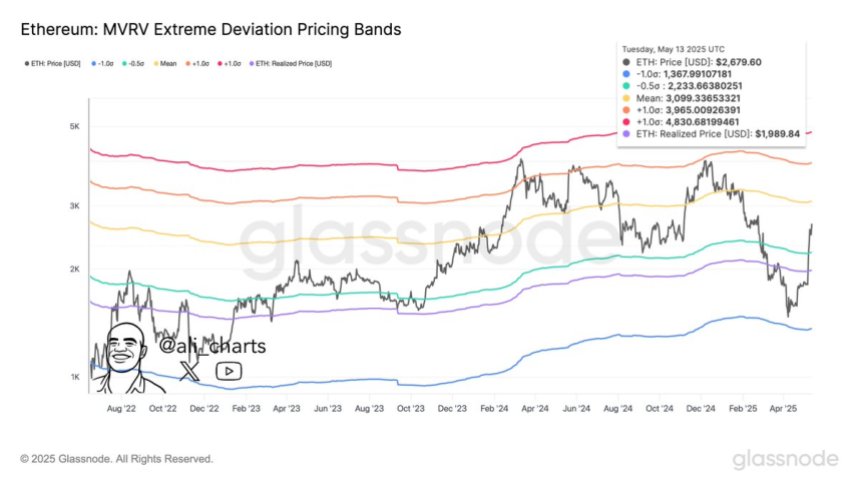

Ethereum MVRV Pricing Bands Show Key Resistance Around $3,100 Level – Details

Ethereum is trading firmly above the $2,600 mark after a surge in buying pressure over the past several days, marking a strong shift in momentum across the broader market. After months of choppy action and bearish sentiment, bulls are clearly back in control. ETH has reclaimed several key levels with conviction, signaling a potential continuation toward higher targets. Related Reading: XRP Open Interest Surges 41% As Speculation Grows – Over $1B Added In Just One Week Price action now looks structurally bullish, with Ethereum pushing through resistance zones that previously capped upside for weeks. This rally has reignited investor confidence and brought renewed attention to Ethereum’s medium-term outlook, especially as altcoins start to show strength alongside Bitcoin’s recent consolidation. According to fresh data from Glassnode, the next major resistance area to watch is at $3,100, where Ethereum is likely to encounter heavier sell pressure. This level, derived from pricing bands, now defines Ethereum’s current trading range and will likely dictate price direction in the coming sessions. With volatility returning and sentiment improving, Ethereum appears poised for a critical breakout or a decisive retest of support, depending on how bulls handle the next leg. Ethereum Nears Key Resistance As Altseason Expectations Grow Ethereum has rallied over 98% since its April 9th low, marking one of its most powerful recoveries in recent years. This explosive move has not only flipped sentiment from bearish to bullish, but also reignited speculation around a broader altseason — a period in which altcoins significantly outperform Bitcoin. After months of heavy selling pressure that began in late December, Ethereum is now showing sustained strength for the first time. The price has reclaimed critical levels, and momentum continues to build as traders and investors rotate capital back into ETH and other large-cap altcoins. Market participants are watching closely to see if Ethereum can maintain this pace and confirm a longer-term trend reversal. Top analyst Ali Martinez shared Ethereum’s MVRV Extreme Deviation Pricing Bands, offering a clear technical framework for what’s next. According to the data, the next key resistance level is at $3,100 — a region that could act as a short-term ceiling if buying pressure fades. On the downside, the major support zone sits at $2,233, a critical level to hold in the event of a pullback. As Ethereum continues to climb, these levels will become increasingly important. A clean breakout above $3,100 could open the door to a broader rally across altcoins, while a rejection or correction would likely test the market’s true conviction. For now, ETH remains in a bullish structure, supported by growing volume, on-chain signals, and renewed investor enthusiasm. The coming days will be crucial in determining whether Ethereum leads the charge into a full-fledged altseason. Related Reading: Solana Network Activity Grows As 11M Wallets Now Hold 0.1 SOL Or More – Analyst ETH Price Action: Testing Resistance After Massive Rally Ethereum (ETH) is currently trading around $2,604, consolidating after a sharp surge that lifted it from under $1,400 to a high of $2,725 in just two weeks. The daily chart shows that ETH is now approaching the 200-day simple moving average (SMA) at $2,702.60, which is acting as a key resistance level. This zone also coincides with recent local highs from early February, making it a critical area to break for further upside continuation. The recent rally brought strong volume and bullish momentum, with ETH closing multiple daily candles above the 200-day exponential moving average (EMA) at $2,435.66. This is a positive sign for trend reversal after months of sustained bearish pressure. However, today’s pullback signals that bulls are losing some steam as the price tests this crucial resistance. Related Reading: Ethereum Recovery Gains Strength: Massive Comeback Above Key Support If ETH can consolidate above the $2,500–$2,600 range and break through the 200-day SMA with convincing volume, the next upside target lies near the $3,100 level, as noted in recent technical studies. On the downside, maintaining support above $2,435–$2,450 is essential to avoid a deeper correction. The coming days will reveal whether Ethereum can turn this consolidation into a true breakout or if further cooling is needed before the next leg up. Featured image from Dall-E, chart from TradingView