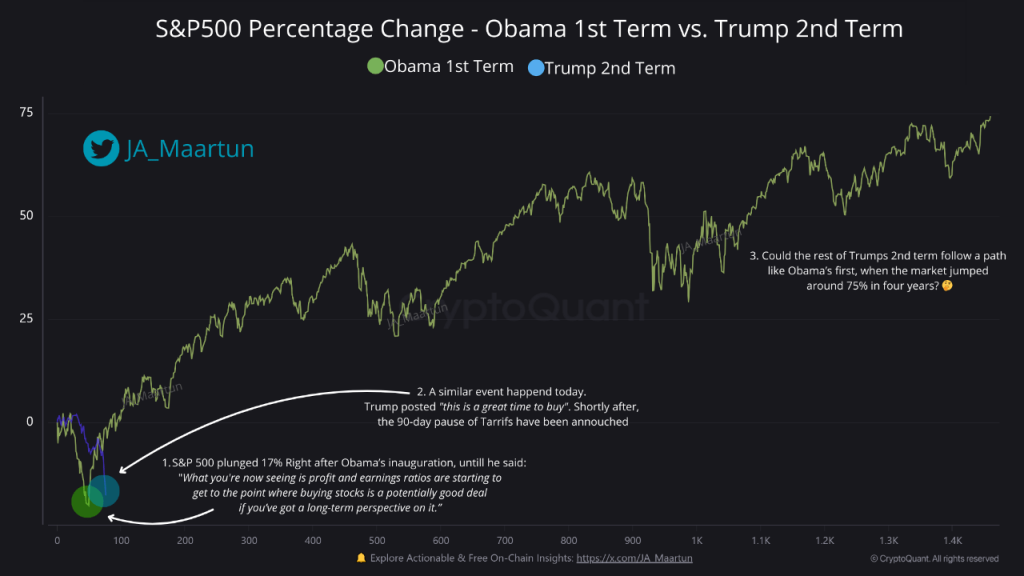

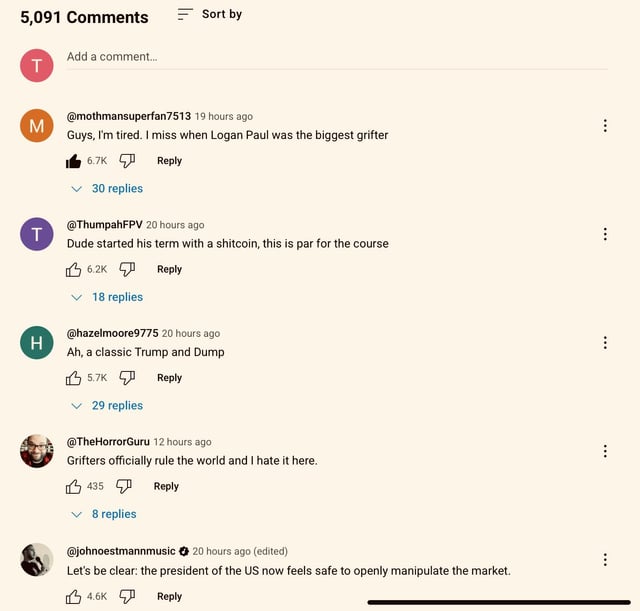

What Is REAL? Conor McGregor’s staking-enabled memecoin explained Conor McGregor, also known as “Notorious,” is an Irish mixed martial artist born in Dublin on July 14, 1988. He is renowned for his achievements in the Ultimate Fighting Championship (UFC), where he became the first fighter to simultaneously hold titles in two weight classes — featherweight and lightweight. Beyond his fighting career, McGregor ventured into entrepreneurship, in 2018 launching his whiskey brand, Proper No. Twelve, named after his Dublin roots. He leveraged his UFC fame to market the triple-distilled blend. In 2021, McGregor sold a majority stake to Proximo Spirits for an estimated $600 million, while retaining a significant role.In April 2025, McGregor ventured into the crypto market by introducing a memecoin named “REAL.” Promising to change the crypto world, the digital token was launched through a sealed-bid auction to prevent interference from bots and snipers. Developed in collaboration with the Real World Gaming (RWG) decentralized autonomous organization (DAO), the REAL memecoin offers holders staking rewards and voting rights within its ecosystem. What happened during REAL memecoin fundraising? With the REAL memecoin, McGregor aimed to make a big impact in the crypto world. However, things didn’t go as planned.McGregor partnered with RWG, a decentralized autonomous organization, to raise funds for the project with a minimum goal of $1,008,000. But during the 28-hour presale, the DAO collected $392,315 in USDC (USDC) from 668 contributors, only 39% of its target.RWG acknowledged that the auction failed to hit the minimum raise, stating that they would fully refund all the bids. McGregor himself endorsed the announcement.For the fundraising, the REAL token was sold through a sealed-bid auction on Axis Finance. Users privately submitted bids specifying the quantity and price they desired, and tokens were allocated to the highest bidders at a single clearing price.After deliberating where they went wrong, RWG is now looking to relaunch the fundraising. The team hasn’t yet provided a date for the relaunch.McGregor has remained outspoken, characteristically announcing or endorsing project updates with his signature line, “Ladies and gentlemen, this is REAL!” The team plans to reshape the token’s purpose and possibly modify its fundraising approach for a more successful relaunch.Did you know? Memecoins often rise in value due to community hype and viral trends, not technical innovation. While they lack strong fundamentals, social media buzz and celebrity endorsements can drive massive short-term gains, making them popular among high-risk, high-reward investors. Reasons for REAL memecoin’s fundraising failure RWG’s attempt to launch the REAL memecoin faced multiple challenges, leading to the DAO’s failure to meet fundraising goals. Several factors contributed to this outcome:Market timing: The launch coincided with a downturn in the cryptocurrency market. Major cryptocurrencies, including Ether (ETH) and Solana (SOL), faced sharp declines. Only Bitcoin (BTC) was an exception, as investors viewed it as a value holder. Memecoins faced almost a 60% decline after Dec. 24, except GHIBLI. Such a gloomy environment wasn’t conducive for the launch of yet another memecoin.Economic