Trump-Backed Truth Social Files Bold Bid for Dual Bitcoin-Ethereum ETF on NYSE Arca

Key Takeaways:

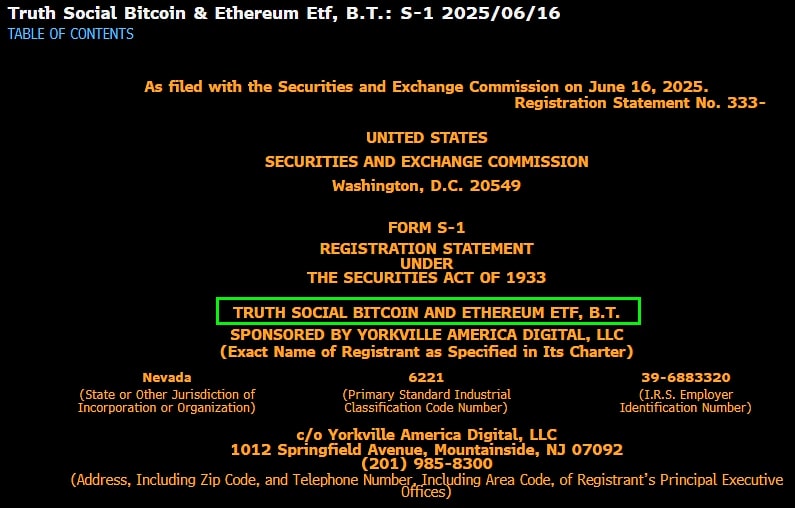

- Trump’s Truth Social has officially filed with the SEC to launch a dual Bitcoin and Ethereum ETF.

- The ETF, sponsored by Yorkville America Digital and backed by Crypto.com, will start with a 3:1 Bitcoin-to-Ethereum ratio.

- If approved, the ETF will trade on NYSE Arca and join a growing list of crypto ETFs entering the U.S. market.

In a bold move that could reshape how retail investors access digital assets, Truth Social, the media platform backed by former President Donald Trump, has filed a registration with the U.S. Securities and Exchange Commission (SEC) to launch a dual Bitcoin and Ethereum ETF. The filing was confirmed on June 16 via Form S-1, marking the company’s second foray into crypto-based financial products.

This proposed exchange-traded fund (ETF) seeks to simplify exposure to Bitcoin (BTC) and Ethereum (ETH), the two most valuable cryptocurrencies by market cap. It’s the latest in a wave of crypto ETF initiatives following the SEC’s recent openness to spot digital asset funds.

Read More: Bitcoin ETF Filing From Trump-Linked Firm Would Shake Up $130 Billion Market

Truth Social’s Strategic Move into Crypto Finance

Truth Social’s parent company, Trump Media & Technology Group (TMTG), is taking clear steps toward integrating financial products into its broader strategy. Just weeks after receiving approval for a $2.3 billion Bitcoin treasury registration, the company is now aiming for the dual-asset ETF space, a niche previously untouched by retail-friendly Trump-affiliated ventures.

Unlike the previous filing focused solely on Bitcoin, this new product—Truth Social Bitcoin and Ethereum ETF—will hold both BTC and ETH. According to the prospectus, it will launch with a 3-to-1 ratio in favor of Bitcoin, giving investors a weighted entry point aligned with current market dominance but maintaining significant Ethereum exposure.

Initial Allocation:

- 75% Bitcoin

- 25% Ethereum

(Subject to rebalancing by the fund sponsor)

The ETF will be sponsored by Yorkville America Digital, an asset manager known for its growing crypto footprint. Yorkville is also behind Canary Capital’s proposed staked CRO ETF, further underlining its strategic alignment with Web3 assets.

Custody and Management: Crypto.com’s Role

Truth Social has tapped Foris DAX Trust Company, LLC, doing business as Crypto.com, to serve as the crypto custodian for the ETF. This makes it one of the few SEC-facing ETF proposals to leverage a crypto-native custodian, possibly increasing investor confidence in the fund’s operational readiness.

Although the fund’s ticker symbol and cash custodian are yet to be finalized, the decision to name Crypto.com early signals a level of preparedness uncommon among politically adjacent ventures.

Security Note:

Crypto.com is a registered trust company in Nevada, known for its robust custody and compliance framework, which could be instrumental in receiving SEC approval.

Listing Venue and Trading Mechanics

The ETF is slated to trade on NYSE Arca, a leading platform for digital asset-related ETFs. If approved, it would join the ranks of other high-profile products from Franklin Templeton, Bitwise, and Hashdex that offer spot or hybrid exposure to digital assets.

The fund will operate using a cash-only creation and redemption model at launch—common among crypto ETFs to avoid handling actual digital tokens in-kind. However, the trust signaled its intent to transition to in-kind processing, which would reduce friction in primary market operations.

This model mirrors strategies used by leading ETF providers like BlackRock and Grayscale, who pushed for similar flexibility in their filings and operational models.

SEC Climate and Timing: Why This Filing Matters Now

The SEC’s stance toward crypto ETFs has shifted significantly in the past year. After a historic green light for spot Bitcoin ETFs in January 2024, and spot Ethereum ETFs in May, the regulator is under mounting pressure to accommodate additional digital asset funds.

In total, the SEC has now received:

- 7+ Solana spot ETF filings

- Multiple staked-asset ETF proposals

- Ongoing revisions from firms like VanEck, 21Shares, and Fidelity

Yorkville and Truth Social are clearly riding this momentum. The proposed dual ETF positions itself as a “Made in America” product—a branding Yorkville has used in recent statements to appeal to national sentiment and regulatory conservatism.

Interesting context:

Even Trump himself — who once attacked cryptocurrencies as “based on thin air” — has changed his tune. At 2024 campaign stops, he would throw treats to Bitcoin holders, pledging to “protect your right to self-custody” and “keep innovation in America.” This ETF filing could be a glimpse into a broader crypto integration within Trump’s media and political branding schemes.

What This Means for the ETF Market and Small Investors

If it’s approved, the Truth Social Bitcoin and Ethereum ETF would:

- Pave the way for hybrid ETFs offered outside the confines of conventional financial institutions

- Grow retail investment in digital assets via the user base and brand of Truth Social

- Appling pressure to get other dual or multi-asset ETFs (such as BTC-SOL, BTC-XRP ) approved by the SEC

For investors, the fund provides a passive, regulated entry point into two of the world’s largest crypto assets without the need to manage private keys, or trade cryptographic exchanges.

The post Trump-Backed Truth Social Files Bold Bid for Dual Bitcoin-Ethereum ETF on NYSE Arca appeared first on CryptoNinjas.