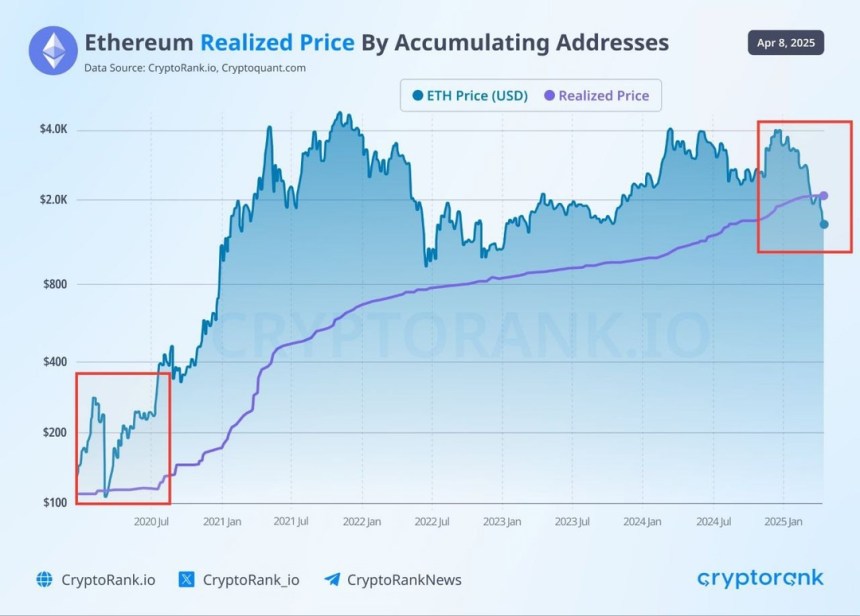

Ethereum (ETH) has recovered 10% in the past 24 hours, driven by the US administration’s 90-day pause on the trade tariffs for over 75 nations. The second-largest crypto by market capitalization now targets the $1,800 resistance as the next key level to reclaim for a rally continuation. Related Reading: Bitcoin (BTC) Jumps To $82,000 As Trump Announces 90-Day Pause On Tariffs Except China Ethereum Jumps To $1,600 Ethereum’s price hit a 2-year low of $1,385 during this week’s correction, fueling a bearish sentiment among many investors. The cryptocurrency lost the lower zone of its $2,100-$3,900 macro range on March 9 and has retraced around 16% in the past month. Since then, Ethereum eyed a retest of historical demand zones, dropping below the $1,640 area to hit this week’s lows. As a result, many analysts have noted that ETH’s bleeding might not be over, and a retest of the $1,000-1,200 price range is likely if the king of altcoins doesn’t reclaim key levels. Amid its recent performance, ETH dropped below its realized price by accumulating address of $2,000, which some market watchers consider a potential bottom sign. According to research and analytics platform Crypto Rank, the last time Ethereum fell below this level was in March 2020, when the price dropped from $283 to $109 before significantly recovering in the coming months. Notably, US President Donald Trump’s 90-day pause on tariffs for multiple nations, except China, saw the crypto market and stock prices soar, with Ethereum recovering 10% in an hour. Is A Breakout In The Horizon? Analyst Titan of Crypto noted that Ethereum could be on the verge of a comeback based on the ETH/BTC trading pair. In the ETH/BTC chart, the “RSI is showing a familiar pattern. One that previously signaled a potential shift in momentum.” Notably, the multi-year chart shows that the pair tested the trendline three times before momentum shifted and the ETH price surged toward its 2021 ATH. Similarly, the pair has tested the trendline thrice since 2022, suggesting the cryptocurrency might be headed for a comeback. Analyst Crypto Bullet considers a weekly close above $1,550, a key historical support level, necessary for ETH’s bullish momentum. Meanwhile, pseudonym trader Lluciano affirmed that Ethereum “is showing signs of a breakout after holding strong at key support.” Related Reading: Solana (SOL) Needs 15% Bounce After Multi-Year Support Retest, Recovery Ahead? Yesterday, ETH, which was retesting the 2018 all-time high (ATH) levels, jumped from $1,480 to $1,600, briefly nearing the $1,700 resistance before stabilizing between the $1,580-$1,640 price range. He pointed out that “the market could be ready for a bullish reversal” as the cryptocurrency has formed a falling wedge pattern. Per the post, if ETH breaks above the pattern’s upper trendline, at around the $1,840 mark, ETH could see “significant gains” and rally toward higher levels. As of this writing, Ethereum trades at $1,566, an 11% decline in the weekly timeframe. Featured Image from Unsplash.com, Chart from TradingView.com