What Are Telegram Trading Bots? A Beginner’s Guide for 2025

The Telegram trading bots are automated tools that connect your Telegram app with crypto exchanges to follow trading signals and place trades for you. They enable trading without manual intervention, serving both beginners and experienced traders.

The benefits of Telegram crypto bots are 24/7 trading, emotion-free decisions, fast execution, support for multiple exchanges, simple setup, and built-in risk tools. The risks of using Telegram bots for crypto trading are API key security, market uncertainty, technical skills needed, scam bots, and bot failures.

This guide covers what a Telegram trading bot is and how they work. We will also highlight their potential risks and benefits, along with full steps to set up a Telegram trading bot.

What Are Telegram Trading Bots?

Telegram trading bots are automated tools that execute crypto signals and trades within the Telegram chat app. You don’t need to trade manually; when a signal arrives, the bot executes buy or sell orders automatically.. Additionally, you can connect bots to your crypto exchanges to follow your instructions or preset rules for buying and selling.

These bots streamline trading by automating buy and sell orders based on signals. You can, for instance, replicate the trades of professional traders, buy new tokens automatically as soon as they launch (known as “sniping”), or place orders to sell at a certain profit or loss. Telegram trading bots are highly accessible because the crypto market is always open 24/7 and can be traded by the bots even when you are not awake.

How Do Telegram Trading Bots Work?

Telegram trading bots work as automatic tools that follow crypto trading signals and place trades for you without manual effort. They are connected to your Telegram app and then your crypto exchange account.

To understand how Telegram bots work, you must know they use API keys from your crypto exchange. These API keys give the bot access to your account and orders on your behalf. But you remain in control of your funds. The bot can’t withdraw or transfer funds except if you provide full access. A primary function of Telegram trading bots is to monitor and execute trading signals from Telegram channels or groups. When you can set up rules for the bot to follow when a signal is posted, say, “Buy BTC at $104,000 and sell at $102,000”, the bot reads this message and executes that very order on your exchange. This entire activity takes place within seconds.

The bots use automation and algorithms to execute trade instructions. Some of the bots also enable you to customize options such as stop-loss, take-profit, or position size. A key advantage is that you can pause or stop the bot at any time.

Why Use Telegram Crypto Bots?

You should use Telegram crypto bots for their ease of use, high-speed real-time execution, 24/7 trade automation, and advanced features like copy trading and sniping new token launches, all from a single app.

- Ease of Use and Accessibility: One of the biggest reasons people use a crypto bot on Telegram is that it is highly intuitive. You do not need to be a computer expert to use it. The bot works inside the Telegram app, which many people already have on their phones. All you have to do is chat with the bot using simple commands, like “/buy” or “/sell”. This simple setup is exactly what a Telegram bot is used for – to make crypto trading easy for everyone.

- Real-Time Execution and Speed: Another reason to use a crypto bot on Telegram is fast execution. The bot reads trading signals and places orders within seconds. This is much faster than doing it manually. You won’t miss trades due to delay.

- Automation of Trades: A Telegram crypto bot can trade for you 24/7, even when you are busy or sleeping. You can set rules, such as stop-loss or take-profit levels, for the bot to follow. For example, you can tell it to automatically sell a token if its price drops to a certain point (a “stop-loss”) or when it reaches a profit target (a “take-profit”). This automation takes the emotion out of trading.

- Can follow expert signals: Many bots connect to top signal providers. When they send a trade idea, the bot follows it. This helps you copy professional traders. You don’t need your own strategy.

- Sniping New Token Launches: “Sniping” is when you buy a brand-new cryptocurrency the very moment it becomes available for trading. Doing this manually is almost impossible because you are competing with thousands of other bots. A crypto bot Telegram can be set up to watch for when a new token gets liquidity and then automatically execute a buy order in the same block. This gives you a much better chance of buying at the lowest possible price before it potentially goes up.

What Are the Key Features of Telegram Trading Bots?

The key features of Telegram trading bots are automation and signal execution, portfolio tracking and alerts, and integration with trading platforms.

Automation and Signal Execution

A primary feature of Telegram trading bots is automation. As soon as a trading signal is posted in a Telegram channel, the bot reads it and executes the trade automatically. You don’t have to look at charts or make the decisions yourself.

The signal could read “Buy Ethereum at $2,500,” and the bot will execute it in real time on your exchange. This makes the process quick and seamless. The bot also obeys commands such as placing stop-loss or take-profit levels. You can also adjust risk settings.

