Weeks of Prosperity: MKR Holders See Wealth Grow By Over 100% Amidst Price Boom

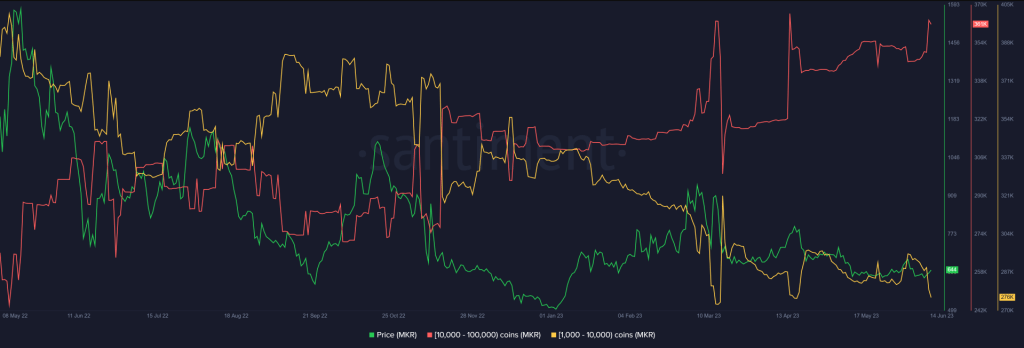

MakerDAO (MKR) has navigated a tumultuous path in the Decentralized Finance (DeFi) market since June, marked by regulatory pressures and various challenges numerous projects face. Nonetheless, a shift in focus has occurred as altcoins, spearheaded by MKR, appear to overshadow this turbulence. Presently, the value of MKR on CoinGecko stands at $1,346, showing a noteworthy 9.1% surge within the past 24 hours, accompanied by an impressive week-long ascent of 18.0%. Related Reading: Curve DAO (CRV) Price Recovery Post-Exploit: What Would Be A Realistic Scenario? From mid-June, MKR has achieved an increase exceeding 115%. This growth has effectively diminished the proportion of investors encountering losses by a significant margin of 26%. MKR Price Report Reveals Sustained Accumulation, Whale Activity MKR has emerged as a notable hotbed of investor interest, with a recent price report shedding light on intriguing market dynamics. The journey of MKR’s price has been marked by a distinct trend of accumulation (see chart below) that has been underway since March, underscoring the growing interest and confidence among investors. Source: Santiment As the calendar flipped to June, the accumulation of MKR gained considerable traction. Notably, this month saw a strategic move by prominent investors, often called “whales,” who opted to divest a portion of their holdings. This strategic decision, seemingly aimed at capitalizing on profits, had the unintended consequence of temporarily affecting the supply. However, the cryptocurrency market is known for its intricate interplays, and MKR’s case was no exception. While whales reduced their holdings, more oversized wallet holders recognized an opportune moment and swiftly absorbed the newly available supply. This orchestrated shift in ownership demonstrated the agility and resilience of the MKR ecosystem. Resurging Interest In DeFi Tokens DeFi has recently witnessed a fascinating shift in dynamics, drawing attention from analysts and investors. Glassnode’s insightful observations highlight a distinct surge of interest in DeFi tokens sparked by lackluster performances within the ecosystem. The backdrop against which this resurgence unfolds is crucial to understanding its significance. The previous dip in DeFi token prices was undeniably attributed to a significant event – the release of a memo by the US Securities and Exchange Commission (SEC). Maker (MKR) is currently in a positive trend, trading at $1,328 on TradingView.com This regulatory communication deemed approximately 68 tokens unregistered securities, casting a shadow of uncertainty over the DeFi landscape. Related Reading: Uniswap (UNI) Stays Afloat With 11% Gain As Rest Of Top 50 Coins Sink Amidst the tumultuous landscape, the resurgence of interest is indeed noteworthy. Glassnode’s analytical lens zooms in on this intriguing development, offering valuable insights into the changing sentiment. The data analysis firm aptly captures the essence of this rebound: “This is the first outperformance since September 2022, with very similar performance thus far.” This assessment not only underscores the significance of the current uptick but also draws parallels to a prior period, hinting at the potential of a sustained trajectory. (This site’s content should not be construed as investment advice. Investing involves risk. When you invest, your capital is subject to risk). Featured image from The Coin Republic