Bitcoin Poised For 10x Surge? Analyst Points To Gold’s Playbook

Bitcoin eased back this week after a fresh peak, but a loud bullish pitch is making rounds. According to market updates, the coin hit about $124,390 before slipping to $114,158 and then nudging up to $115,285 at press time.

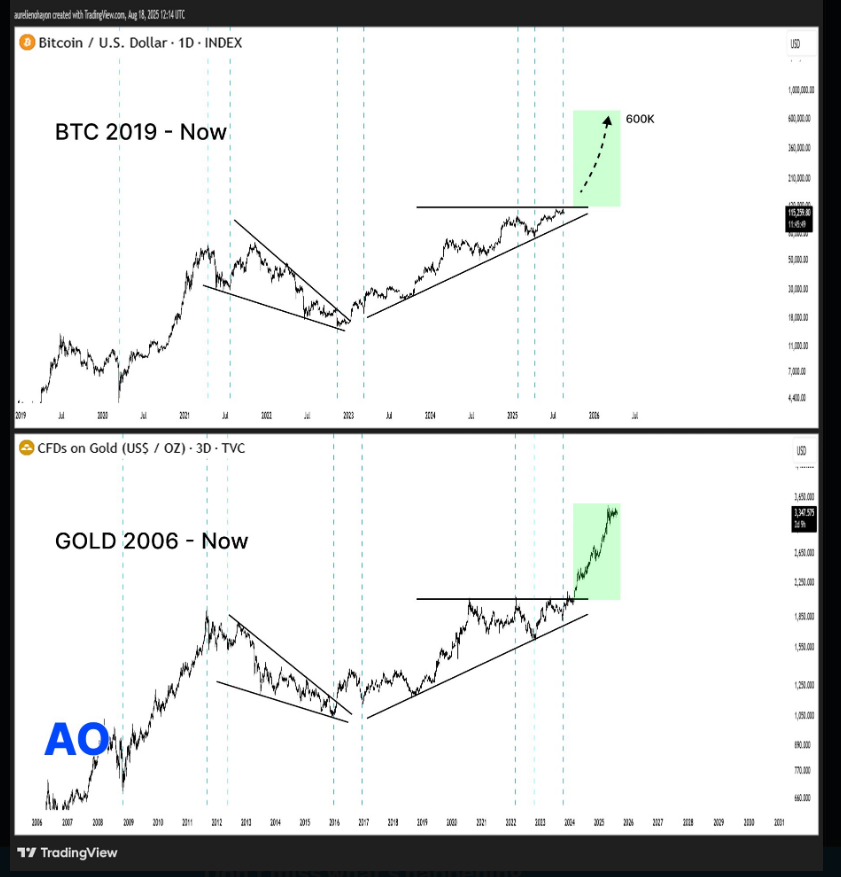

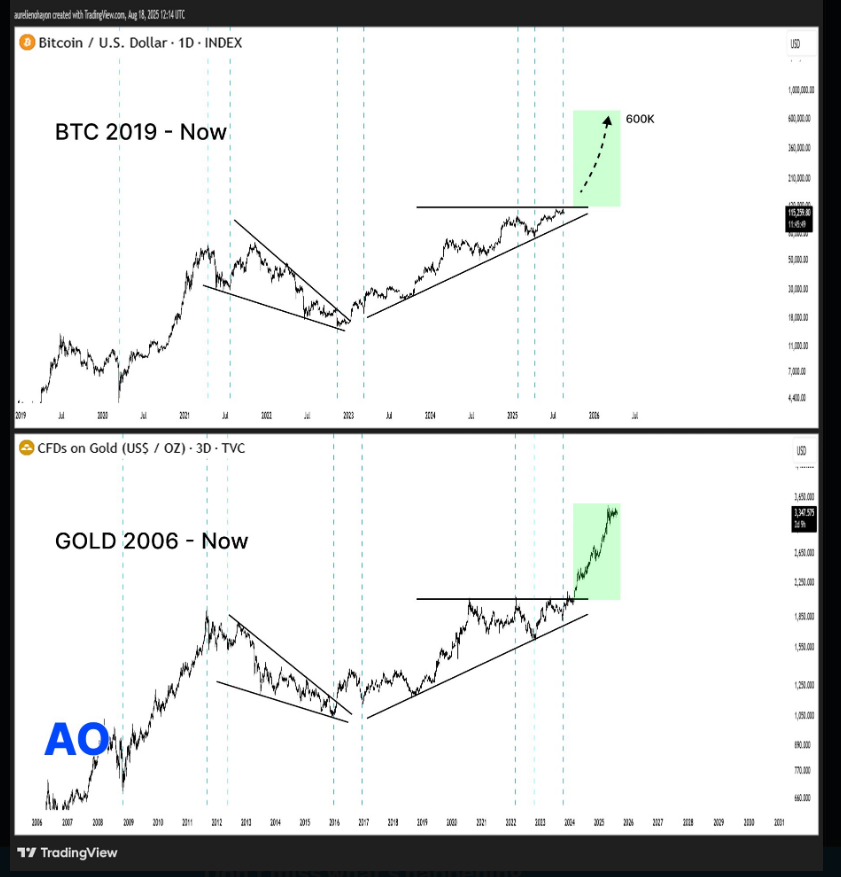

Based on reports from a chart-focused analyst who goes by AO, Bitcoin may be tracing a pattern like gold’s, and that pattern could point to a rise toward $600,000 — a jump of roughly 420% from current levels.

Analyst Sees Gold Pattern

AO’s view rests on chart shapes. He compares Bitcoin’s recent wedge and ascending triangle to the way gold moved over the last decade. According to AO, Bitcoin’s consolidation around $115,000 could be the base for a large breakout.

#BITCOIN IS READY FOR A HUGE BULL RUN. pic.twitter.com/eorprzknEQ

— AO (@AO_btc_analyst) August 18, 2025

AO’s scenario includes what he calls “missing legs,” and he puts a possible run above half a million dollars by 2026 if the pattern completes the way he expects.

Reports have mentioned similar geometric comparisons from other watchers, though few attach a precise price target like $600,000.

Market Scale If Target Hits

Based on those numbers, a $600,000 price tag would imply market value in the ballpark of approximately $12 trillion.

That figure would push Bitcoin past many big tech names and place it closer to gold’s valuation than where it stands now.

According to the same reports, that is the idea being used to argue Bitcoin’s case as a major store of value. The math behind the headline number is simple, and the size of the move — about 420% from roughly $115,000 — is what makes the claim dramatic.

Bull Case Backed By Some Big Names

Institutional voices add fuel to the talk. Strategy’s Michael Saylor, who has been one of Bitcoin’s most consistent backers, continues to argue that the asset will outshine traditional stores of value as more companies adopt it for their balance sheets.

Ark Invest’s Cathie Wood has projected that Bitcoin could eventually climb to the $1 million mark, underscoring the growing confidence among high-profile investors.

Meanwhile, Mexican billionaire Ricardo Salinas Pliego has also voiced his view that Bitcoin could surpass gold’s roughly $22 trillion valuation in time.

Signals That Could Change The Story

Not everyone treats the pattern call as a forecast. Some analysts warn that matching a chart shape to gold doesn’t prove the same outcome will follow.

The two assets have different buyers, liquidity and use cases, and a huge lift to $600,000 would likely need long-term, large flows into Bitcoin — for example, big institutional allocations or permanent reserve moves — not just a short-term momentum spike.

Regulation, interest rates and market shocks are other real factors that could alter any plan.

Featured image from ETF Stream, chart from TradingView