Bitcoin’s Drop Under $90K Sparks Bold Claims From Crypto Execs: ‘This Is A Generational Opportunity’

Bitcoin slipped below $90,000 this week, a level it had not touched in seven months, according to data. Traders watched nervously as the flagship token moved around $90,700, leaving it roughly 25% beneath its recent all-time high of just over $126,000 reached on Oct. 6. Markets noted that a big liquidation event on Oct. 10 still echoes through trading desks.

Analysts See A Near-Term Bottom

According to an interview on CNBC, BitMine chairman Tom Lee said the Oct. 10 liquidations and ongoing uncertainty about whether the US Federal Reserve will cut rates in December have kept pressure on crypto.

He described signs of exhaustion among sellers and cited technical work suggesting a bottom could appear soon.

Bitwise Asset Management chief investment officer Matt Hougan shared a similar line of thinking, calling current pricing a “generational opportunity” and urging longer-term investors to take notice. He added that traders are jittery about the economy, high AI valuations, and US President Donald Trump’s tariffs, which may have added to selling.

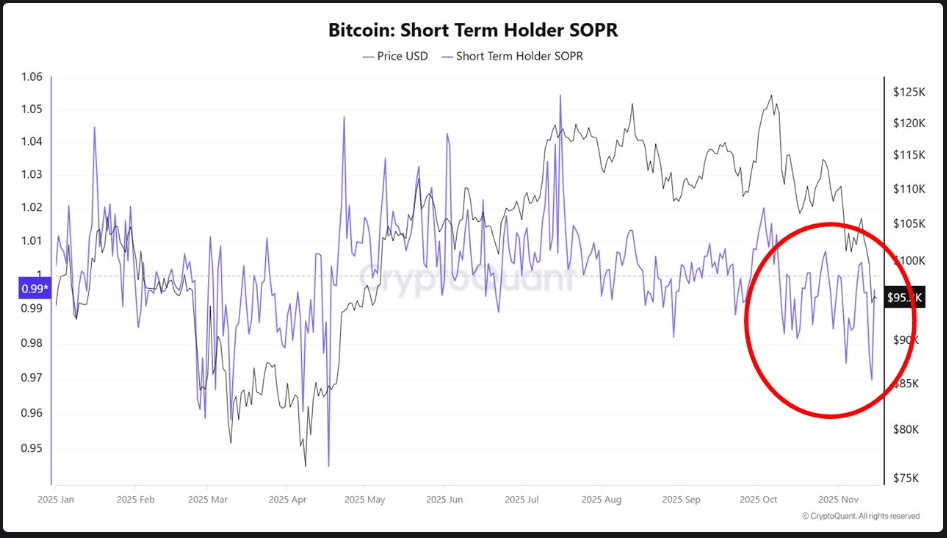

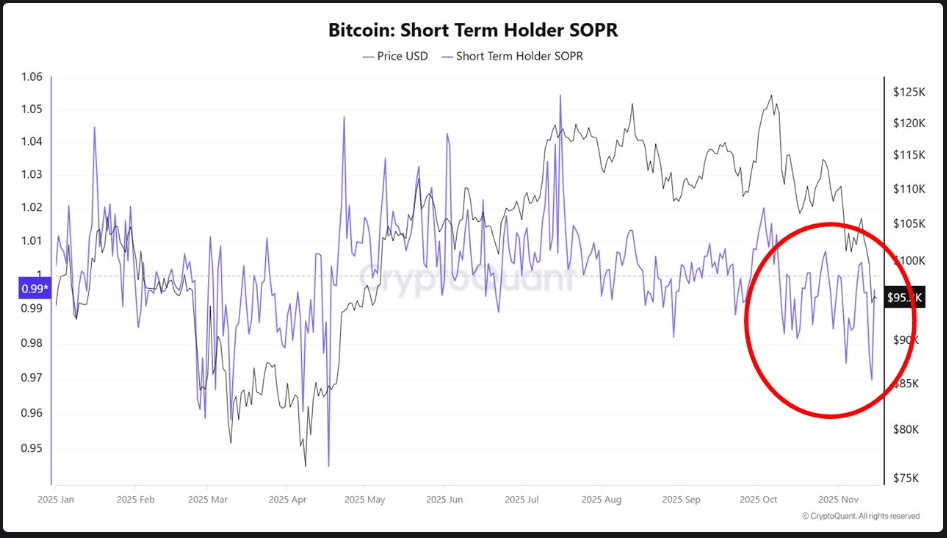

Selling Fueled Mostly By Short-Term Holders

According To XWIN Research, a review of on-chain measures showed short-term holders did much of the heavy lifting in the recent decline.

The Short-Term Holder Spent Output Profit Ratio fell below 1 on multiple occasions, which signals many short-term owners sold at a loss. XWIN also said coins younger than three months made up most of the spent volume during the worst of the drop.

That pattern points to panic-driven exits by recent buyers rather than mass, late-cycle distribution by longtime holders.

At the same time, metrics such as Coin Days Destroyed, Realized Profit, and Long-Term Holder Net Position Change registered increased distribution by long-term holders since September, but XWIN argued this behavior matches routine profit-taking during a bull run rather than blow-off top selling.

Flow From ETFs And Whales Adds Pressure

Reports have disclosed that exchange-traded fund outflows and large sales by whales also contributed to the weakness, while rising geopolitical tensions added a further layer of risk.

Market participants described Bitcoin as an early mover that started to weaken before other risk assets, which some investors took as a warning signal for broader markets.

Outlook Hinges On Stocks And Policy

Lee expects a rebound if equities rally later this year, saying a stronger stock market would likely lift Bitcoin back to fresh highs before year-end.

Hougan agreed that a recovery could come quickly and that the current window offers an attractive entry for investors planning to hold for 12 months or more.

Yet traders remain split; a few see the recent data as clear exhaustion, while others warn macro events and policy decisions could push prices lower before confidence returns.

Featured image from Unsplash, chart from TradingView