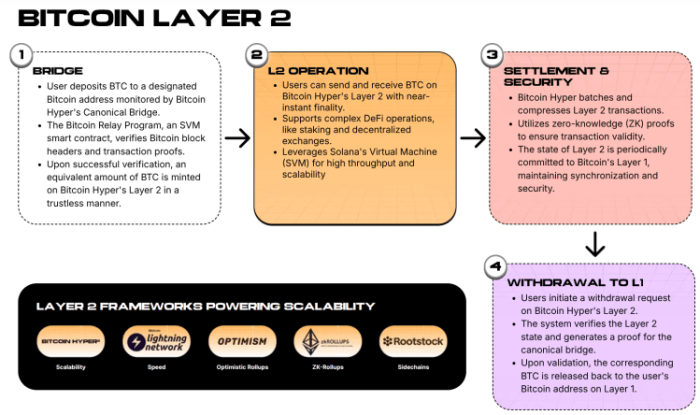

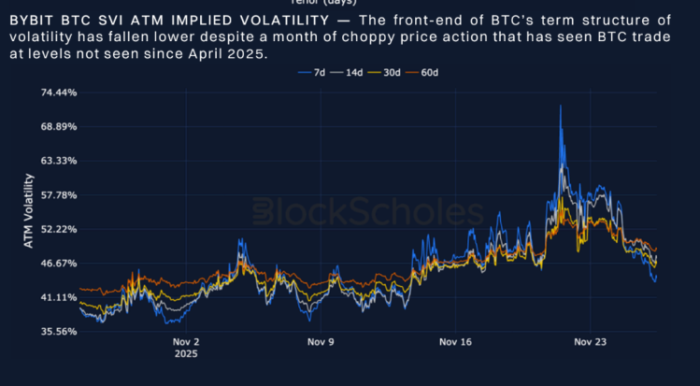

What to Know: With derivatives markets finally chilling out and funding rates normalizing, traders are quietly swapping fear for early accumulation. This low-volatility window offers a perfect chance to rotate into solid tech plays before leverage-fueled FOMO kicks back in. Bitcoin Hyper is turning heads by raising over $28M to bring Solana-speed smart contracts directly to Bitcoin’s network. Traders are also eyeing SUBBD Token’s AI tools for creators and Monero’s new security upgrades as top picks for this cycle. Derivatives desks are finally taking a breath. Funding rates that were deep underwater are grinding back toward neutral, and implied volatility is dropping across the board, according to a recent report from Black Scholes and ByBit Analytics. This shift matters because it usually signals the move from pure fear to early FOMO. When funding normalizes and volatility drops, leverage hasn’t fully returned yet, but spot and high-conviction altcoins start catching a bid. You’re seeing this right now in specific Bitcoin plays, AI narratives, and legacy privacy tech. In this phase, the market usually rewards projects solving real bottlenecks: Bitcoin’s speed, creator money, and on-chain privacy. Before funding rates get overly excited, there’s a window where rotating into these themes can really boost your risk-reward profile. Here are three best altcoins sitting in that sweet spot: Bitcoin Hyper ($HYPER), SUBBD Token ($SUBBD), and Monero ($XMR). They’re at the intersection of demand and new narratives that traders are jumping on as markets stabilize. 1. Bitcoin Hyper ($HYPER) – The Bitcoin Layer-2 Making $BTC a Powerhouse Everyone knows Bitcoin is the pristine collateral of crypto, but actually using it is still slow and expensive. Bitcoin Hyper ($HYPER) changes the math by plugging the Solana Virtual Machine (SVM) directly into Bitcoin’s network. Think of it as giving Bitcoin a nitrous boost: this Layer-2 gives you the rock-solid settlement of $BTC, but the transaction is instant and cheap, just like Solana. This isn’t just a technical upgrade; it’s about unlocking DeFi on Bitcoin. At the heart of this is the Canonical Bridge, a mechanism that lets you lock native $BTC to mint wrapped assets on the high-speed layer. This allows developers to finally build fast apps – trading, lending, gaming – using tools they already know, without clogging up the main chain. Want to know more? Check out our ‘What is Bitcoin Hyper’ guide for more information. The smart money is clearly paying attention. The presale has already swept up over $28.8M with tokens priced at $0.013355. Our experts are already projecting a massive run, seeing $HYPER reach $0.08625 by the end of 2026, a staggering 546% ROI if you invested at today’s price. On top of that capital appreciation, $HYPER is offering 40% staking rewards, giving you a way to compound your position while the network scales. Get your $HYPER today. 2. SUBBD Token ($SUBBD) – The Creator Economy’s AI Upgrade While Hyper fixes plumbing, SUBBD Token is tackling the creator economy. The problem is simple: creators do the work, but platforms keep the control (and the fees). SUBBD Token ($SUBBD) flips this by mixing AI with crypto payments. It gives creators tools to automate the grind – imagine an AI assistant that handles fan chats or voice cloning tech that lets you create content without being glued to a microphone 24/7. It’s essentially ‘Scale as a Service’ for influencers, backed by a token that handles access and payments. Holding $SUBBD isn’t just a speculative bet; it’s an access pass. You get voting rights on platform governance, exclusive access to premium token-gated content, and significant discounts on platform subscriptions. Plus, buying in now secures priority access to beta AI tools before the public rollout. The presale is gaining traction with over $1.3M raised, and the 20% staking APY is a solid incentive for getting in early. The upside potential here is catching eyes too; our experts predict the token could hit $0.668 by the end of 2026. If you invest at today’s price of $0.057075, that represents a massive 1,070% ROI. If you’re looking for a narrative that blends AI utility with real-world adoption, this is the one to watch. Check out our ‘How to Buy SUBBD Token’ guide for more details. Buy your SUBBD Token ($SUBBD) today. 3. Monero ($XMR) – The Silent Insurance Policy Monero doesn’t need much introduction – it’s the gold standard for privacy. But right now, it’s becoming more relevant than ever. As surveillance increases and ‘clean’ crypto becomes a regulatory obsession, the demand for truly private, censorship-resistant money quietly grows. $XMR isn’t trying to be the fastest or the wildest; it’s trying to be the most resilient. The upcoming FCMP++ upgrade is doubling down on this, making transactions even harder to trace and strengthening the network’s anonymity set. Traders hold Monero not for the hype, but as a hedge. It’s the portfolio insurance you buy when you realize a fully transparent blockchain future might be a little too transparent. Crucially, the ‘delisting’ fears that used to plague the coin have mostly been solved by the rise of atomic swaps and decentralized exchanges like Haveno. You can now swap $BTC for $XMR peer-to-peer without a centralized middleman or ID check, meaning liquidity is becoming unbannable code rather than a corporate compliance decision. Real usage is also ramping up, with a growing ‘circular economy’ where vendors accept XMR directly for goods and services like VPNs and hosting. Unlike speculative assets that just sit in wallets waiting for a pump, Monero is being used as actual digital cash, giving it a fundamental demand floor that’s hard to shake. Buy Monero ($XMR) on top exchanges like Margex. Recap: As derivatives markets move from fear to early FOMO, structural themes tend to outrun the beta. Bitcoin Hyper, SUBBD Token, and Monero each target real frictions, Bitcoin execution, creator monetization, and on‑chain privacy, making them the best altcoins to buy now. Remember, this isn’t intended as financial advice, and you should always do your own research before investing. Authored by Aaron Walker, NewsBTC — https://www.newsbtc.com/news/best-altcoins-derivatives-stabilize-bitcoin-hyper-subbd-monero/