conditions: The world economy is going through a phase of reconstruction due to the Trump administration’s reorganization of tariffs. This resulted in a US stock crash of about $5 trillion, more than the total market cap in crypto. (Though the crash happened after the fundraising failure, the story was in the making). The tariffs led to uncertainty in the world economic system, which also impacted the crypto market. Recession fears and substantial losses in US equities made investors more cautious. Scams surrounding memecoins: In 2024, over $500 million was lost to memecoin rug pulls and scams, as reported by Merkle Science, fostering significant distrust toward memecoins. One instance involved hackers compromising Kylian Mbappe’s X account to promote a fraudulent memecoin that reached a $460 million market cap before a rug pull. Similarly, Wiz Khalifa’s 35.7 million X followers were targeted with a fake WIZ token that briefly hit a $3.4 million market cap before collapsing. This decline in investor confidence likely affected the REAL token’s reception. Nansen Research’s Nicolai Sondergaard noted that experienced traders were quickly taking profits.Misinterpretation of the token’s objective: Despite McGregor’s assertions that REAL was a legitimate project with real-world applications, many perceived it as another celebrity-endorsed memecoin. This misunderstanding may have undermined the token’s credibility and deterred potential investors.Investor skepticism toward celebrity tokens: The crypto community has grown wary of celebrity-backed tokens, especially after several high-profile failures. Even tokens tied to Donald Trump and Melania declined sharply, causing investors significant losses. Other known celebrity token failures include Hawk Tuah (HAWK) by Haliey Welch and Daddy Tate (DADDY) by Andrew Tate. Several celebrities associated with crypto earned a bad name for themselves. Davido, a popular Nigerian Afrobeat star, launched his memecoin Davido (DAVIDO) and made money using pump and dump. These incidents caused investors to view memecoins with suspicion.McGregor’s image: While central to his success in the UFC, Conor McGregor’s brash persona worked against him in the crypto world. His history of controversies and impulsive behavior undermined trust in the project’s legitimacy. His image raised red flags, especially in a space already plagued with scams. Did you know? Some memecoins have sparked real-world donations and activism. Dogecoin’s community once raised over $50,000 to send the Jamaican bobsled team to the 2014 Winter Olympics, showing that memecoins can fuel fun and philanthropy. Purpose and tokenomics of REAL memecoin The purpose of REAL is to facilitate functions like staking, governance, and utility, as well as a real-world MMA fight simulator and future business integrations. Its tokenomics, however, have come under criticism.According to the RWG team, the REAL memecoin tokenomics model was designed for transparency and community engagement, as 32% of the total supply was allocated to the DAO treasury to support ecosystem growth, while 17% was distributed to the community to incentivize participation. To earn governance rights and rewards, tokenholders could stake the coin; 10% was reserved for the development team. The model aimed to fund sports and gaming startups, blending hype with practical