All Signs Point To A Bitcoin Liftoff—Here’s What The Experts See

Based on reports from analyst Moustache, Bitcoin may be gearing up for its next big move. The world’s largest cryptocurrency climbed above $105,000 for the second time this week. At press time, it was trading at nearly $104,000, up 0.50% over the past 24 hours.

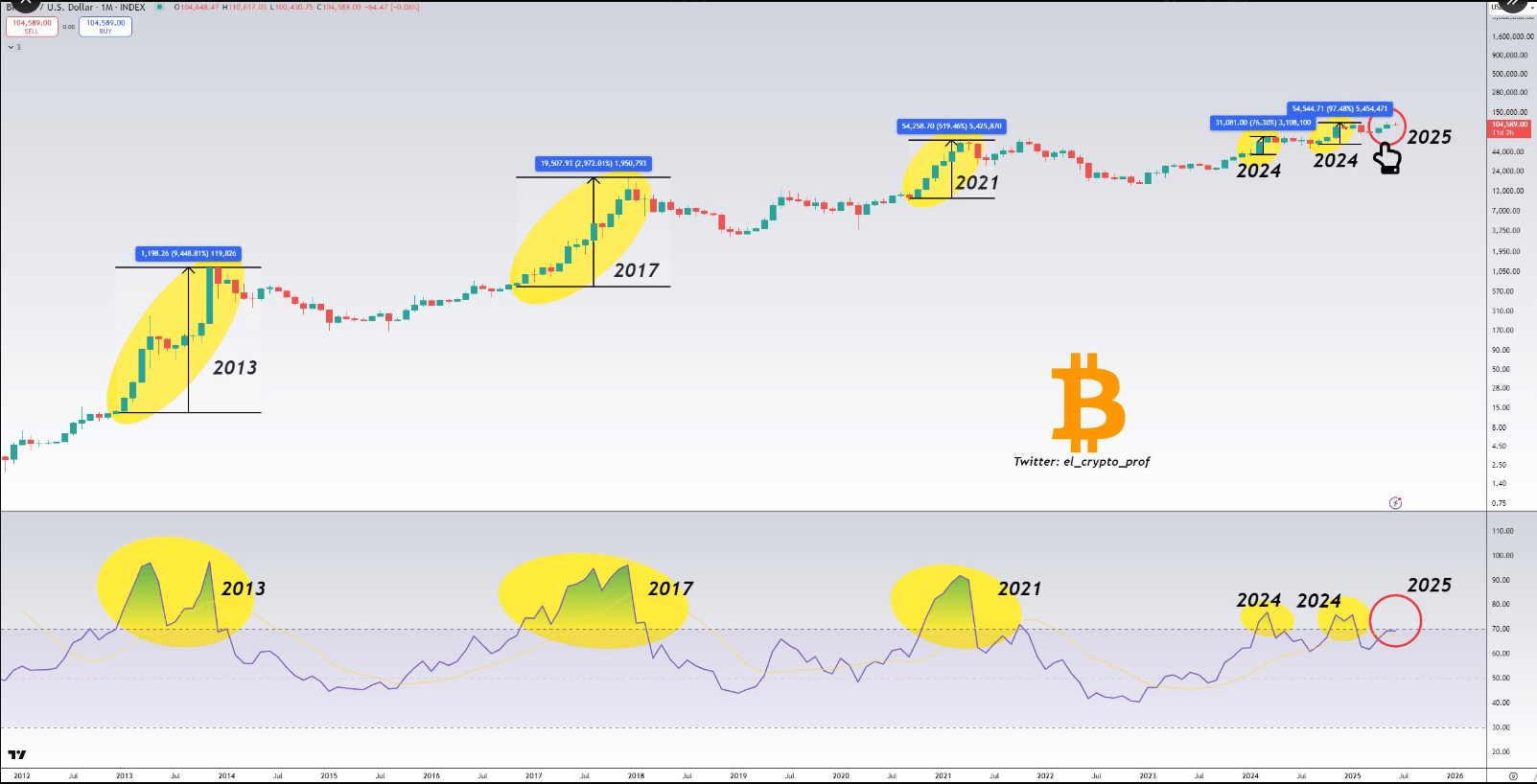

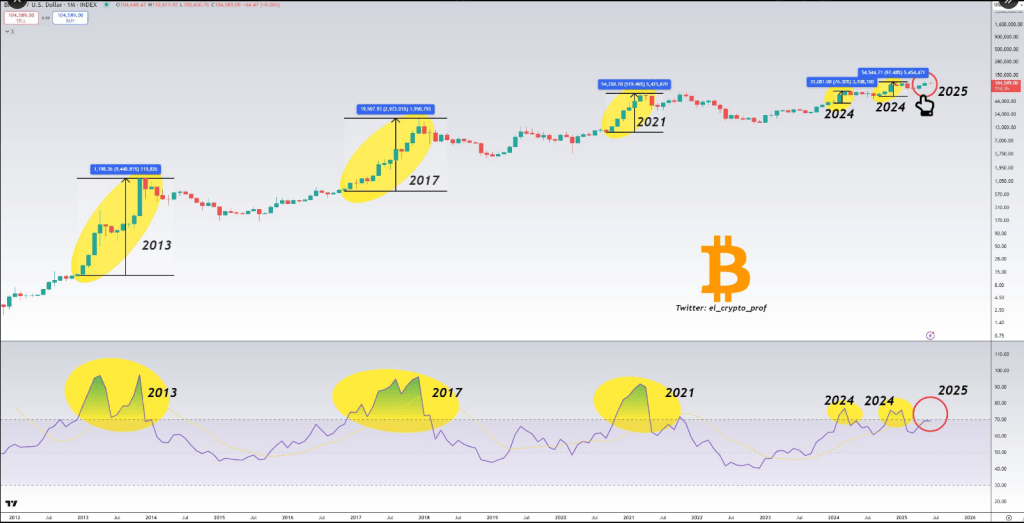

Historical RSI Breakouts Could Signal New Push

According to the charts shared by Moustache, Bitcoin’s monthly Relative Strength Index (RSI) tends to surge into overbought territory just before major rallies. Back in July 2013, Bitcoin sat at $66, then jumped to nearly $1,120 by November as the RSI hit high levels.

A similar spike happened in May 2017, when BTC rose from about $1,300 to $19,700 by December. On April 1, 2021, Bitcoin reached $64,800 while the RSI again climbed beyond its usual range. In 2024, those RSI peaks came on March 1 at $73,800 and again in November when it cleared $100,000.

#Bitcoin$BTC monthly RSI is so close to entering overbought territory.

The real run starts with this. Look at the past and you know why. pic.twitter.com/8O1Z8RDuNs

— 𝕄𝕠𝕦𝕤𝕥𝕒𝕔ⓗ𝕖

(@el_crypto_prof) June 19, 2025

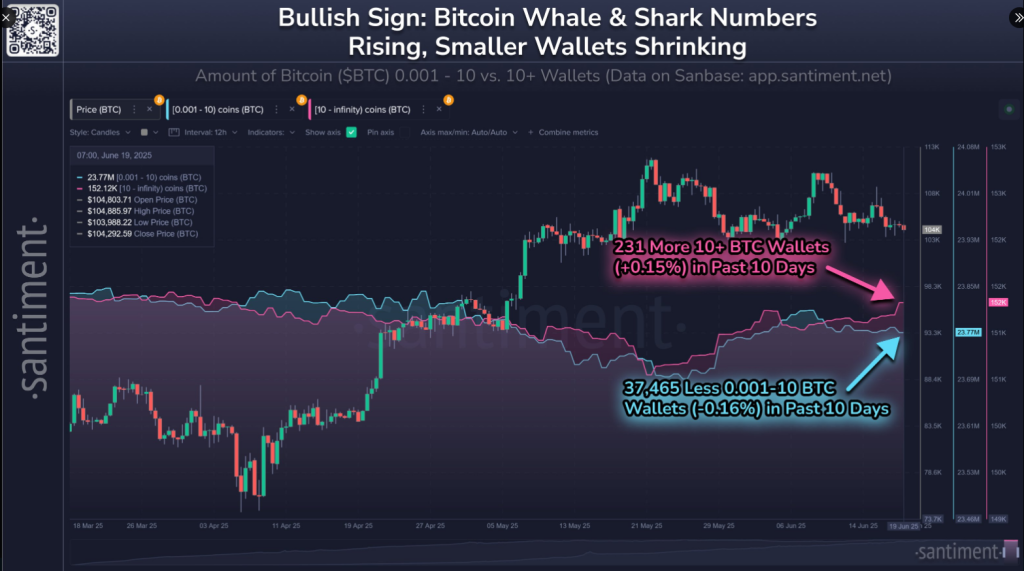

Whales Stack Up Bitcoin While Retail Pulls Back

Based on reports from on‑chain data provider Santiment, large holders are scooping up coins even as smaller investors step aside. Over the last 10 days, wallets with at least 10 BTC rose by 231 addresses.

