The Best Artificial Intelligence (AI) Coins and Projects to Buy in 2025

The best AI crypto coins and projects to buy in 2025 are Snorter Bot ($SNORT), SUBBD ($SUBBD), Bittensor (TAO), NEAR Protocol (NEAR), Artificial Superintelligence Alliance (FET), Virtuals Protocol, Internet Computer (ICP), Render Network (RENDER), Story Protocol (IP), and The Graph (GRT).

AI cryptocurrencies are tokens integrating blockchain with artificial intelligence to optimize network functionality. They use AI for enhanced data analysis, robust security, and efficient automation. AI tokens offer early growth potential, compelling use cases, passive income opportunities, and AI-blockchain synergy.

In this guide, we will explain the top 10 best AI cryptos to invest in, along with their use cases and future growth potential. We will also cover what AI cryptocurrencies are, how AI crypto projects work, and the criteria to choose the best ones to buy.

1. Snorter Bot ($SNORT)

Snorter Token ($SNORT) is the native cryptocurrency of the Snorter Bot. Launched in 2025, it operates within Telegram for streamlined trading. The bot’s main focus is on making crypto trading, particularly with meme coins, faster, secure, and efficient for regular traders. It also facilitates identifying promising tokens, executing swift trades, and avoiding common scams, such as “rug pulls” and “honeypots”.

Market Cap: Snorter Token ($SNORT) is currently in its presale and has already raised approximately $1.2 million. The total supply of $SNORT is 500,000,000 tokens.

Use Cases: The primary use case for $SNORT is powering the Snorter Bot. Holding $SNORT tokens grants fee discounts when using the bot.. In addition to fee discounts, $SNORT holders can also earn staking rewards and airdrops. The bot also provides other features such as automated token sniping, copy trading from popular wallets, limit orders, and primarily honeypot and rug pull detection.

Growth Potential: Snorter Bot has significant growth potential due to its focus on enhancing the security and efficiency of meme coin trading within the Telegram ecosystem. Its ability to detect scams with high accuracy and then offer lower trading fees compared to competitors could attract a large user base. The project’s roadmap also includes multi-chain expansion and the potential for revenue from bot fees to be used for token buybacks or direct profit distribution to holders.

2. SUBBD ($SUBBD)

SUBBD ($SUBBD) is an AI‑powered crypto token built for the creator economy. It serves as the native payment currency on the SUBBD platform, which is designed to help creators monetize content, engage fans, and automate workflows using AI tools. SUBBD also supports staking rewards with a fixed APY of 20% and powers content paywalls, AI assistants, and community rewards. SUBBD disrupts high-fee platforms by enabling fast, low-cost payments for creators and fans.

Market Cap: As of now, SUBBD ($SUBBD) is in its presale phase. Thus, its market capitalization is not fully established, unlike tokens on major exchanges. The total token supply is 1 billion tokens, and the project has already raised over $700k.

Use Cases: The primary use case for $SUBBD is to act as the native currency within its AI-powered creator platform. $SUBBD enables fans to pay for subscriptions, access exclusive content, join live streams, and tip creators. Creators can leverage the platform’s integrated AI tools, including AI-generated influencers, voice cloning, and image generation, to scale their content creation and enhance fan engagement.

Growth Potential: SUBBD has good future potential, primarily because it’s tapping into the growing creator economy and integrating artificial intelligence. The platform has over 2,000 creators with substantial followings. And its decentralized model, which allows creators to retain a higher percentage of their earnings, could attract more talent.

3. Bittensor (TAO)

Bittensor is a decentralized AI network. It enables developers, miners, and validators to contribute machine learning models and data on-chain. TAO is its native token. Here, contributors can earn TAO when their work is judged useful via the Yuma “proof‑of‑intelligence” consensus. TAO’s supply is capped at 21 million tokens, and halvings also occur about every four years.

Market Cap: Bittensor (TAO) market cap is currently around $3.6 billion, according to CMC data. It is also among the top 50 cryptocurrencies by market capitalization.

Use Cases: Bittensor’s main use case is to reward the development of decentralized AI. It creates a market where contributors earn TAO for sharing AI models. These AI models can then be utilized for various tasks, such as building more effective chatbots, enhancing predictive analysis, or even developing new AI services.

