Arizona Moves Closer to Holding Bitcoin Reserves as Senate Revives Controversial Bill

Key Takeaways:

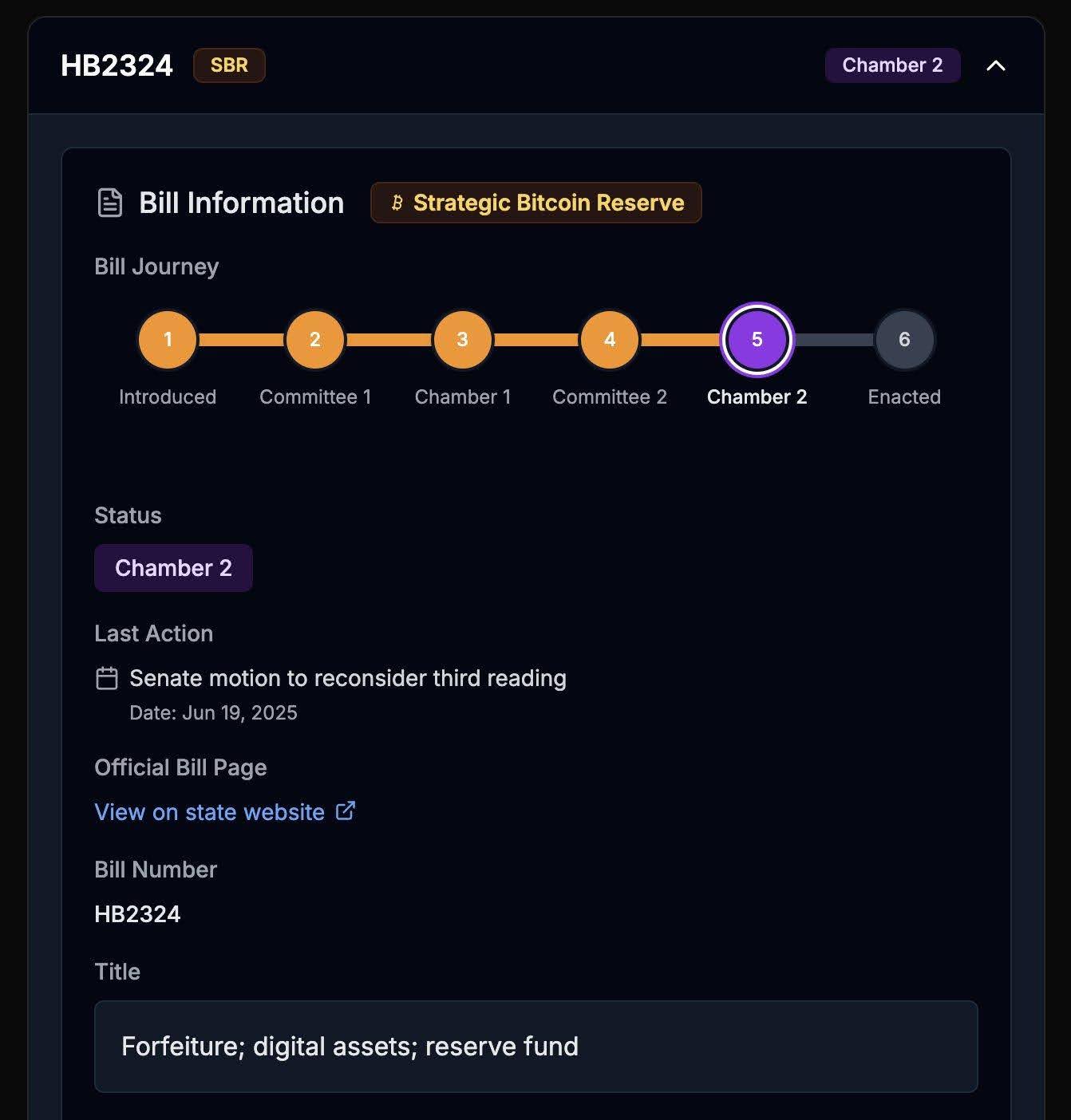

- Arizona Senate revives HB2324, a bill that would create a state-managed Bitcoin reserve fund.

- The fund would handle digital assets seized in criminal investigations, with options to hold or sell them.

- The bill faces uncertain prospects in the House and potential veto by Governor Katie Hobbs, who has rejected similar legislation.

Arizona is once again at the center of U.S. crypto legislation as its Senate voted to reconsider and revive House Bill 2324—an ambitious proposal that would establish a Bitcoin and Digital Assets Reserve Fund. The bill, which failed in a House vote last month, has returned to the legislative spotlight after a narrow 16-14 Senate vote brought it back to life.