Also, automation prevents emotional errors and is time-saving. This automation enables many traders to use Telegram bots effectively. They assist you in following crypto signals and trading intelligently, even if you lack experience.

Portfolio Tracking and Alerts

Managing investments across multiple crypto exchanges can be time-consuming. That’s where portfolio tracking comes in handy with a Telegram bot. When you connect it to your crypto exchanges, it essentially keeps an eye on all your assets, no matter where they are held, and gives you a clear overview of how they’re performing. You can see your total value, how much each coin has gained or lost, and just generally keep tabs on your whole investment picture in one spot.

On top of that, these bots send you alerts. The bot sends alerts for trade entries, exits, or changes. So, if your trade hits a stop-loss or take-profit level, you’ll receive an instant message. Some bots provide daily or weekly portfolio performance reports. These updates help you stay informed without logging in to your exchange every time, and you can follow your trading progress, manage your funds better, and avoid surprises. This feature helps beginners and active traders manage crypto activities efficiently within Telegram.

Integration With Trading Platforms

This feature is about connecting your Telegram trading bot to the places where you actually buy and sell cryptocurrencies, such as major exchanges like Binance. The bot uses an API to connect. You don’t need to transfer funds anywhere. The money stays in your exchange account, and the bot only places trades when signals come. The bot cannot withdraw or transfer funds unless you grant full access, which is not advised.

This integration allows the bot to execute trades on your behalf securely. So, when the bot decides to make a trade based on your settings or a signal it received, it sends that instruction directly to the exchange. This means you can manage your trading activities, from placing orders to checking balances, all through Telegram, without having to log in and out of different exchange websites or apps.

What Are the Benefits and Risks of Telegram Crypto Bots?

Advantages for Beginners

The advantages of Telegram crypto trading bots for beginners include their ability to trade 24/7, make emotion-free decisions, offer speed and efficiency, connect to multiple exchanges, provide a simplified trading experience, and come with helpful risk management tools.

- 24/7 Trading: The crypto market never closes, and neither do these bots. They can keep an eye on markets and make trades around the clock, so you don’t miss out on opportunities, even while you’re sleeping or busy with other tasks. Continuous trading is critical, as humans cannot monitor markets 24/7.

- Emotion-Free Decisions: When you’re trading, it’s common for emotions like fear or greed to prompt impulsive decisions. Bots, though, just follow the rules you set, without any feelings. Thus, they stick to your strategy, promoting disciplined and consistent results.

- Speed and Efficiency: As you know, crypto is highly volatile, and crypto prices can change rapidly, and humans just can’t react fast enough sometimes. Cryptocurrency trading bots can analyze vast amounts of data and place orders almost instantly. So, this quick action can make a huge difference in volatile markets and help you grab opportunities before they disappear.

- Connects to Multiple Exchanges: Most Telegram crypto bots support many exchanges like Binance, Bybit, OKX, and KuCoin. You can link more than one account at the same time. This helps you manage trades across platforms easily. You can manage trades across platforms without logging into each exchange.

- Simplified Trading: For beginners, crypto trading can seem really complicated. These bots often have user-friendly interfaces right within Telegram. It is very easy to set up trades and manage your portfolio without needing to navigate multiple complex exchange websites.

- Risk Management Tools: Most of the Telegram trading bots come with risk control features, like setting “stop-loss” orders. The bot will automatically sell your crypto if it drops to a certain price, limiting your potential losses.

Potential Risks and Limitations

The risks and limitations of crypto trading bots on Telegram involve security concerns with API keys, market unpredictability, the need for technical know-how, the presence of scams, and bot reliability issues.

- Security Concerns (API Keys): To work, bots generally need access to your exchange account through API keys. If these keys aren’t handled securely by the bot’s developers or if you give too many permissions (like allowing withdrawals), your funds could be at risk if the bot is hacked or malicious. Therefore, implement robust security measures, such as 2FA, to protect your account.

- Market Volatility and Unpredictability: While bots can react fast, they’re programmed for specific conditions. Crypto markets can be incredibly unpredictable, with sudden, unexpected swings. In these extreme situations, a bot’s preset strategy might not perform well, and it could even lead to losses if it can’t adapt quickly enough.

- Technical Knowledge Required: Even though some bots are user-friendly, setting them up properly and understanding how to program your trading strategies still requires some basic knowledge of trading and the crypto market.