Growth Potential: Bittensor has substantial growth potential because it’s tackling a major area: decentralizing AI. Today, the AI industry is growing, and the platform that allows for open, collaborative, and incentivized AI development could also become very important. Its future plans, like the rollout of Dynamic TAO and expansion of subnet slots, can significantly enhance its price.

4. Near Protocol (NEAR)

Near Protocol (NEAR) is a layer-one blockchain designed primarily for speed, low fees, and ease of use. It utilizes sharding (also known as Nightshade) to process multiple transactions simultaneously. Today, it increasingly supports AI applications. NEAR aims to reliably host smart contracts, AI agents, and open finance services at scale.

Market Cap: The current market cap for Near Protocol (NEAR) is approximately $3.1 billion. It ranks approximately #33 in terms of size among cryptocurrencies today.

Use Cases: The Near Protocol has several key use cases that distinguish it. It provides a scalable and efficient platform for decentralized applications (dApps). Additionally, the NEAR token is used to pay transaction fees and cover data storage costs on the network. You can even stake your NEAR tokens to help secure the network and earn rewards in return. A primary focus today is on AI agents and their applications, intending to be the go-to blockchain for user-owned AI.

Growth Potential: Near Protocol has some solid growth potential, and its sharding technology is key for scalability as more users and applications come online. The recent upgrades, can also boost its market value, like full-chain abstraction, cross‑chain tools, and expanding AI agent support.

5. Artificial Superintelligence Alliance (FET)

The Artificial Superintelligence Alliance is basically a merger of three leading projects: Fetch.ai (FET), SingularityNET (AGIX), and Ocean Protocol (OCEAN), with CUDOS later joining as a network member. The alliance seeks to build a robust, open-source, decentralized AI ecosystem. Today, they’re also working towards building Artificial General Intelligence (AGI) and eventually Artificial Superintelligence (ASI) that’s not controlled by just a few big tech companies.

Market cap: FET’s market cap stands around $1.79 billion USD, trading at about $0.757 per token with a circulating supply of ~2.39 billion FET. It ranks #53 based on market value.

Use Cases: The ASI Alliance is building a comprehensive platform for decentralized AI. Fetch.ai provides autonomous AI agents for task automation and digital economies, while SingularityNET offers a marketplace for AI services. Now, Ocean Protocol handles data sharing, ensuring that AI models have access to diverse and privacy-preserving datasets. Together, they enable decentralized data management, AI-driven predictive tools, and web3-native models like ASI-1 Mini.

Growth potential: The growth potential for the ASI looks promising, and this is largely because it aims to disrupt the centralized AI landscape with more open and community‑owned alternatives. Hence, the ongoing demand for AI, coupled with a push for decentralized solutions, can significantly promote the adoption of their platform.

