What Is Slippage In Crypto And How To Calculate It in 2025?

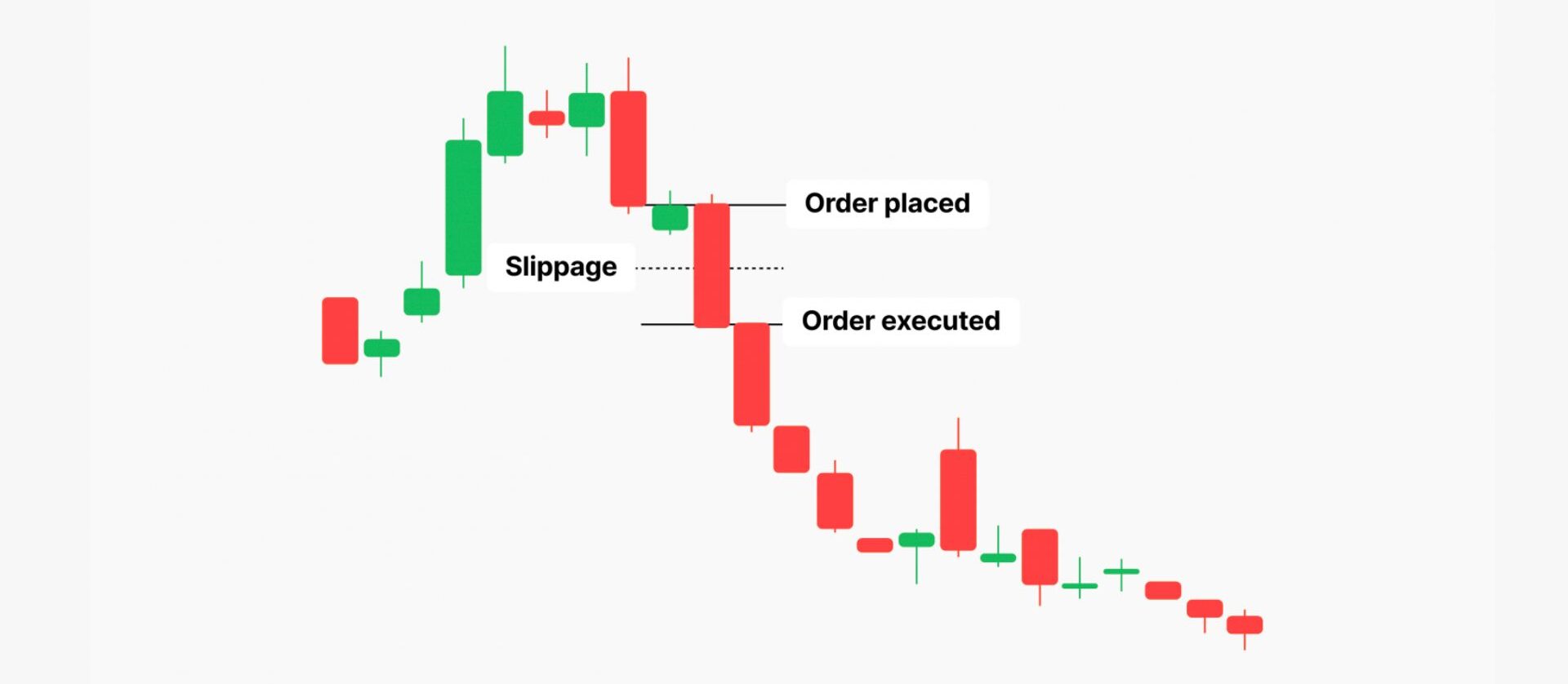

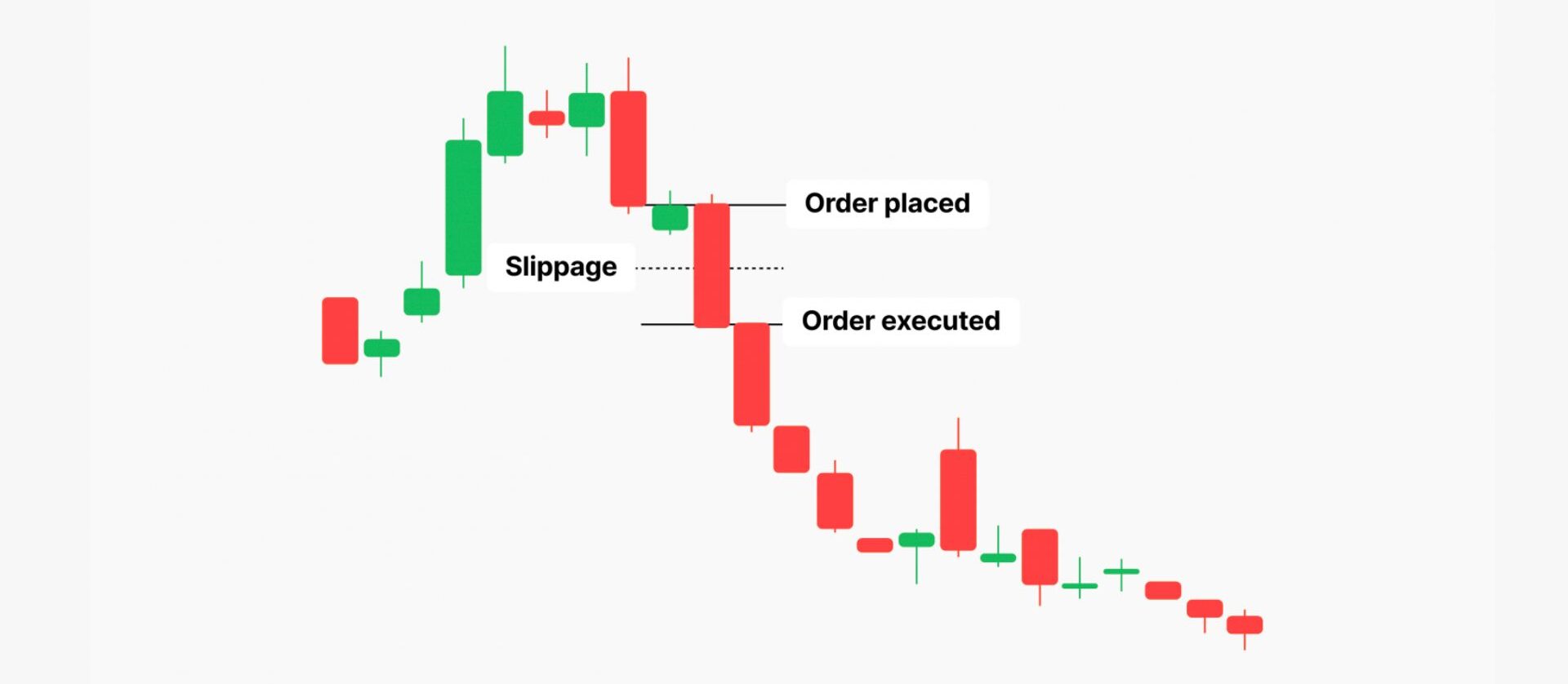

Slippage in crypto is the difference between the price you expected to pay for a coin and the price you actually get when your trade executes. The slippage happens in trading because of high market volatility, low liquidity, network congestion, and large order sizes. Hence, to avoid crypto slippage, you need to use limit orders, trade during high-liquidity periods, and break large orders into smaller trades.

This guide will explain exactly what slippage in crypto is, how to calculate that percentage, and give you the best steps to avoid it or minimize it by using slippage tolerance.

What is Slippage in Crypto Trading?

Slippage is basically the difference between the expected price of a crypto trade and the actual price at which that trade is executed. So, for example, say you try to buy 1 Bitcoin at $100,000, but by the time your order goes through, the price has actually jumped to $100,500. Well, that extra $500 is slippage. To minimize slippage, you should use highly liquid crypto exchanges like Binance.

Now, you need to know that slippage isn’t always a bad thing, though. There are two main types you might run into: positive and negative slippage.

- Negative Slippage: This is the one that costs you money, and it generally happens when you buy a coin at a higher price than expected, or you sell a coin at a lower price than expected. To be exact, you end up with a worse deal.