- Scams and Untrustworthy Bots: The Telegram space, unfortunately, has its fair share of scams. Some “bots” are just fronts for fraudsters who want to steal your digital assets. So, it’s crucial to thoroughly research and only use reputable trading bots.

- Bot Reliability and Maintenance: Bots are software tools, and like any software, they can have glitches, go offline, or need updates. If there are bot malfunctions or the developers stop maintaining it, your trades could be affected, or you might miss some good trade opportunities.

How to Set Up a Telegram Trading Bot?

To set up a Telegram trading bot, you need to choose your bot and set up Telegram, connect to your crypto exchange via API keys, configure your trading strategy, and monitor and adjust its performance.

Step 1: Choosing Your Bot and Setting Up Telegram

First, you must choose a Telegram trading bot to use. There are many of them available, some free, some paid, and they each function uniquely, support different exchanges, and may cater to different strategies. It’s worth conducting thorough research here, reading reviews, and knowing what the bot does and does not do.

Once you have a bot in mind, you will, of course, need to have a Telegram account. Now, go to the bot’s Telegram page. You need to start a chat with the bot, and it will usually guide you through initial configuration with a basic “start” command.

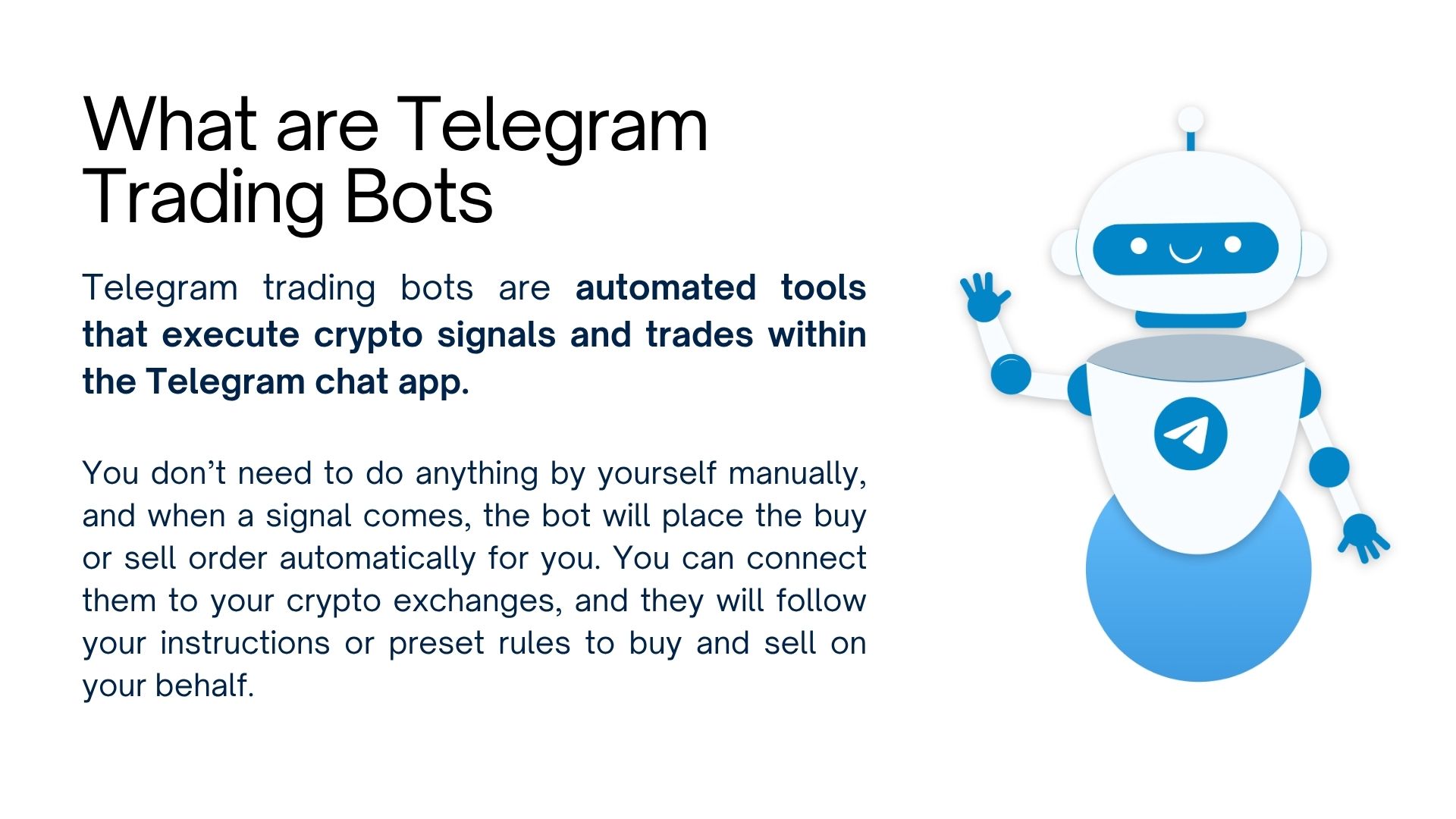

Step 2: Linking Your Crypto Exchange through API Keys

For the bot to actually buy and sell cryptocurrency on your behalf, it will need permission to interact with your chosen crypto exchange (like Binance, Bybit, or others). You’ll need to head to your cryptocurrency exchange account settings, most often in a section called “API Management” or “API Keys”. There, you’ll generate new API keys.