At the same time, retail wallets holding between 0.001 and 10 BTC fell by 37,460 addresses. That shift suggests big players are using recent dips as a buying chance. In past cycles, similar moves by whales have come before sustained price gains.

Bitcoin’s elite vs. mortal wallets are moving in two different directions as its market value sits just north of $104.3K.

Wallets with 10+ $BTC: +231 Wallets in 10 Days (+0.15%)

Wallets with 0.001 to 10 $BTC: -37,465 Wallets in 10 Days (+0.15%)

When large wallets… pic.twitter.com/uhZf6rPYvq

— Santiment (@santimentfeed) June 19, 2025

Overbought But Not Out

Analysts warn that an overbought RSI doesn’t always mean an instant surge. In past runs, Bitcoin often paused or pulled back for days or even weeks before the real rally got underway.

Sometimes the RSI stayed elevated while prices drifted sideways. In 2017, for example, a correction followed the high RSI but the broader uptrend kept going. Today’s RSI is near those same levels—and could linger there for a while.

What Comes Next For Bitcoin

Investors will be looking beyond technical cues. Macro events, ETF moves and regulatory announcements may guide the next direction. If institutions continue to accumulate and retail continues to avoid, price pressure will develop.

But a surprise headline or policy change might go the other direction. For now, the intersection of high RSI and increasing whale demand suggests a setup that has fueled previous bull frenzies.

Featured image from Unsplash, chart from TradingView