What Is Crypto Impermanent Loss and How to Calculate It in 2025

The impermanent loss in crypto is the temporary reduction in the value of your assets when you deposit them into a liquidity pool, compared to if you just held those same assets in your own wallet. Hence, it directly impacts liquidity providers (LPs) by reducing their potential returns, and even studies have shown that for over half of LPs in some major pools, the loss is actually higher than the trading fees they earn. To compensate liquidity providers, many DeFi protocols even distribute additional token rewards or trading fees.

To minimize impermanent losses in DeFi, you need to use strategies like choosing stablecoin pools (ETH/WBTC), using correlated asset pairs, or opting for uneven liquidity pools. This guide will cover what impermanent loss is, how liquidity pools work with price divergence and token ratios, and the exact formula and calculators you can use to calculate it.

What is Crypto Impermanent Loss?

Impermanent loss is basically a risk you take on when you decide to provide liquidity to a decentralized exchange’s liquidity pool. You see, when you deposit your crypto tokens into a pool, you’re mainly becoming a liquidity provider (LP) there. Now, you know, this is how DeFi works, allowing people to trade tokens without needing any of the traditional middlemen, like a bank or a centralized exchange.

So, what is impermanent loss? Well, the core of impermanent loss is simply the difference in value between the two scenarios: providing liquidity versus holding the assets yourself. It’s called “impermanent” because, theoretically, if the token prices eventually go back to where they were when you first deposited, the loss goes away. But, you know, crypto prices can be pretty volatile, so that’s not always a guarantee.

Generally, this loss only becomes permanent if you decide to withdraw your tokens out of the pool before the prices correct themselves. Also, many of the studies have shown that for some pools, specifically on those popular platforms like Uniswap V3, over 50% of LPs have actually been unprofitable because their impermanent losses were bigger than the trading fees they earned.

How Does Crypto Impermanent Loss Work?

Impermanent loss mainly happens because of how automated market makers, or AMMs, are designed to keep the pool balanced. Basically, every liquidity pool change depends on maintaining a constant and equal value of the two assets it holds.

Today, the most common kind of pool, used by platforms like Uniswap V2, uses a simple math formula to manage this balance…

X * Y = K

Here, this formula means the quantity of Token A (X) multiplied by the quantity of Token B (y) must always equal a constant value (K).

And, you should know, that constant value, K, is why the pool automatically adjusts. So, when an actual trade happens, it changes the ratio of the two tokens in the pool. For instance, if someone buys a lot of Token A, the supply of Token A in the pool goes down, and the supply of Token B will go up.

Now, to keep the product (K) the same, the price of Token A inside the pool has to go up, and the price of Token B goes down.

Hence, here come the arbitrage traders. Actually, they are the ones who basically make impermanent loss occur. They’re constantly watching the prices of tokens inside the pool compared to the external market price on exchanges like Coinbase or Binance.

So, if the price of Token A goes up on an outside exchange, it becomes cheaper inside your liquidity pool. Here, arbitrage traders will then buy the cheaper Token A from your pool, bringing in more of Token B, until the price ratio in the pool matches the outside market again.

You, the LP, end up with more of the token that hasn’t changed as much in value and less of the token that just became more valuable. Hence, this automatic rebalancing is going to cause the difference, or the loss, compared to if you had just held both tokens.

Price Divergence and Token Ratio

The amount of impermanent loss depends on how far apart the token prices move. You know, small swings generally create minor differences only, but big divergences really bite.

Because the loss grows faster than the price change, a doubling in price causes a bigger hit than a 50% increase. Hence, the effect is symmetrical: a 2x increase or a 50% decrease both lead to the same percentage loss.

Example Scenario: ETH/USDT Pool

Let’s walk you through a simple example so you can see exactly how impermanent loss works in real life…

Initial State

- You deposit: You decide to deposit an equal dollar amount of ETH and USDT. So, let’s say ETH is priced at $2,000.

- Your deposit is $4,000 total: You deposit 1 ETH (worth $2,000) and 2,000 USDT (worth $2,000).

- HODL Value: Now, you know, if you just held your tokens, your value would be $4,000 (but that never happens because of market volatility)

Scenario After Price Change

- Let’s say the price of ETH doubles on external exchanges, going from $2,000 to $4,000. But the price of USDT stays at $1.00.

- Now, arbitrage traders notice that ETH is still cheaper in your pool. So, they start buying ETH from your pool, depositing more USDT, until the new price of ETH in the pool is close to $4,000.

