U.S. Shocks Markets: Crypto to Be Counted as Mortgage Asset by Fannie Mae and Freddie Mac

Key Takeaways:

- The FHFA has officially ordered Fannie Mae and Freddie Mac to treat crypto as valid mortgage assets.

- Cryptocurrency held on U.S.-regulated centralized exchanges can now count toward borrower reserves.

- This directive may unlock new access to homeownership for crypto holders, reshaping U.S. mortgage finance.

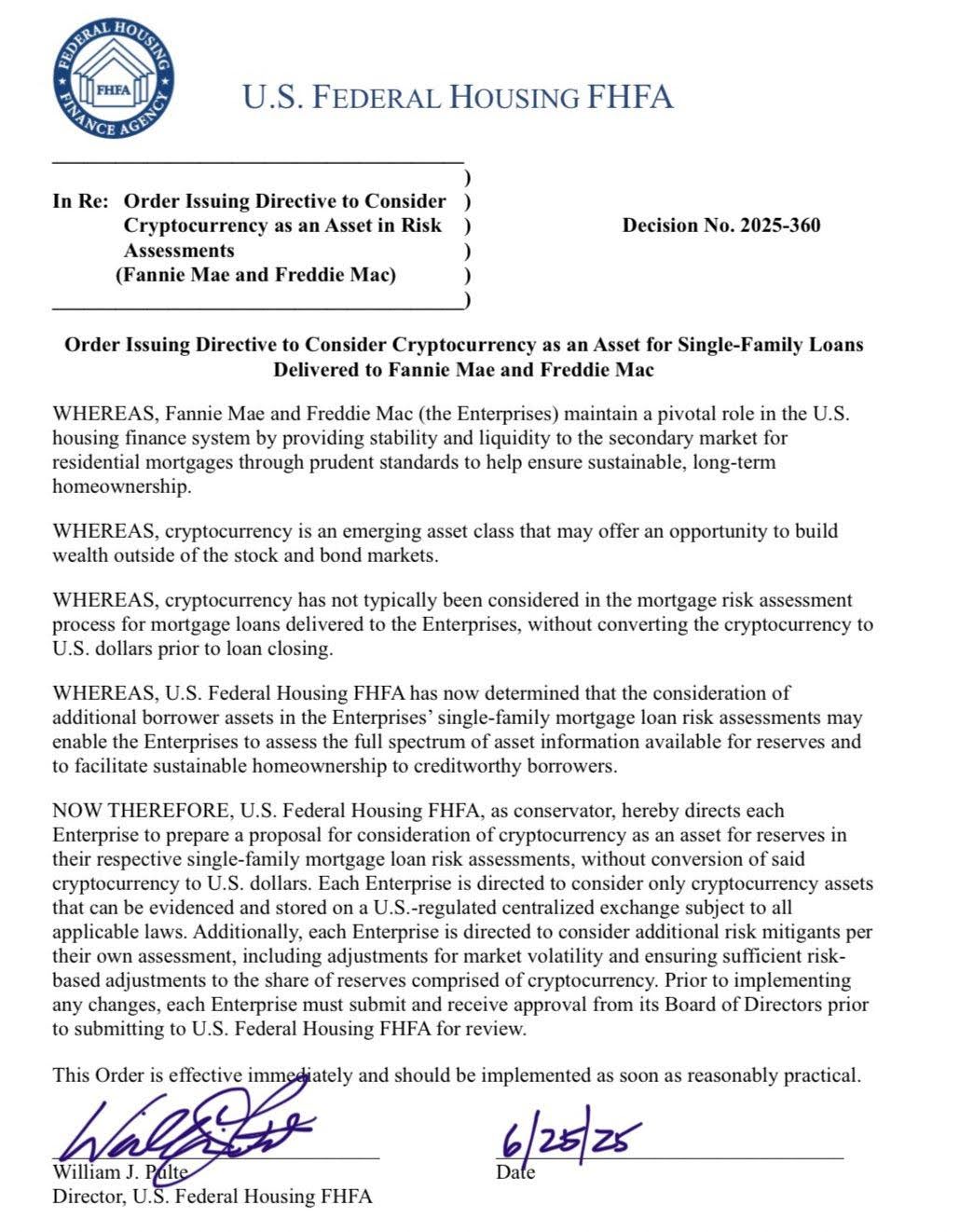

The Federal Housing Finance Agency (FHFA) has issued a groundbreaking directive to Fannie Mae and Freddie Mac. Effective immediately, these government-sponsored enterprises (GSEs) must begin considering cryptocurrency as a legitimate asset class for single-family mortgage loan risk assessments—without requiring conversion into U.S. dollars.

