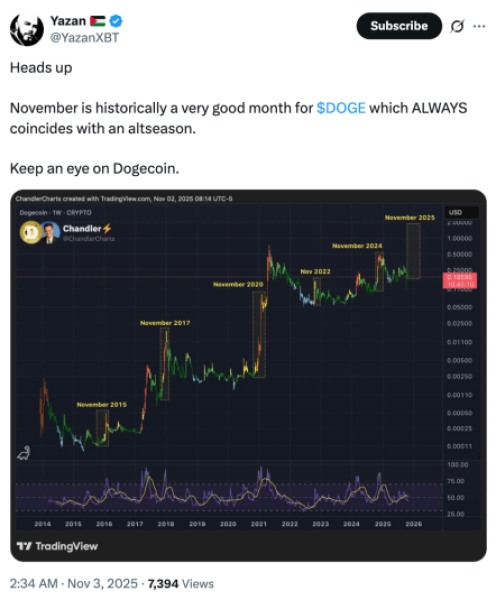

What to Know: Dogecoin ($DOGE) could be in for a strong November given its historical performance over the same month in the last eight years. A crypto analyst on X made bullish predictions, citing data from November 2017, 2020, 2022, and 2024. While the broader crypto market is in Bitcoin season, some of the best meme coins to buy now continue to pump, including Bitcoin Hyper ($HYPER) and Maxi Doge ($DOGE). Dogecoin ($DOGE) could be in for a massive November if its historical performance at this time of the year repeats itself, predicted a crypto analyst on X. Given this scenario, a $DOGE rally could usher in a new altcoin season. At the moment, the market is heavily dominated by Bitcoin ($BTC), as traders see it as a safer bet amid market uncertainty. That’s not to say that there aren’t a lot of opportunities to be found in the altcoin sector today. In fact, the likes of Bitcoin Hyper ($HYPER) and Maxi Doge ($DOGE) continue to grow on presale and building their momentum towards exchange listings, making them the best meme coins right now. Dogecoin Season Soon? This Analyst Thinks So Yazan XBT, a crypto analyst with over 39K followers on X, predicted that $DOGE will pump this month, at least according to historical data. He added that a good month for the coin always coincides with an altcoin season. The analyst cited similar growth in 2017, 2020, 2022, and 2024. With November just beginning, there’s plenty of potential for $DOGE to make a repeat performance and usher in a major rally for altcoins. In the meantime, the following meme coins are making serious waves in the market. 1. Bitcoin Hyper ($HYPER) – Unlock Bitcoin’s Meme Coin Potential with a Layer 2 Network Bitcoin may continue to dominate the market, but it’s not without its weaknesses. Among these is its slow transaction speed, at only seven transactions per second (TPS) on average. In contrast, Solana can process up to 65K TPS. Given its limited blockchain scalability, $BTC is also only good as a store of value. That means you can’t use it for more advanced things like DeFi and other use cases relying on microtransactions and smart contracts. Bitcoin Hyper ($HYPER) wants to change that with its Layer 2 (L2) network. The L2 will run on a Solana Virtual Machine, which will deliver Solana-level speeds, smart contracts, and lower transaction costs within the Bitcoin ecosystem. It’ll also feature a canonical bridge that will allow you to send your $BTC to the L2 and use it for various applications, such as meme coin launchpads, lending protocols, and interacting with dApps. 👉🏼 For more information on the project, be sure to check out our ‘What is Bitcoin Hyper?’ page. To get the most out of the L2 when it launches, consider getting its native $HYPER token. More than as a means to pay for transaction fees, it’ll also give you governance rights and access to exclusive features as the ecosystem expands. Right now, you can get $HYPER tokens for $0.013215, which you can also stake to earn 46% APY rewards. There’s less than two days before the next price increase, so now’s your last chance to grab tokens at their current price. Join the $HYPER presale today. 2. Maxi Doge ($MAXI) – Chase Max Meme Gainz, One Sleepless Night at a Time Dogecoin may be the big dog of the meme coin market, but it’s no longer the only game in town. In fact, over the years, a lot of doge-themed coins have cropped up. However, none have become a serious threat — until today. Maxi Doge ($MAXI) is Doge’s distant cousin that’s nipping at the paws of the world’s most valuable meme coin. He’s a gym-maxxing Shiba Inu not to be messed with. Powering him is his ceaseless desire to get maximum gains, green candles, and his mom’s approval, with liters of energy drinks flowing through his veins to fuel the grind. He’s pulling in like-minded degens through his Maxi Doge token presale. With over $3.8M raised since the presale began, the newest doge in town is clearly attracting a lot of followers these days. Things are only going to get huge from here. That’s because after the presale, Maxi will also launch on major DEXs and CEXs, starting on Uniswap. 💰Learn how to get your hands on $MAXI tokens in our Maxi Doge buying guide. When it happens, expect the coin to pump. Unlike other dog tokens, $MAXI sits on a lower token supply (capped at 150.24B) and a 15% liquidity pool, with more tokens vested for staking and 40% going towards marketing. If you want to get in early, you can still get $MAXI tokens via its official presale page for $0.000266 and wait for the explosive meme potential. A few hours are left before the next price increase. Get your Maxi Doge tokens here. 3. Comedian ($BAN) – Bucking the Greater Market Trend with Loads of Humor and Irony If there’s a classic definition of a meme coin, it’s that it has no inherent utility, relying instead on community sentiment. It’s the kind of premise that made the likes of Dogecoin reach mind-boggling heights, defying expectations of the broader crypto market. Comedian ($BAN) follows the same vein, as it aims to grow purely on community vibes. That’s the reason why its price yo-yoed over the years—from its $0.3993 ATH in November last year to its present price around $0.0600. But don’t let its current price fool you. After a coin cools down, there’s more upside potential left when the next rally comes. In fact, $BAN’s up by about 8% over the past 24 hours, once again bucking the market trend, which saw the majority of meme coins on a downtrend over the same period. Is it the meme coin for contrarian traders? Perhaps. But it goes deeper than that, even if meme coins aren’t really supposed to be that deep in the first place. When you buy Comedian, you’re making a statement. What makes a coin valuable? Is it the coin itself, its notoriety, or what it stands for? With no real answer to those questions, Comedian can be anything you like. A speculative buy, a dive into the degen mindset, or just something to do for the laughs. Find $BAN on Bybit for good liquidity. Recap: After the onslaught of October on the crypto market, there’s hope for recovery yet, with $DOGE’s historical price movements hinting at an upcoming rally and, possibly, a new altcoin season. The best meme coins right now, including Bitcoin Hyper ($HYPER) and Maxi Doge ($DOGE), could see even more attention moving forward. Disclaimer: This article is not investment advice and meme coins are high-risk, unregulated assets. DYOR before buying and invest responsibly. Authored by Aaron Walker, NewsBTC — www.newsbtc.com/news/best-meme-coins-to-buy-dogecoin-prediction-november