Final Pool Position vs. HODL Value

- If you HODLed the original 1 ETH and 2,000 USDT, your holdings would actually be worth $6,000 (1 ETH worth $4,000 + 2,000 USDT)

- But in the Liquidity Pool, your share would have automatically rebalanced. Hence, you’d end up with less ETH (about 0.707 ETH) and more USDT (about 2,828 USDT).

- Your Pool Value: Your new holdings in the pool would be worth: ($4,000 * 0.707) + ($2828) = $5,656.

The Impermanent Loss

- The difference between HODL ($6,000) and Pool Value ($5,656) is $344.

- Now, $344 divided by $6,000 is approximately 5.7%.

Well, that 5.7% difference is your impermanent loss. By the way, this loss percentage holds true only for any 2x price change, up or down, in a standard 50/50 pool. There may be different scenarios as well.

Impermanent Loss Estimation in Crypto Liquidity Pools

Estimating impermanent loss helps you decide whether providing liquidity is worth it, and the simplest approach is to compare the trading fees you expect to collect with the potential shortfall. Obviously, assuming a standard 50/50 pool ratio.

Here are the approximate loss percentages for different levels of price divergence:

| Price Change (Ratio of New Price / Old Price) | Impermanent Loss (vs. HODL) |

| 1.25x (25% change) | 0.6% loss |

| 1.5x (50% change) | 2.0% loss |

| 2x (100% change) | 5.7% loss |

| 3x (200% change) | 13.4% loss |

| 4x (300% change) | 20.0% loss |

| 5x (400% change) | 25.5% loss |

Look, as you can see, a 5x price change means you are basically losing over a quarter of the value you would have if you had just held the tokens. Well, that’s a pretty big market-making risk to take on, so you want to be sure you are being compensated enough by the trading fees.

How to Calculate Impermanent Loss?

The easiest way to calculate impermanent loss is to compare your final token value to your original HODL value, as we did in the example, but there is also a standardized formula.

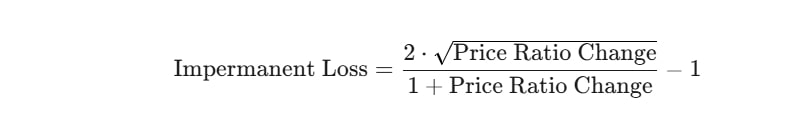

Impermanent Loss Formula

The official formula used by many protocols, assuming the pool is a standard 50/50 split, is based only on the price ratio change. Basically, the magnitude of the price difference is all you need.

So, how to calculate impermanent loss? Well, the impermanent loss formula is:

