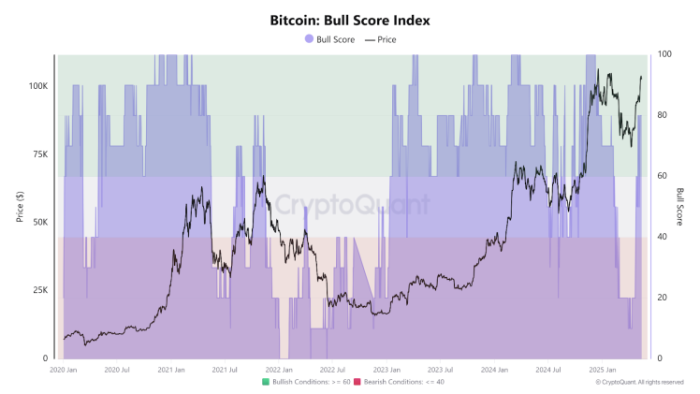

Bitcoin has protected the $100K mark and is consolidating above the all-important price level. There are several factors that have contributed to Bitcoin’s recent run. For starters, the CBOE Volatility Index is now down to just under 20. Also known as the fear index, the CBOE measures the expected volatility in markets for the next 30 days. A lower VIX shows less expected volatility and signs of stability. Earlier in the year, the VIX stood at just under 60, representing high uncertainty. However, it’s now come down to a 30-year average of just 20. The recent de-escalation in the ongoing US-China tariff war has also played a major role in strengthening Bitcoin above $100K. The US has agreed to tariffs of 30%, whereas China will now only impose a 10% tariff on US goods. This has led to ‘risk on’ sentiment when it comes to Bitcoin investors. Keep reading as we dig into various technical reasons that point towards an even greener crypto market in the coming weeks. We’ll also recommend three tokens that could be the next crypto to 1,000x if the market remains this bullish. Bitcoin ‘Risk-On’ Sentiments The US CPI inflation rate has also dropped to 2.3% YOY in April 2025, down 0.1% compared to March. This is the lowest it has been since February 2021. Slowing inflation indicates stable economic conditions, supporting the ‘risk-on’ environment for Bitcoin. Data from CryptoQuant shows that the Bitcoin Bull Score Index has increased from 20 to 80. While a score of 22-50 indicates neutral to slightly bullish conditions, a score above 80 indicates that Bitcoin is extremely bullish with strong rallies. Historically, whenever the Bull Score Index has hit 80, it has been followed by strong market rallies. What’s more, the Bitcoin fear-greed index is also moving up. It now stands at 53.3%. Although you could argue that this is slightly higher, it’s still quite far from the overload zone at 80%. All these positive market sentiments suggest that Bitcoin may soon break its all-time high and head towards the highly anticipated $135K level. Trump’s Promise Confirms Bullish Bias Speaking at the Saudi-US investment forum, Trump said that the markets are going to go a lot higher from here. He said that a lot of investment is happening, and jobs are being created at a pace never seen before. This will propel the equity markets to a new high. The magic may also pass on to Bitcoin, which has become a ‘safe-haven’ investment for corporations. Speaking of $BTC-loving corporations, Strategy has stashed over 550K $BTC so far. Semler Scientific has also purchased 1,510 $BTC since the beginning of 2025, taking its total holdings to 3,808 $BTC. Similarly, Twenty One Capital, an investment vehicle backed by Cantor Fitzgerald, now holds a total of 36,312 $BTC. This is after Tether recently bought $458.7M worth of $BTC for the firm. We continue to accretively grow our Bitcoin arsenal using operating cash flow and proceeds from debt and equity financings. – Eric Semler, chairman of Semler Scientific As is pretty evident, there is an increasing push by corporations to convert part of their cash reserves into Bitcoin. With strong technical indicators and market confidence, Bitcoin looks well poised to reach $135K. If you don’t want to miss out on this once-in-a-lifetime bull run, here are a few cryptos worth investing in. 1. BTC Bull Token ($BTCBULL) – Best Bitcoin-Themed Altcoin to Buy Right Now BTC Bull Token ($BTCBULL) is undoubtedly one of the frontrunners to become the next big crypto coin, thanks to its unique way of rooting for Bitcoin. It’s, in fact, the ONLY crypto today offering free (and 100% real) $BTC in its airdrops to its token holders. This is huge not only because $BTC is essentially worth $100K+ but also because