Pump.fun Funnels $436 Million in USDC Out of Solana Launchpad Amid $PUMP Token Collapse

Key Takeaways:

- On-chain data shows Pump.fun has moved $436.5 million USDC into the exchange Kraken since October 15, and $537.6 million USDC from Kraken to Circle via wallet “DTQK7G.”

- Between May 19 2024 and August 12 2025 the platform sold 4.19 million SOL (~$757 million), including 3.93 M SOL ($715.5 M) deposited into Kraken and 264,373 SOL ($41.6 M) sold directly on-chain.

- The movements triggered intense community backlash and a steep decline in the native token PUMP, as retail users question transparency and project priorities.

Blockchain intelligence platforms show a potentially large-scale cash-out operation. For the Solana-based launchpad Pump.fun, what looks like profit realization is occurring while token holders remain largely in the dark.

Read More: Pump.fun’s Massive $30.65M $PUMP Buyback Sparks Surge in Token Demand

The On-Chain Trace – How the Transfers Played Out

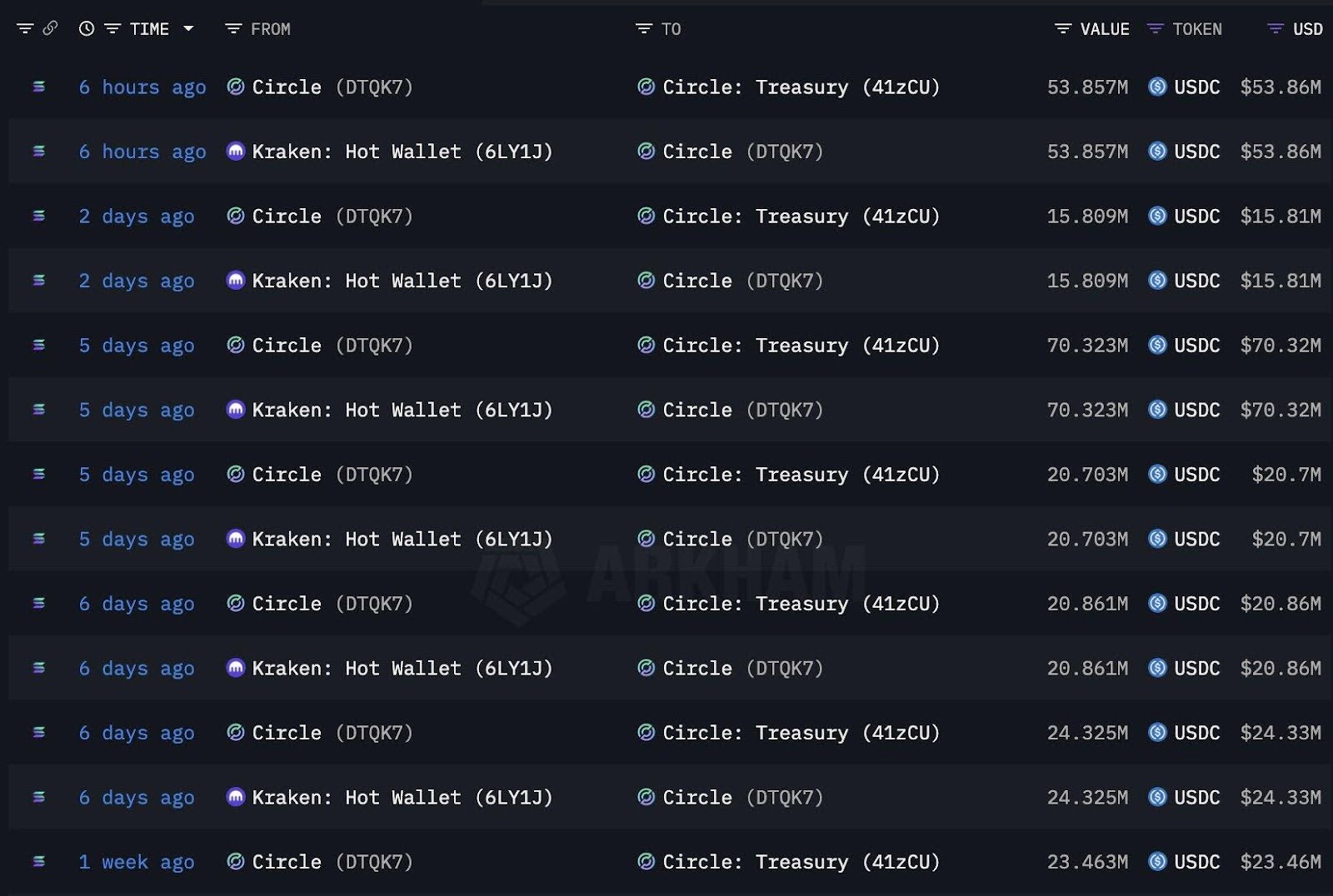

According to analysts and chain-data services, since mid-October Pump.fun began a sustained USDC outflow:

- 436.5 M USDC deposited into Kraken.

- 537.6 M USDC subsequently moved from Kraken to Circle via the wallet DTQK7G.

Meanwhile, earlier data show the platform sold 4.19 million SOL tokens over a ~15-month span, translating to ~$757 million in value: 264,373 SOL sold on-chain, and the rest funneled into Kraken (3.93 M SOL / ~$715.5 M).

These figures indicate that the project’s token-liquidation and fundraising footprint is substantially larger than previously visible, hinting at monetization rather than reinvestment into ecosystem growth.

Read More: Coinbase Makes Its Biggest Solana Push Yet with Strategic Acquisition of Vector’s Trading Tech

Impact on the PUMP Token & Community Sentiment

The native PUMP token has sharply underperformed amid these revelations: retail holders saw a token price drop and voiced frustration online with key complaints:

- No visible air-drops, no enhanced incentives for loyal users, despite large token realisations.

- The management of the launchpad was silent to the outside world with billions of dollars allegedly being transferred.

- People had stopped being speculative with enthusiasm to distrust – a drain that is lethal when it comes to a platform that relies on user momentum.

Large outs of the team or project are historically known to cause sudden price drops in the meme-coin or launchpad ecosystems. This appears to be the case: with large asset movements coinciding with diminished ecosystem activity, PUMP’s value loop is under strain.

Monitoring Signals

Token investors should watch for:

- Large USDC or stable-coin flows into exchanges.

- Sudden drops in project communications or ecosystem updates.

- Mismatch between token realisations and ecosystem development announcements.

What This Means for PUMP Token Holders & Potential Buyers

- Existing holders: The signalling of large asset movements raises caution: monitor spreads, trading volume, and governance disclosures.

- Prospective buyers: A token that has already witnessed major monetisation needs a recovery playbook: improved communication, token burn/air-drop programmes, clearer roadmap. Without those, upside may be limited.

- Risk-averse traders: protocol execution risk and team monetisation risk Risk-averse traders: Launchpad tokens are typically double-risk (team monetisation risk and protocol execution risk). Punishment through percent distribution and stop-loss rationale is recommended.

This saga points to one of the central developments in crypto: transparency is a highly important factor in innovation. On-chain flows that are publicly available do not allow large realizations to be concealed.

The post Pump.fun Funnels $436 Million in USDC Out of Solana Launchpad Amid $PUMP Token Collapse appeared first on CryptoNinjas.