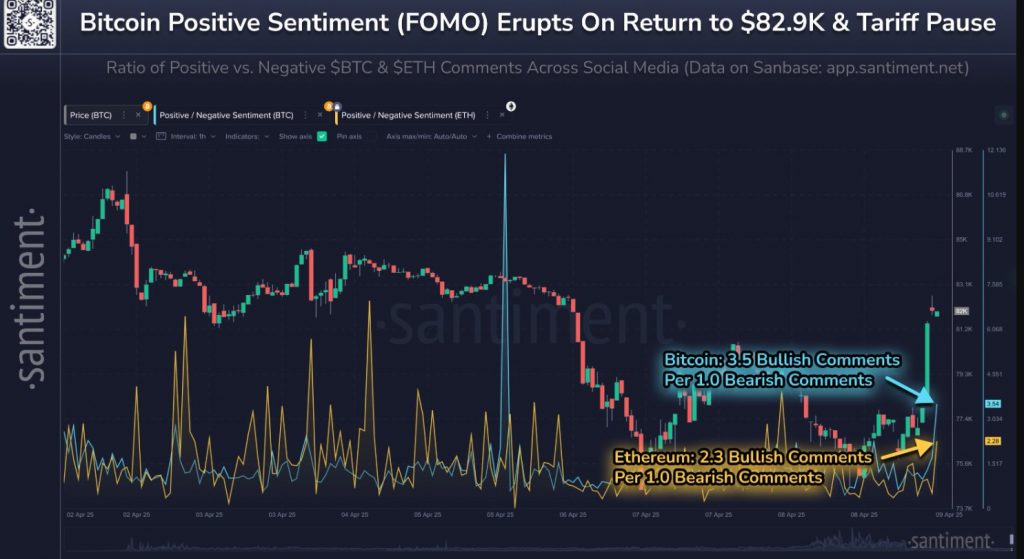

The IRS revised its definition of a broker last year to include decentralized cryptocurrency exchanges (DEX). However, Trump has now signed a new law that will overturn this change, thereby exempting DEXs from IRS regulations. Keep reading to understand its implications, how it’s yet another pro-crypto move by the new president, and how you can benefit from this by buying the best presales. DEXs No Longer Brokers, Says Trump A lot of DeFi exchanges had objected to their inclusion as brokers by the IRS. Logically, unlike centralized exchanges (CEX), which act as intermediaries between buyers and sellers, decentralized exchanges look to eliminate the middleman so that market participants can transact directly. This increases anonymity on the blockchain. However, the IRS had tax evasion concerns, hence the inclusion. The IRS believed that a lot of crypto holders aren’t paying taxes. This is why it required decentralized exchanges to send tax forms to the IRS besides, of course, crypto holders. Given the anonymity of blockchains, this was always a difficult task. The concern has now been adequately dealt with by the ‘crypto president,’ and DEXs will no longer be considered as a broker for tax purposes. A Huge Boost to DEX Positive crypto regulations were one of the major promises Trump had made during his presidential campaign. With this latest relief, the entire DEX industry has dodged a bullet. Being classified as a broker would have increased regulatory compliance, adding a lot of hindrance to its day-to-day work. Now that the uncertainty is gone, it will make it easier for decentralized platforms to operate and innovate, which will increase trading volumes. The total 24-hour trading volume on DEXs right now is $5.91B, which is expected to increase going forward. Plus, most newly launched cryptos usually trade on DEXs, driving more traders to these platforms. If you’re also looking to benefit from the upcoming DEX market growth, here are three new cryptos you should not miss out on. 1. MIND of Pepe ($MIND) – Revolutionary AI Crypto Offering Investment Advice With crypto trading set to receive a push by Trump’s new mandate, this could be the right time to invest in a new cryptocurrency like MIND of Pepe ($MIND), which has been specifically designed to revolutionize crypto investing. $MIND is an AI agent programmed to talk to the crypto community on online platforms like X. By hearing out and then analyzing countless people’s biases towards crypto, MIND of Pepe will be able to find the crypto coins most likely to explode next. Manually doing so, i.e., studying market sentiments to identify purchase-worthy meme coins and altcoins, is nearly impossible. Thanks to $MIND’s cutting-edge AI technology, though, crypto investing will be much simpler. As a $MIND token holder, you’ll benefit not only from the AI agent’s exclusive investing recommendations but also from the increase in the token’s price once it launches. As per our $MIND price prediction, the token could reach as high as $0.0263 by the end of 2030. This translates to a nearly 710% potential gain if you buy $MIND now. Each token is currently available for just $0.0037015, and the project has raised nearly $8M in presale funding. For more info, here’s a guide on how to buy MIND of Pepe. 2. BTC Bull Token ($BTCBULL) – Best Presale to Buy for Bitcoin Maximalists Bitcoin shot up by over 5% immediately after Trump’s tariff pause. This shows just how positively it can react to favorable macroeconomic conditions. In light of Trump’s pro-crypto attitude, we can reasonably expect Bitcoin (and crypto) to rally higher in the near future. When that happens, holders of the BTC Bull Token ($BTCBULL) will rejoice the most. That’s because $BTCBULL will offer real (and free) $BTC to its token holders every time the OG crypto smashes through a new milestone, like $150K, $200K, and $250K. All you have to do to be eligible for free bitcoins is buy and HODL $BTCBULL tokens in Best Wallet. Additionally, the project’s creators have decided to follow a deflationary model. This means they’ll eliminate a portion of the total $BTCBULL token supply at regular intervals. The logic behind this is simple. Strangle supply to effect an increase in demand and, ultimately, an increase in BTC Bull Token‘s price. The best altcoins follow this tactic. After careful research, our $BTCBULL price prediction has put the token’s price at $0.0096 by the end of 2026. Currently, though, the token is selling for just $0.002455. It’s one of the best cheap cryptos because it’s in presale, where it has already raised over $4.5M. 3. PepeX ($PEPX) – First-Ever AI-Powered No-Code Launchpad for Meme Coins PepeX ($PEPX) takes a leaf out of the OG Pepe, which was one of the best meme coins of all time. However, although $PEPX has a similar frog-themed mascot, there’s nothing old-school about this AI-based crypto project. Self-proclaimed as the first-ever AI-powered no-code launchpad for meme coins, PepeX aims to revolutionize how meme coins are built. Essentially, it no longer wants only cunning developers to possess the power of creating meme coins. Instead, by offering a platform that can create meme coins with just prompts, PepeX will tear down the barriers the industry has put on token creation with full-stack development. Non-tech-savvy crypto enthusiasts like us will be able to create, promote, and manage our own meme coins thanks to PepeX’s AI agents. Even better, these AI agents will also integrate with X and Telegram, which have emerged as the go-to platforms for the marketing of new meme coins on presale. You won’t have to worry about security, either. PepeX employs on-chain monitoring and anti-sniping tech to ensure transparency and fairness in the distribution and trading of your meme coins. $PEPX is currently in presale and has already amassed over $1.3M. You can grab one token for only $0.0268 if you get in now. Bottom Line Even with the best presales in your portfolio, there’s no guarantee that you won’t make losses. As such, only invest an amount that you’re comfortable with, and do your own research before investing. As always, none of the above is a replacement for financial advice from a qualified professional.