The FHFA Brings Crypto into the Heart of Mortgage Finance

In a formal directive signed on June 25, 2025, FHFA Director William J. Pulte ordered Fannie Mae and Freddie Mac to prepare proposals allowing cryptocurrency to be counted as reserves in mortgage evaluations. This is the first time in U.S. history that digital assets will be included directly in government-backed mortgage risk assessments.

The directive explicitly permits borrowers to use cryptocurrency stored on U.S.-regulated centralized exchanges as part of their reserve holdings. Historically, such assets were excluded from underwriting criteria unless first converted to fiat. Now, that barrier has been lifted—potentially widening the path to homeownership for millions of crypto-savvy Americans.

What the Directive Says — and What It Changes

Under the directive (Decision No. 2025-360), the FHFA outlined several key conditions:

- Only crypto assets stored on U.S.-regulated centralized exchanges will qualify.

- The assets must be verifiable and evidenced, complying with applicable federal laws.

- Enterprise must incorporate market volatility adjustments and risk-based weighting in assessing reserves.

- Changes must be reviewed and approved by each Enterprise’s Board of Directors before submission to the FHFA.

Crucially, this allows crypto to be considered without requiring borrowers to liquidate their holdings. For long-time holders of Bitcoin, Ethereum, and other major cryptocurrencies, this offers a way to maintain exposure to their assets while also using them to qualify for a mortgage.

The Political and Strategic Context Behind the Move

Trump-Era Crypto Policy Gaining Steam

Director William Pulte announced the move in a post on X, explicitly tying it to former President Donald Trump’s vision of making the U.S. the “crypto capital of the world.” The timing of this policy shift—coming just months before the 2025 election cycle—signals a deepening political will to integrate crypto into mainstream financial systems.

“After significant studying, and in keeping with President Trump’s vision… I ordered the Great Fannie Mae and Freddie Mac to prepare their businesses to count cryptocurrency as an asset for a mortgage,” Pulte wrote.

The message was clear: crypto is no longer fringe. It is now federal.

The Implications for Borrowers and the Housing Market

This change could open the door to new borrowers who were previously excluded from homeownership due to traditional banking limitations. Many in the crypto space are “asset-rich but fiat-poor”—holding significant digital assets but lacking large U.S. dollar reserves. By counting crypto, Fannie Mae and Freddie Mac could underwrite a broader, more modern borrower base.

It also sends a clear signal to private lenders and fintech platforms: the gate has opened.

Crypto as collateral is no longer just for niche lenders or experimental products. It’s entering the U.S. housing finance core—through two of the most systemically important institutions in the market.

Industry Reaction — Praise and Pushback

While the news drew praise from crypto advocates and market participants, it also sparked debate.

Michael Saylor, Executive Chairman of MicroStrategy and a vocal Bitcoin advocate, hailed the decision:

“Bitcoin has been recognized as a reserve asset by the U.S. housing system… A defining moment for institutional BTC adoption and collateral recognition.”

Saylor also offered to share MicroStrategy’s proprietary BTC-based credit models with the FHFA to help them evaluate volatility, loan duration, and other risk factors.

However, not all of the reactions were positive. Opponents of the move said the directive doesn’t apply to crypto stored in self-custody wallets, but only to crypto held on centralized exchanges that are regulated in the U.S.—prompting fears of surveillance, control and erosion of the decentralized nature of crypto.

Crypto-native users pushed back on the fact that the exclusion of self-custody wallets defeats the entire purpose of blockchain ownership standards and might lead users to using custodial platforms that have lost their trust.

Read More: Mastercard & Chainlink Launch Direct On-Chain Payments

The Rise of Crypto-Backed Mortgages Just Got a Boost

While the concept of crypto-backed mortgages has existed in niche corners of fintech—through services like Milo, Ledn, and others—this directive propels the idea into the mainstream. It legitimizes the practice and adds a federal framework around compliance, documentation, and risk evaluation.

In fact, companies like Ledn and Figure have already originated millions of dollars in crypto-backed mortgages, where borrowers use their Bitcoin or Ether as collateral for real estate purchases. This federal move might now compel larger banks and mortgage originators to develop similar offerings with government support.

Read More: Bitcoin Hyper Gains Attention in June — What’s Fueling Investor Interest?

The post U.S. Shocks Markets: Crypto to Be Counted as Mortgage Asset by Fannie Mae and Freddie Mac appeared first on CryptoNinjas.