- Positive Slippage: It happens when you buy a coin at a lower price than expected or you sell a coin at a higher price than expected. Here, you actually get a better deal than you planned, and you can’t count on it, but it’s really profitable when it happens.

So, if you want deep liquidity and minimal slippage, you can always trade on Binance, the world’s largest crypto exchange by trading volume.

What is a Good Slippage for Crypto?

A good slippage for crypto is always going to be as close to 0% as possible, but what you can actually get depends a lot on the specific coin you are trading. Well, you should basically aim for the lowest number you can reasonably get without your trade failing all the time.

Now, for popular and highly liquid cryptocurrencies like Bitcoin ($BTC) or Ethereum ($ETH) on a major exchange, you should often expect or aim for a slippage of less than 0.1% to 0.2%. Since these assets are traded constantly and have massive liquidity pools, even large orders usually don’t move the price that much in a split second.

But again, if you are trading a lower-volume altcoin on a decentralized exchange, this time, you might have to accept a higher slippage of 1% or even 2% just to make sure your trade goes through.

Here’s a simple way to look at acceptable slippage, especially on DEXs:

- Highly Liquid Coins (BTC, ETH, Stablecoins): Aim for 0.1% to 0.5%.

- Medium Liquid Altcoins: Aim for 0.5% to 1%.

