Is Bitcoin Headed For A Meltdown? Veteran Trader Sees 75% Crash Ahead

Bitcoin’s recent price surge hasn’t stopped warnings of a steep drop. After rising 1.87% in 24 hours and 3.61% over the past week, Bitcoin trades near $109,192. According to Peter Brandt, a veteran trader, these gains could be setting up the biggest crash in years.

Crash Scenario Outlined

According to Brandt’s analysis, Bitcoin could plunge by as much as 75%. If that happens, today’s $109,800 price would fall to roughly $27,290. That level takes us back to the lows of early 2023. It would wipe out a huge chunk of value, reversing more than two years of gains. Few investors have models ready for such a steep slide.

Historical Parallels With 2022

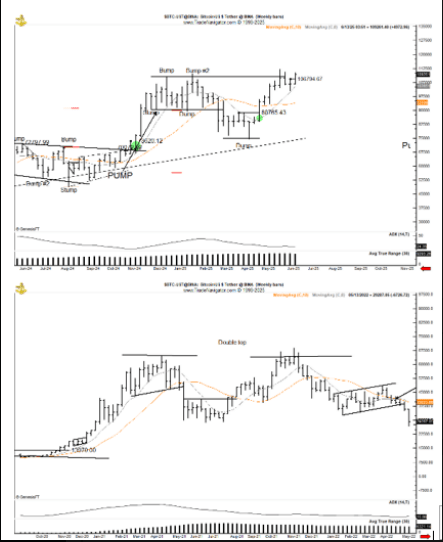

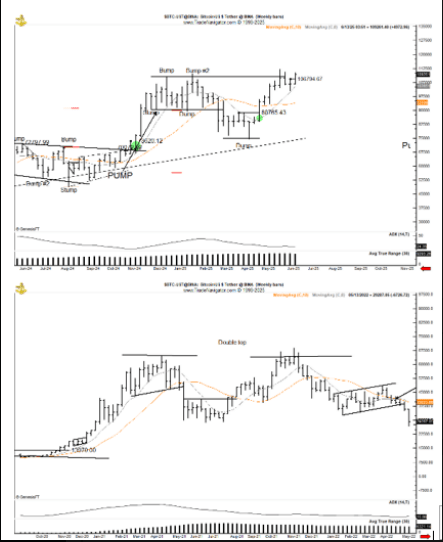

Based on reports, Brandt sees a replay of the 2022 chart. Back then, Bitcoin hit tops of $65K in April 2021 and $69K in November 2021. It then fell sharply into the bear market, losing more than half its value.

Is Bitcoin $BTC following its 2022 script and setting up for a 75% correction? Doesn’t hurt to ask this, does it? pic.twitter.com/BAywkhSwgy

— Peter Brandt (@PeterLBrandt) June 10, 2025

This time around, the world’s top crypto formed highs above $108,000 in December 2024 and January 2025, then dropped under $100,000. After recovering near $112,000 last month, BTC may be gearing up for a similar breakdown.

Trigger Points To Watch

Key technical markers are flashing red. The 9-period EMA has just crossed below the 21-period EMA on the daily chart. In past sell-offs, that crossover marked the start of big downtrends.

Traders will want to see if Bitcoin closes below both EMAs for a week or more. A failure to reclaim the $108,000 level could be the final trigger before panic sets in.

Market Reactions And Risks

Derivatives data is mixed but leans bearish. Trading volume jumped almost 30% to $100 billion, while open interest rose 1%. On Binance and OKX, the long/short ratios sit at about 0.5501 and 0.53, showing more shorts than longs.

When too many people bet on a drop, a squeeze can follow—if the crash doesn’t start soon. Still, the current crowding could backfire if Bitcoin holds above support.

Funds tied to Bitcoin have seen nearly $57 million in outflows over the past week. That may sound big, but it’s under 0.2% of the roughly $50 billion assets under management.

By contrast, Ethereum products attracted $295 million. So while some money is leaving Bitcoin, it’s shifting around inside crypto rather than fleeing entirely.

For now, Bitcoin sits at a crossroads. Will it break support and roll over toward the mid-$20,000s? Or will it shake off warnings and press higher? Either way, traders need to watch the $108,000 zone closely.

According to Brandt, a 75% drop could catch unprepared investors off guard. Managing risk and keeping orders tight seems more critical now than ever.

Featured image from Pixabay, chart from TradingView