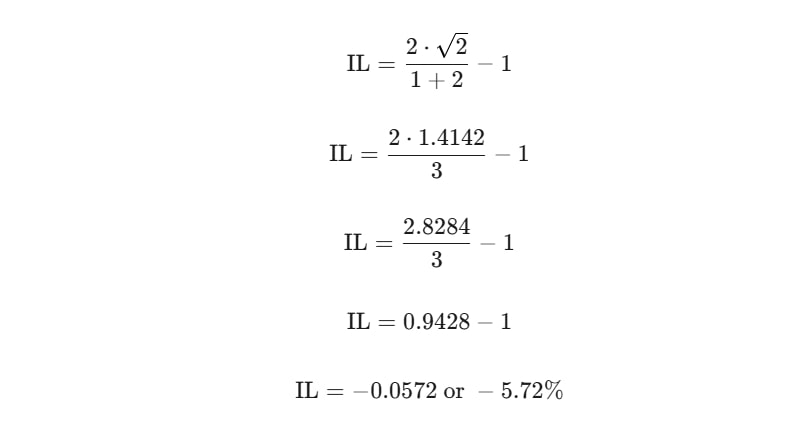

Alright, let’s plug in the numbers from our ETH example where the price doubled…

Using Impermanent Loss Calculators

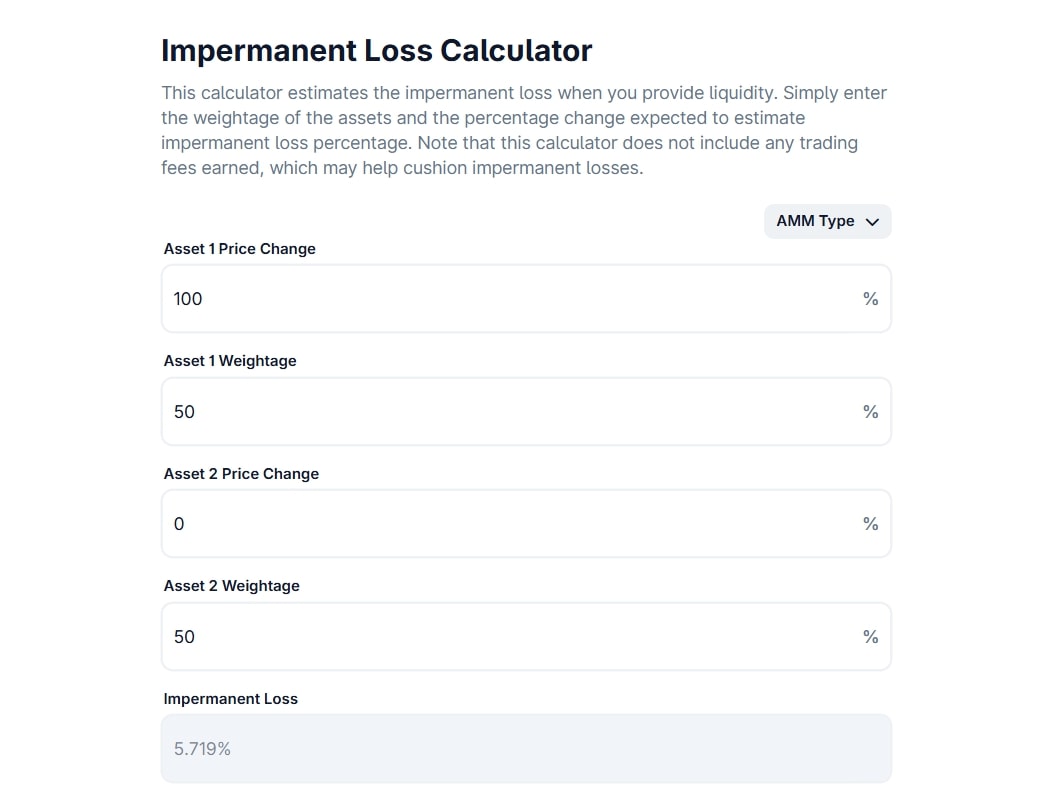

The most straightforward way for an everyday user is to skip the manual math and use one of the many online impermanent loss calculators. The best impermanent loss calculators are: Coingecko calculator and dailydefi.org.

Mainly, these calculators will generally give you the breakdown of your final token amounts in the pool versus the original token amounts. But a quick warning also, many simple calculators only show the impermanent loss itself, not your total profit or loss. So, you must include the trading fees you earned while your funds were in the pool.

Here is the example from the CoinGecko calculator:

How to Minimize Impermanent Loss?

You cannot avoid impermanent loss in most liquidity pools, but you can definitely choose strategies that minimize your exposure to it.

- Pick Stablecoin Pools: This is the best approach, as if you provide liquidity for a pair of stablecoins, such as USDC/DAI or USDT/USDC, the price divergence will be pretty minimal since both tokens are pegged to the same dollar value. In this case, impermanent loss is almost non-existent. However, your fee rewards would usually be lower because the trading fees are always lower for these pairs.

- Use Correlated Asset Pairs: You can smartly pick tokens that move in correlation, for example, ETH/WBTC, which will also reduce the risk because their prices usually follow similar market trends. Hence, the ratio between them doesn’t change as drastically as it would with an altcoin paired with a stablecoin.

- Uneven Liquidity Pools: On some of the platforms, pools can be created that are not a normal 50/50 split. They may be 80/20 or 60/40. In general, you can hedge the pool to a less volatile asset. Therefore, in an 80% stablecoin / 20% volatile token pool, you are less exposed to the price swings of the token.

- Concentrate Your Liquidity: Some of the newer models for an AMM, such as concentrated liquidity in Uniswap V3, let you provide liquidity only within a certain price range. So, if the token price stays within the range you set, you are making so much more in fees while taking on less impermanent loss.

Conclusion

In a nutshell, impermanent loss is the gap between what your liquidity position is worth and what you would have if you simply held the coins. Mainly, it comes from AMMs rebalancing the ratio of tokens as prices move, and leaves you with more of the asset that falls in value and less of the one that rises.

Also, by understanding how price divergence, fees, and time horizons interact, you can easily check whether providing liquidity fits or it’s just too risky. Hence, if you do a bit of your research and use the strategies we’ve talked about here, you can definitely manage the risk and potentially make your liquidity providing profitable.

The post What Is Crypto Impermanent Loss and How to Calculate It in 2025 appeared first on CryptoNinjas.