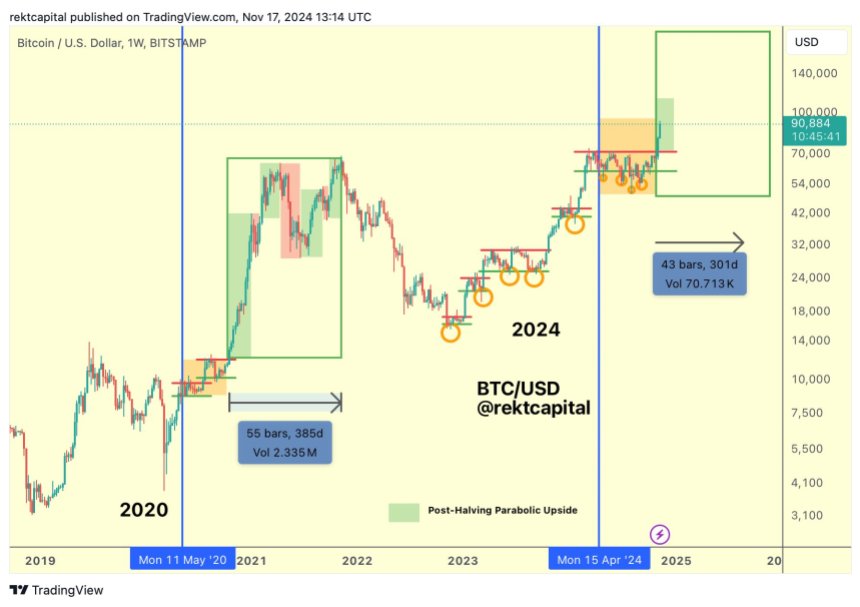

Bitcoin (BTC) started the week by breaking out of a bullish pattern after moving sideways for most of the weekend. The flagship cryptocurrency just started its “parabolic phase,” sitting 3.4% below its all-time high (ATH), which could bring “massive moves” for BTC this week. Related Reading: Shiba Inu (SHIB) Ready To Roar! Analyst Calls For A 200% Spike Bitcoin ‘Parabolic Phase’ Just Started Bitcoin has seen a massive surge in the last two weeks, jumping 32% to the $89,000-$90,000 price range. BTC’s remarkable performance saw it soar 11% last Monday, preparing the ground for its eventual surge toward its latest ATH of $93,400 two days later. Since then, Bitcoin’s price has hovered between the $89,000-$92,000 range, briefly falling to $87,000 last Friday. Over the weekend, the flagship crypto continued to move within this rage, registering its largest weekly close in Bitcoin history. Crypto analyst Rekt Capital pointed out that BTC is barely starting its “parabolic phase,” noting that week three of the cycle’s “first price discovery uptrend” started today. The analyst explained that, historically, BTC has seen around 300 days of parabolic run each cycle, with the first major pullback coming over a month after entering price discovery mode. Per the post, it took six weeks before the flagship crypto’s first major pullback in 2013. In 2017, BTC rallied for eight weeks before registering a deeper pullback. Meanwhile, it soared for four weeks before experiencing a major retrace in the 2020-2021 cycle. Based on this, the analyst considers that “history suggests there’s more upside to come and that the first Price Discovery Correction is still weeks away.” Is A Move Massive Move Coming This Week? Ali Martinez noted that Bitcoin seems to be repeating 2020’s pattern. In 2020, after breaking its previous ATH of $19,700, BTC rose 26% and consolidated for a week. Following its consolidation, BTC jumped 66% toward $40,000 in the next two weeks. Martinez pointed out that Bitcoin has risen 28% since surpassing its March ATH and has been consolidating for nearly a week. This suggests that the cryptocurrency’s price could be getting ready for a substantial surge in the following days, potentially hitting the $100,000 mark this week. Crypto Yapper, another market watcher, stated that Bitcoin will likely make a “massive move” soon. The analyst highlighted the flagship crypto’s consolidation, noting the significant price action around the $89,000-$90,000 mark. Related Reading: Bitcoin Bulls Aren’t Backing Down: Rally Continues? This horizontal level acted as a key resistance zone earlier last week but has been confirmed as support throughout the past five days. As Bitcoin retested the $91,000 earlier today, the analyst also pointed out its price could continue the bullish trajectory and aim for a new ATH around $95,000. Additionally, BTC started the week breaking out of a one-week symmetrical triangle pattern. To Crypto Yapper, this is a “typical continuation pattern” for the cryptocurrency, which suggests that Bitcoin is set to continue its climb if the breakout is confirmed throughout the day. The analyst stated that BTC’s continuation of its uptrend could hit $100,000 by Sunday. As of this writing, Bitcoin is trading at $90,260, a 10% increase in the weekly timeframe. Featured Image from Unsplash.com, Chart from TradingView.com