Read More: Arizona Moves Closer to Crypto Milestone with Bitcoin Reserve Bills Approved by House

Inside HB2324 — Arizona’s Bold Crypto Play

HB2324 aims to modernize Arizona’s handling of seized digital assets by creating a fund managed by the state treasury. This “Bitcoin and Digital Assets Reserve Fund” would receive, hold, and potentially dispose of cryptocurrencies confiscated through criminal forfeiture.

The bill sets three central approaches for taking care of these resources:

- Retain them as they are in state-approved wallets.

- Sell them on registered crypto exchanges.

- Store them under custody requirements such as blockchain-based access and third-party management.

If enacted, the legislation would direct the first $300,000 of any digital asset liquidation to the Arizona Attorney General’s Office. Any additional funds would be divided:

- 50% to the Attorney General

- 25% to the state’s general fund

- 25% to the Bitcoin and Digital Assets Reserve Fund

That structure is an attempt to bolster law enforcement as well as to shore up public finances and hold crypto long-term — and do it without using taxpayer money.

A Partisan Push with National Implications

HB2324 has become the epicenter of Arizona’s increasingly political dispute over how to regulate crypto. Though it approved the bill by a razor-thin margin, the vote was almost entirely along party lines. Notably, one Republican senator, Jake Hoffman, dissented, suggesting not all conservatives stand together on the bill’s dangers and potential benefits.

The bill’s sponsor, Republican Jeff Weninger, has positioned it as a practical move given the rising amount of criminal cases tied to crypto assets and a step forward in terms of financial independence and modernization. But opponents say the state’s move to retain assets prone to wild swings in value could pose undue financial risk to New Jersey, particularly without clear direction from the federal government.

Arizona’s not the only state going for it with crypto laws. Texas, Wyoming, and Florida have each proposed or enacted legislation affecting custody, mining, or blockchain infrastructure. The national conversation, especially against the backdrop of a Trump-branded Republican revival, has emboldened states to try financial experiments at the state level.

Governor Hobbs’ Crypto Record Casts Doubt

Despite the Senate’s vote to revive HB2324, the bill still faces a steep climb in the House and even steeper odds at the Governor’s desk. Arizona Governor Katie Hobbs has consistently vetoed similar crypto-related bills, citing concerns over market volatility and fiduciary responsibility.

In May 2024, Hobbs vetoed:

- SB 1025, a bill that called for up to 10% of state pension and treasurer funds to be invested in Bitcoin.

- SB 1373, which would have established a broader “Digital Assets Strategic Reserve Fund” with seized assets or legislative appropriations.

In both his vetoes, Hobbs pointed out that “untested and volatile” assets, like cryptocurrency, were too risky for public funds and retirement systems.

Yet, Hobbs has already signed more modest crypto bills including:

- HB 2749, which allows the state to retain unclaimed crypto without liquidating it.

- HB 2387, which imposes consumer protection rules on crypto ATMs in Arizona.

These are not the actions of someone who is anti-crypto, but against reckless use of taxpayer funds in the sector.

Read More: Landmark Bill Protecting Bitcoin Mining Rights Passes in Arizona

Crypto in the State Treasury: An International Trend on the Rise

The pattern of HB2324 in Arizona is consistent with a growing international trend. Nations including Ukraine, El Salvador and Pakistan have made moves to integrate digital assets into the national cohort of reserves or public infrastructure.

- The most extreme case so far is El Salvador, which made Bitcoin legal tender and owns BTC on its balance sheet.

- State in wartime Ukraine accepts cryptocurrency donations, state-controlled crypto reserve model considered by government.

- In the U.S., Wyoming has passed a law allowing the state to establish a crypto custody framework for stablecoins and other digital assets.

Supporters of Arizona’s bill argue that having the option to retain digital assets—instead of converting them into fiat—allows for long-term value appreciation and hedging against inflation. Critics, however, maintain that state governments should not act as speculative investors, particularly without a federal regulatory framework.

What Happens Next?

For HB2324 to move forward:

- It must receive at least 31 votes in the 60-member Arizona House.

- If passed, it will be sent to Governor Hobbs for final approval.

Given the Governor’s past crypto vetoes and her cautious stance, the bill’s future remains highly uncertain. Still, its revival indicates growing political will in Arizona to define a crypto policy path—one that could influence other U.S. states watching closely.

If HB2324 passes and is signed into law, Arizona would become one of the first U.S. states to create a formal digital asset reserve fund using seized cryptocurrencies—potentially creating a new legal and financial precedent in American crypto governance.

The post Arizona Moves Closer to Holding Bitcoin Reserves as Senate Revives Controversial Bill appeared first on CryptoNinjas.