- Low Liquid or New Meme Coins: You might need to set it to 1% to 3% (or sometimes even higher, just to get the trade to process, but this is pretty risky).

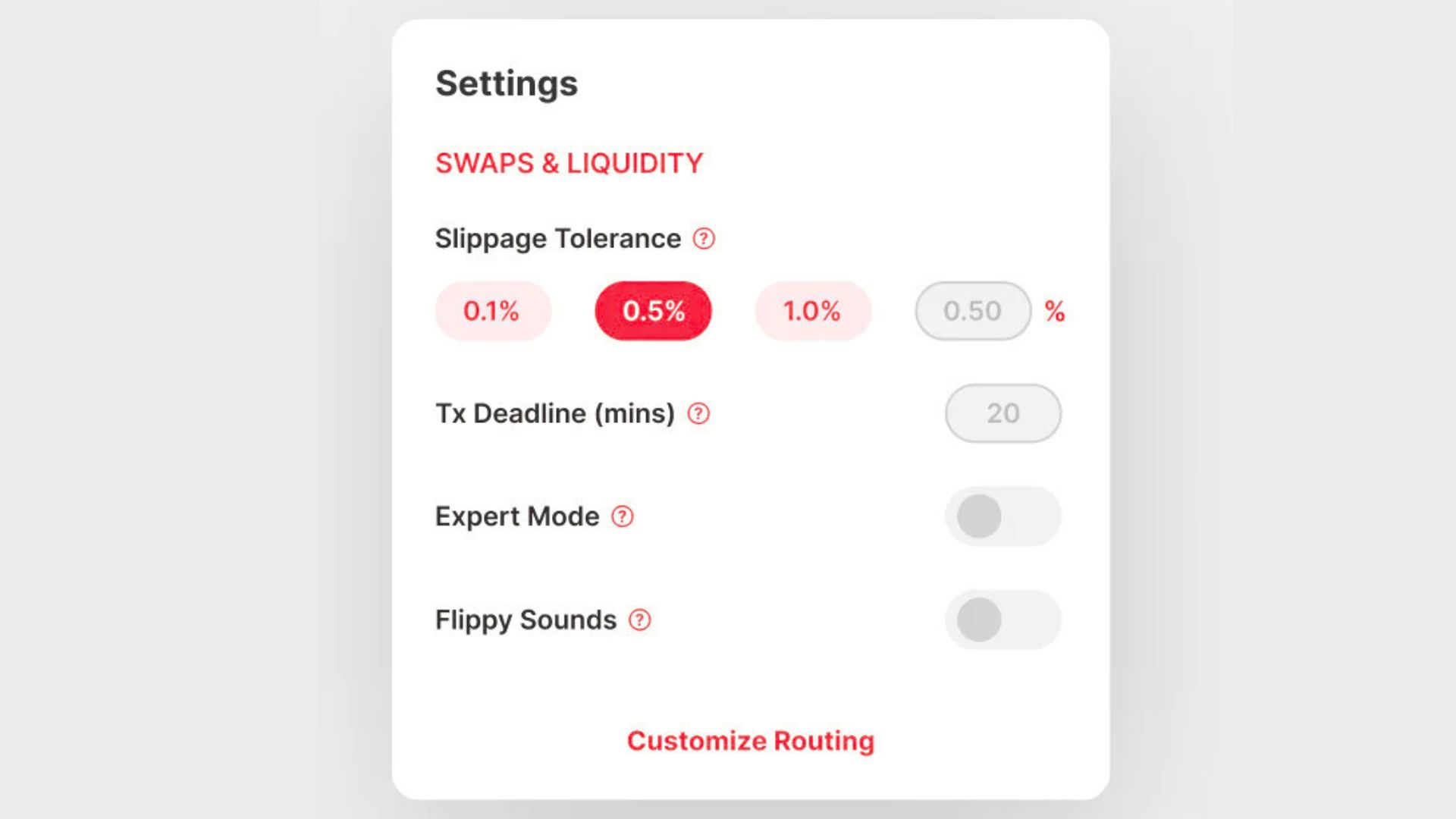

What is a Slippage Tolerance?

A slippage tolerance is a setting you adjust on trading platforms, especially on decentralized exchanges (DEXs), that tells the platform the maximum percentage of negative slippage you are willing to accept before your trade is automatically canceled. Well, this one setting is for your own safety net, and it basically says, “Okay, if the price moves against me by more than this much percentage, don’t do the trade”.

Now remember, if you set it too low, like 0.1%, your trades might fail constantly, especially when the market is volatile. But if you set it too high, this time let’s say 5%, you run a risk of getting a terrible execution price and losing a huge chunk of your money on slippage. So, set it in balance like around 0.5%-1%.