Here, it is very important to grant only the necessary permissions to the bot, mostly “read” access. This way, even if something goes wrong with the bot, it cannot withdraw your funds from your exchange account. Once generated, you’ll copy these keys and then paste them into the Telegram bot’s setup area.

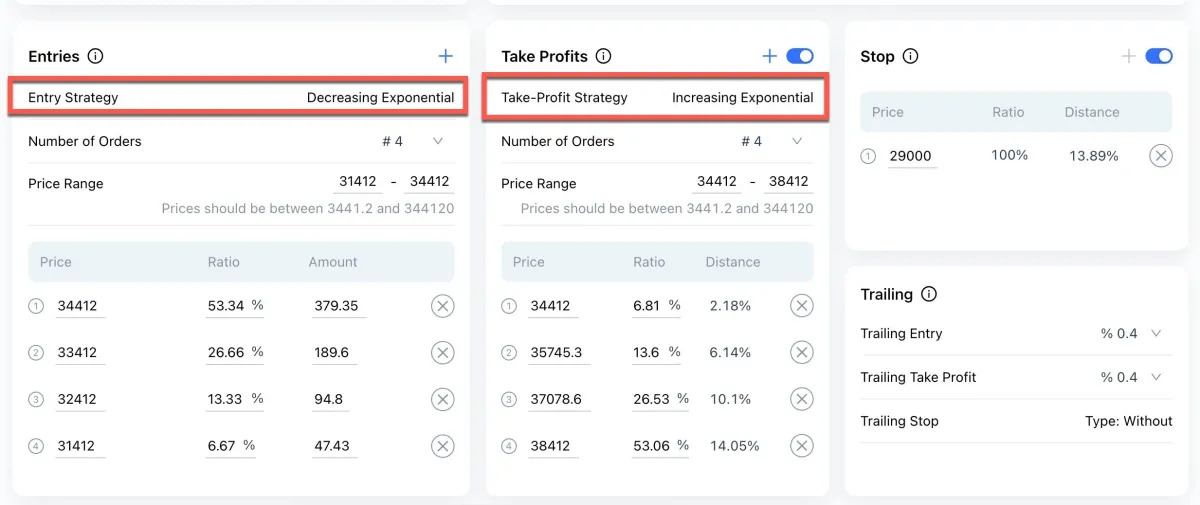

Step 3: Setting Up Your Trading Strategy

This configuration typically involves setting parameters such as which cryptocurrencies to trade, the amount of capital to use per trade, when to buy, and when to sell. Also, you’ll usually set up risk management tools like “stop-loss” and “take-profit” orders. For more on crypto strategies or signals, explore our guide to the best cryptocurrency signals Telegram groups.

Step 4: Monitoring and Adjusting

Once active, the bot requires ongoing monitoring, not a one-time setup. Monitoring your bot regularly is very crucial. Most Telegram bots will give you notifications about trades and portfolio changes within the chat. Therefore, adjust trading parameters as needed. You can also learn what crypto signals are in our in-depth guide.

Are Telegram Trading Bots Real?

Yes, Telegram trading bots are real and widely used in the crypto market. These automated trading bots are software tools that work inside the Telegram app and connect with your crypto exchange through API keys to execute trades. In Telegram, the best crypto trading bots are Cornix, Cryptohopper, Banana Gun, and Unibot. Today, these automated trading tools are used by millions of crypto users.

The post What Are Telegram Trading Bots? A Beginner’s Guide for 2025 appeared first on CryptoNinjas.