Yearn Finance Suffers $9M Breach As Attacker Creates Endless yETH Tokens

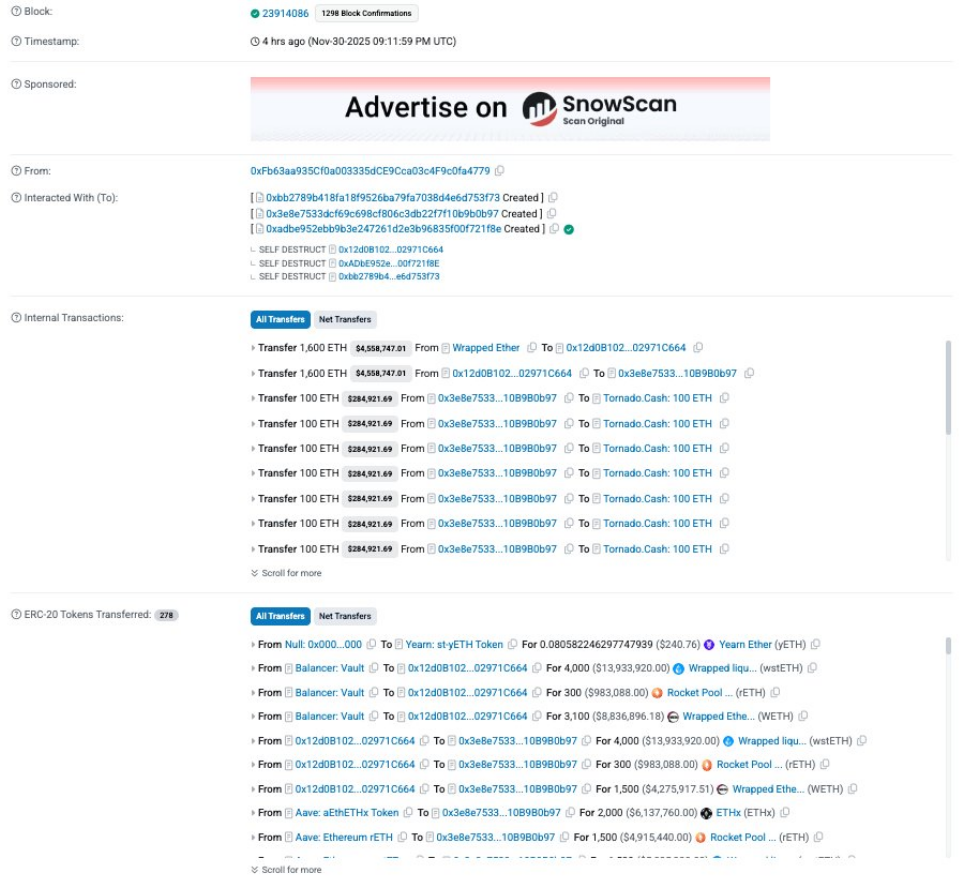

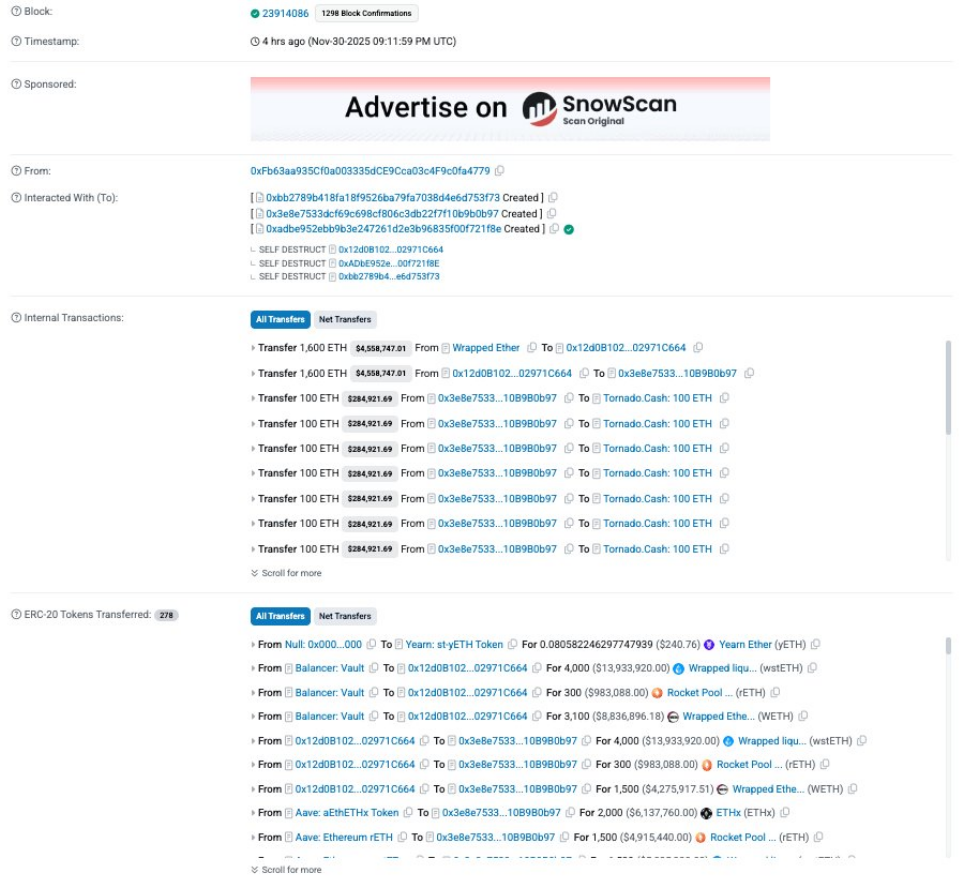

Yearn Finance reported that a legacy yETH product was hit by an exploit that allowed an attacker to mint a massive amount of fake tokens and swap them for real assets.

According to on-chain alerts and protocol statements, the attacker created a near-infinite supply of yETH in a single transaction, then used those tokens to pull ETH and liquid-staking derivatives from liquidity pools.

The incident was first flagged on November 30, 2025, and the total impact has been reported at roughly $9 million.

#PeckShieldAlert Yearn Finance @yearnfi suffered an attack resulting in a total loss of ~$9M.

The exploit involved minting a near-infinite number of yETH tokens, depleting the pool in a single transaction.

~1K $ETH (worth ~$3M) was sent to #TornadoCash, while the exploiter’s… pic.twitter.com/IXNygpwoWa

— PeckShieldAlert (@PeckShieldAlert) December 1, 2025

How The Exploit Worked

Based on reports, the attacker took advantage of a flaw in the yETH minting logic and produced tokens on the order of 235 trillion in one go.

Those worthless tokens were then swapped for real assets from Balancer and Curve pools tied to the product, emptying liquidity in minutes. Chain monitors and security researchers showed the mint and subsequent swaps unfolding very quickly on the blockchain.

At 21:11 UTC on Nov 30, an incident occurred involving the yETH stableswap pool that resulted in the minting of a large amount of yETH. The contract impacted is a custom version of popular stableswap code, unrelated to other Yearn products. Yearn V2/V3 vaults are not at risk.