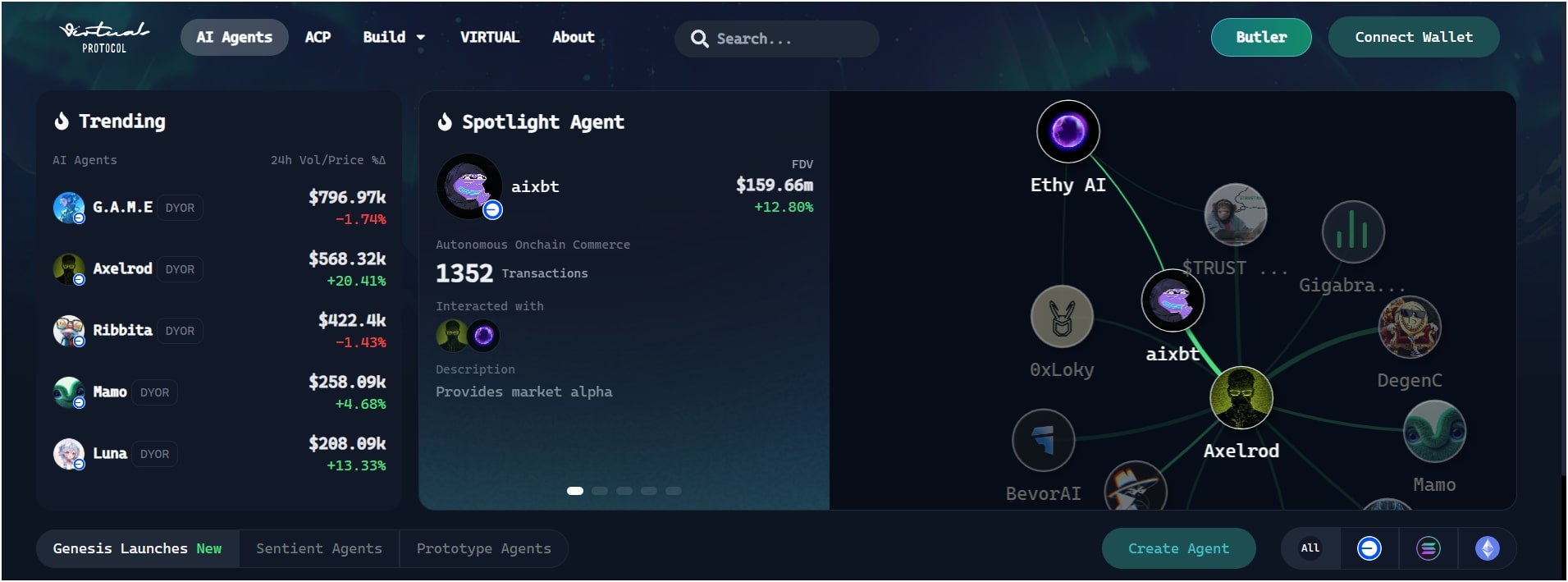

6. Virtuals Protocol

Virtuals Protocol is a blockchain platform that lets people build, own, and earn from AI agents. These agents are autonomous programs that can talk, act, and even hold assets across games and social apps. You can own parts of agents via token sales called Initial Agent Offerings (IAO). It is built on the Ethereum Layer 2 network Base.

Market Cap: Virtuals Protocol (VIRTUAL) has a market capitalization of approximately $1.2 billion, with a circulating supply of around 655 million VIRTUAL tokens out of a total maximum supply of 1 billion tokens.

Use Cases: Virtuals Protocol focuses on creating AI agents that can be easily integrated into games, social media, and virtual environments. These agents function as digital workers, generating revenue for token holders. The platform also has a framework called G.A.M.E. (Generative Autonomous Multimodal Entities) that helps these agents interact with their surroundings, make decisions, and then process all entire information.

Growth Potential: The growth potential for Virtuals Protocol looks promising as it tries to build an “AI agent economy”. Hence, if AI agents become more popular and integrate further into our daily digital life, we can see a significant adoption of Virtuals Protocol.

7. Internet Computer (ICP)

The Internet Computer (ICP) is a layer-1 blockchain protocol created by the DFINITY Foundation, with the primary aim of building a fully decentralized “world computer” to replace traditional cloud services. It uses canister software, an advanced form of smart contracts.

Market Cap: The market cap for Internet Computer (ICP) is currently around $2.93 billion USD. The circulating supply is around 535.31 million ICP tokens.

Use Cases: ICP has several key use cases. First, it mainly allows for fully on-chain hosting of web applications, meaning everything from the user interface to the backend and data stores is directly on the blockchain. Second, it’s used for decentralized AI. This helps AI models to run as tamper-proof smart contracts. Third, ICP tokens are used for governance and to pay for computation fees on the network.

Growth potential: Growth for ICP may come from AI integration and multichain support. Recently, ICP added Solana and Bitcoin support, released AI‑self‑writing apps, and then launched privacy tech like vetKeys. Plus, the focus on running AI models as smart contracts and its interoperability features, like being able to interact directly with Bitcoin and Ethereum, are also strong points.

8. Render Network (RENDER)

Render Network (RENDER) is essentially a decentralized marketplace where people can share their unused GPU (Graphics Processing Unit) power. Users with idle computers can lend processing power to creators requiring significant computational resources for things like 3D rendering, animation, or even AI tasks. In return, you will get paid in RENDER tokens. It supports rendering engines like Blender Cycles, Redshift, and Octane, plus AI imaging tools like Runway and Stability AI.

Market Cap: The current market cap of Render Network stands at $1.9 billion. It is based on a circulating supply of about 518 million RENDER tokens.