utility.Critics found flaws in the tokenomics, and many regard that as a reason for the poor show in fundraising. They were particularly harsh on the token’s 12-hour unlock window. This allowed investors to sell their tokens shortly after the acquisition and make profits, even while the price declined. Several projects had used such a structure earlier for pump and dump, which created a bad precedent. This deterred long-term investors seeking sustainable growth.The project’s marketing strategy also raised concerns, as many felt the project added no real value and was just an attempt to take advantage of a celebrity’s name. The use of third-party logos on its website led to accusations of misleading promotional tactics, undermining the project’s credibility and deterring potential investors. And the lack of a clear roadmap for REAL only amplified investor skepticism. Broader risks of celebrity-backed tokens The fate of McGregor’s REAL memecoin fundraising highlights the broader risks of celebrity crypto endorsements. While celebrities bring attention and massive followings, their involvement often lacks substance, long-term commitment or technical understanding of the projects they promote. Celebrity-backed tokens often ride on hype rather than real value, leading to pump-and-dump scenarios where early investors benefit while latecomers suffer losses. The credibility of the crypto industry suffers when such projects collapse, reinforcing public distrust. The way REAL’s fundraising event turned out serves as a warning that fame doesn’t equal a project’s credibility.Regulators also scrutinize such endorsements more closely, potentially bringing legal consequences for misleading promotions. For the crypto space to mature, projects must prioritize transparency, utility and experienced leadership over viral marketing. The REAL memecoin fundraising failure emphasizes that genuine trust and long-term vision are more valuable than celebrity clout in crypto fundraising.Did you know? Shiba Inu, launched in 2020 by “Ryoshi,” was dubbed the “Dogecoin killer.” With a quadrillion-token supply and a vibrant “Shib Army” community, it hit a $40 billion market cap in 2021. What can investors learn from the failure of REAL memecoin fundraising? Investors in the crypto space can learn many lessons from the failed fundraising of REAL memecoin. First and foremost, hype is not a substitute for value. Relying solely on celebrity influence without understanding the fundamentals of a project can lead to poor investment decisions.REAL also revealed how quickly investor sentiment can shift. Initial excitement turned into skepticism as users noticed the lack of community involvement and utility behind the token. McGregor’s limited engagement and controversial public image further fueled doubts, proving that star power doesn’t guarantee project longevity or trustworthiness.Investors need to recognize the importance of doing their own research (DYOR). Just because a celebrity backs a token doesn’t mean it is credible. Checking for real-world use cases, developer activity, tokenomics and community feedback is essential.Finally, the collapse of REAL fundraising highlights the need for regulatory clarity in celebrity endorsements. Without it, misleading promotions will continue to hurt retail investors and ultimately undermine the credibility of the crypto industry.