— yearn (@yearnfi) December 1, 2025

What Assets Were Taken

Reports have disclosed that roughly $8 million was pulled from the main yETH stable-swap pool, while about $0.9 million was taken from a yETH–WETH pool.

In addition, roughly 1,000 ETH—valued at about $3 million at the time of movement—was sent to Tornado Cash in attempts to obscure the trail. The attacker converted fake yETH into a mix of ETH and liquid staking tokens before attempting to launder funds.

Impact On Yearn’s Core Products

According to Yearn officials and follow-up coverage, the breach was limited to an older, legacy implementation of the yETH product and did not affect Yearn’s main V2 and V3 vaults.

Deposits into the affected pool were isolated while the team and outside experts began an investigation. This isolation is said to have kept the bulk of user funds in active vaults from being touched.

Market Reaction And Wider Concerns

Crypto markets saw selling pressure as the news spread, with traders weighing the risk that comes from combining liquid staking tokens with custom swap code.

Yearn Finance said it is working with outside security teams to run a post-mortem and to patch the vulnerability. Based on reports, teams named in coverage include external auditors and blockchain investigators who are tracking the stolen funds and advising on recovery options.

The protocol’s notice warned users about the affected legacy product and urged caution while the review continues.

Featured image from Unsplash, chart from TradingView