Use Cases: Render Network has some really practical uses. For starters, it’s really best for 3D rendering in films, animation, and visual effects. Beyond that, its GPU power can also be tapped for gaming development, creating immersive virtual reality experiences, and even for scientific research that requires heavy computational tasks. More recently, it’s also found a significant role in AI and machine learning, where training complex AI models demands immense graphical processing power.

Growth Potential: The future growth potential for Render Network looks promising, and this is mainly because it sits at the intersection of several expanding fields like decentralized computing, AI, and even the metaverse. And also, the demand for GPU power is only going to increase with advancements in AI and high-fidelity graphics.

9. Story Protocol (IP)

Story Protocol (IP) is a Layer‐1 blockchain, and it was mainly built to register, license, and monetize intellectual property (IP) on‑chain. It lets people take their creative works, like songs, images, or even AI models, and turn them into digital assets on the blockchain. The best part is that things like royalty payments, usage rights, and creator attribution can be programmed into these digital assets.

Market Cap: Story Protocol (IP) has a market cap of roughly $1.1 billion USD. The circulating supply is around 286.6 million IP tokens, out of a total supply of about 1.01 billion IP. It’s still relatively new, having launched its mainnet earlier this year in February 2025, and it has seen some really good investor interest.

Use Cases: Firstly, it allows creators to register their IP on-chain. Creators can register IP assets (text, art, AI models, music, NFTs) on-chain with programmable licensing terms. Secondly, it enables decentralized licensing. This makes it simpler for creators to set terms for how their work can be used and to manage those terms without needing multiple intermediaries. Plus, Token holders can stake $IP to secure the network and participate in governance.

Growth Potential: Story Protocol looks promising because it’s tackling a significant problem: intellectual property management in the digital age, especially with so much fake AI content. As more content gets created and remixed, and as AI becomes even more integrated into our creative processes, the need for a system like Story Protocol to ensure fair attribution and monetization is only going to grow with time.

10. The Graph (GRT)

The Graph is a decentralized indexing protocol. It organizes blockchain data across many chains so developers can query it easily, and it uses open APIs called subgraphs and GraphQL queries. The platform removes the need for developers to run their own data infrastructure.

Market Cap: The Graph (GRT) has a market capitalization of around $974.95 million with a current circulating supply of 9.87 billion GRT tokens.

Use Cases: The Graph has a bunch of real-world uses. It’s really important for Decentralized Finance (DeFi) projects because it helps them get real-time data for things like decentralized exchanges and lending platforms. Basically, if a dApp needs to query blockchain data efficiently, The Graph is there to help.

Growth potential: The Graph supports AI and analytics by powering data access across many chains, and also, it recently migrated its indexing support to Ethereum layer‑2 Arbitrum to improve speed and lower gas fees. Its ability to support data from over 70 different blockchains means it’s highly versatile. Hence, we may see further adoption if on‑chain data needs keep rising.

What Are Artificial Intelligence (AI) Cryptocurrencies?

AI cryptocurrencies are blockchain projects that use artificial intelligence for different tasks on the network. These platforms integrate machine learning with blockchain for smarter, efficient systems.

They use AI for different things, like improving how the blockchain works, making user experiences more personal, or even helping with automated trading. They are also referred to as AI crypto tokens.

Overall, what are AI coins? These are blockchain projects that use artificial intelligence to make their systems better.

What Is an AI Agent in Crypto?

An AI agent in crypto is a self-operating program that uses artificial intelligence to do tasks. It operates autonomously, programmed to make data-driven decisions using algorithms.

These agents can perform automatic trading, which involves buying and selling crypto depending on market information and set rules. They analyze data, identifying trends, forecasting market activity, and assessing risks from blockchain data.

Why Invest in AI Crypto Projects?

You should invest in AI crypto projects because they combine two leading future technologies, AI and blockchain. These projects use automation, data analysis, and machine learning to improve how decentralized systems work, and many of them solve real problems like fraud detection, smart trading, or secure data sharing. Also, the market for AI in blockchain is still early, so there is strong growth potential, and if you invest now in the right projects, the returns could be high over time.

What are the Best AI Crypto Coins to Buy?