it’s flipping the script on how crypto projects have typically gone about their airdrops, i.e., by offering more of their own tokens for free. BTC Bull Token’s Bitcoin airdrops will occur each time the king cryptocurrency breaches a new landmark figure, such as $150K, $200K, and $250K. To take part, you need to hold your $BTCBULL tokens in Best Wallet. More good news for $BTCBULL investors: the project will follow a deflationary model. Under this, a handful of $BTCBULL tokens will be erased from the total supply at regular intervals. As supply shrinks and $BTC marches on, we can expect $BTCBULL to absolutely explode. It’s worth noting that according to our BTC Bull Token price prediction, this new crypto could easily reach $0.096 by 2026. Looking to buy $BTCBULL? Each token costs just $0.00251, and the project has already raised over $5.7M. 2. SUBBD Token ($SUBBD) – Revolutionary New Crypto Changing the Online Creator Industry SUBBD Token ($SUBBD) sets itself apart by being the first-ever crypto subscription platform to integrate AI. It’s a beacon of hope for the $85B digital content industry that has been struggling with high commissions, little to no automation, and dying creator-fan relationships. Creators on SUBBD will have a slew of AI tools, such as voice, image, and video generators, to upscale and automate the entire process of creating and distributing content. In addition to benefiting from lower platform fees, they’ll also have the liberty to set up various payment models for their content. These include pay-per-view, subscriptions, tipping, and NFT sales. As for the fans, they’ll be able to use $SUBBD, the platform’s native token, to pay for all the exclusive content available on SUBBD. In addition to access to premium AI content, $SUBBD token holders will also get discounts on subscriptions and content, early-bird access to new features, and voting rights. Combined with a staking program that gives token holders access to exclusive creator livestreams, daily BTS drops, and a fixed APY of 20%, it’s not a surprise that our $SUBBD price prediction found the token could jump 1,200% by 2026. Buy the $SUBBD presale token today for just $0.0554 each. The project has so far raised over $390K in early investor funding. 3. Just a chill guy ($CHILLGUY) – Amusing Meme Coin on a Roll Right Now What do you call a person who diligently hustles as a taxi driver in GTA V? Stupid? Depressed? Nah; we’d say they’re ‘Just a chill guy.’ The GTA V example perfectly explains what this extraordinarily viral meme stands for – a ‘lowkey,’ ‘whatever’ attitude that doesn’t care about what anyone thinks. The meme character is quite dashing, too. He dons blue jeans, red shoes, and a grey sweater, all of which, by the way, pale in comparison to the coolness with which he keeps his hands in his pockets and boasts a smirk on his face. Needless to say, this is exactly the kind of meme crypto degens love to back. As a result, there’s nothing ‘chill’ about $CHILLGUY’s performance. The token is up over 130% in the last seven days and a brain-melting 460% in the last month or so. Plus, given that it’s still available for just $0.1140, Just a chill guy is easily one of the best cryptos to buy now. The Next Crypto to 1,000X – A Real Possibility or a Pipe Dream? There’s no refuting that top altcoins like $BTCBULL and $SUBBD have the potential to generate massive gains. However, they, like much of the altcoin space, depend on the broader crypto market’s pace and direction. Even though things, as they stand now, look bright, really bad news could send prices crashing any minute. So, despite the bullishness, we suggest that you only invest an amount you’re comfortable losing. Also, kindly do your own research before investing; our articles are not financial advice.