Why Does Slippage Happen in Cryptocurrency Trading?

Slippage happens in cryptocurrency trading due to high market volatility, low liquidity or trading volume, network congestion, and large order size.

Market Volatility

Market volatility is when crypto prices are moving up or down really fast and unpredictably. So, during these rapid price fluctuations, the price you actually see on your screen changes in the blink of an eye, and now, if you put in a market order during one of these sudden spikes, the price could be totally different by the time your transaction is confirmed on the blockchain. Hence, you’re going to get slippage.

You’ll notice this especially when trading on popular exchanges. But some platforms like MEXC Exchange handle these situations better due to higher liquidity and faster trade execution.

Low Liquidity

Low liquidity basically means there aren’t enough buyers and sellers ready to trade a specific coin at your desired price. So, in crypto, if you try to buy a large amount of a lesser-known altcoin, there might not be enough coins for sale at the current best price you are looking for.

Hence, your order has to “eat through” the exchange’s order book, taking up all the best-priced orders and moving on to worse and worse prices until your whole order is filled. And that’s how traders often become exit liquidity for early movers who sell into the sudden demand.

Network Congestion

Network congestion occurs when the blockchain network itself is quite slow because too many people are trying to make transactions at the same time.

You know, when the network is congested, your transaction generally takes a lot longer to be confirmed and added to a block. Now, while your order is sitting there waiting, sometimes for several minutes, the market price of the tokens you are trading can easily move a lot. Hence, the longer the delay, the bigger the chance for slippage.

Large Order Size

A large order size means the amount of crypto you are trying to buy or sell is big compared to the market’s available liquidity. Even in a pretty liquid market, if you try to buy $500,000 worth of a coin all at once, your order is so huge that it will consume every available sell order at the best price, and then it will have to move on to the next best price, and the next, and so on.

How to Calculate Crypto Slippage?

You can calculate crypto slippage using a straightforward formula. You need two main numbers: the Expected Price (the price you saw when you submitted the order) and the Executed Trade Price (the actual price the trade was filled at).

The formula looks like this:

Slippage Percentage = (Executed Price – Expected Price) / Expected Price * 100

Let’s look at an example so you can totally understand it.

- You Expected to Buy: 1,000 tokens at $1.00 each.

- The Price You Actually Paid (Actual Executed Price): $1.05 each.

- Find the Difference: $1.05 – $1.00 = $0.05

- Divide by Expected Price: $0.05 / $1.00 = 0.05

- Multiply by 100: 0.05 * 100 = 5%

Hence, you experienced a 5% negative slippage.

Is Lower Slippage Better Than Higher?

Yes, low slippage is definitely better for your trading than a higher one. Because if slippage is high, it means you’re way off from your expected price, which usually means paying more or getting less than planned. Also, the only time higher slippage sounds good is if you somehow got positive slippage (like getting a better price than expected), but again, that’s just luck.

How to Avoid Slippage in Crypto Trading?

To avoid slippage in crypto trading, you need to use limit orders, trade during high-liquidity periods, and break large orders into several smaller orders.

Use Limit Orders

A limit order is a tool that lets you set a specific price at which you are willing to buy or sell a coin, and then your order will only be filled at that price or better. Now, if the market price moves past your set price, your order just won’t execute. Hence, you won’t get any slippage.

For example, you want to buy a token, but only at $5 price. Now, you place a limit order at $5, and if the price is $5.10, your order waits. Next, if the price drops to $5.00 or $4.99, your order gets filled.

Trade During High-Liquidity Periods

High-liquidity periods are when a trading pair has a lot of buyers and sellers, which usually means there are plenty of orders in the order book to fill your trade without moving the price too much. Well, this typically happens with major coins and during peak trading hours.

- Tip: You know, when major markets like the US and Europe are all active, trading volume is usually at its highest. So, these are generally the best times for lower slippage.

- Avoid: Trading late at night, especially on a Sunday, or right after a huge, unexpected news event. Actually, that’s when liquidity can be thin and volatility is crazy high.

Break Large Orders Into Smaller Trades

You should break your large order into several smaller orders to get the best execution price without much slippage. So, instead of that one massive order pushing the price against you, you can eventually place several smaller orders. Here, you might still get some slippage on each small order, but the overall price impact will be less severe.

Conclusion

In a nutshell, slippage in crypto is just the price gap between what you thought you’d pay and what you actually pay. And it’s an unavoidable part of trading. You know, it happens because markets move and trades don’t always fill at one fixed price.

Hence, to keep slippage in check, you definitely need to use the tips above: use limit orders, trade during busy market times, and split up large trades into smaller ones. So just remember to manage slippage before your next trade; you’ll be glad you did.

The post What Is Slippage In Crypto And How To Calculate It in 2025? appeared first on CryptoNinjas.