The best AI crypto coins to buy now are Snorter Bot ($SNORT), SUBBD ($SUBBD), Bittensor (TAO), NEAR Protocol (NEAR), Artificial Superintelligence Alliance (FET), Virtuals Protocol, Internet Computer (ICP), Render Network (RENDER), Story Protocol (IP), and The Graph (GRT).

Which AI Is Best for Crypto Prediction?

Incite AI is best for crypto prediction. It uses a special algorithm that learns and adapts to new data, making its predictions accurate and up-to-date. It looks at a lot of information, like past market data, social media trends, and financial news, to find patterns and predict future market movements with good precision.

How Do AI Crypto Projects Work?

AI crypto projects work by adding artificial intelligence tools into blockchain systems to make them smarter and faster. They use machine learning models to study large amounts of data and predict outcomes or trends, and then predictive analytics helps these platforms make better decisions without waiting for human input.

For example, machine learning algorithms can analyze huge amounts of data from the blockchain, like transaction histories, trading volumes, and network activity. This enables them to detect patterns, predict trends, and identify security risks.

Use Cases of AI in Crypto

AI is used in crypto for automatic trading. Here, AI bots can easily buy or sell assets based on live market data. It also helps with deep data analysis by scanning large blocks of information to find useful patterns or signals.

Also, another common use is smart contract automation, where AI adjusts contract terms based on real-time input without your manual action. These features mainly help in reducing risk, improving speed, and supporting better decision-making in blockchain applications. You can also read our guide on the best Altcoins to buy now.

How to Choose the Best AI Crypto Coins to Buy?

To choose the best AI crypto coins to buy, you need to consider factors such as team expertise, technology behind the project, market cap, adoption rate, real-world use cases, and growth potential.

Key Factors for Evaluating AI Crypto Projects

- Team Expertise: A strong team behind an AI crypto project is essential. You want to see people with real experience in both artificial intelligence and blockchain technology because if the team has a good track record, it usually means they have the skills to build and deliver on their promises.

- Technology: Dig into how they are actually using AI. Is it just that they are using the AI hype for investment, or are they really using machine learning or predictive analytics in a meaningful way? A good project always has practical technological solutions that solve a real problem.

- Market Cap: This tells you the total value of all the coins currently in circulation. Generally, a higher market cap can suggest that the project is more established, with good cryptocurrency trading volume and has a bit more stability compared to smaller or newer coins.

- Adoption: This refers to how many people are actually using the AI crypto project, or how many businesses are integrating its technology. So, high adoption means the project has some real-world utility and a growing user base, which is always a good sign for its long-term success.

- Use Cases and Growth Potential: The AI coin or project must have a real-world use case. So, check if it’s genuinely solving a problem or creating new opportunities, like making trading smarter, improving data security, or automating complex tasks. The more practical and needed its uses, the better. Also, it must have a better future roadmap to increase adoption.

Risks of Investing in AI Crypto

The risks of investing in AI crypto coins are high volatility, regulatory concerns, project maturity, and low market adoption.

- Volatility: The crypto market is highly volatile, including AI cryptocurrencies. Their prices can fluctuate rapidly, resulting in significant gains and losses within a short period.

- Regulatory Concerns: Governments and financial bodies worldwide continue to grapple with how to regulate cryptocurrencies. New laws or restrictions could be introduced at any time, which may affect how AI crypto projects operate or even limit their use.

- Project Maturity: Many AI crypto projects are still relatively new or in early stages of development. Hence, they might not have fully proven their technology or built a large user base yet. Additionally, newer projects can be more prone to technical issues, changes in direction, or even failure.

- Market Adoption: Even if a project boasts great technology, if it fails to attract enough people or businesses to actually use it, its long-term value is questionable. If you want to buy AI cryptocurrencies, you can read our honest Binance review and register there.

Is AI Crypto a Good Investment?

Yes, AI crypto can be a good investment if you choose the right projects. These coins are backed by real tech, not just hype, and most of them solve real problems using AI. Certain projects demonstrate compelling use cases, such as automation, data processing, and smart trading. Generally, individuals who invest early in solid AI crypto projects can reap significant benefits as the space continues to grow.

The post The Best Artificial Intelligence (AI) Coins and Projects to Buy in 2025 appeared first on CryptoNinjas.