Here’s Why Hyperliquid Hit New ATH At $39 And Why It Could Continue

Hyperliquid has quickly become a main character in the crypto space after it became the leading decentralized finance (DeFi) exchange for perp trading. As its popularity has grown, so has the price of its native HYPE token. This has seen it rally even at a time of bearish divergence in the crypto market, moving up by more than 50% in one week to reach new all-time highs.

Factors Driving The Hyperliquid Price

The main driver behind the Hyperliquid price pushing to new all-time highs has been the rise in attention being paid to the platform. As crypto investors are pivoting toward more decentralized platforms for their perpetual trading activities, HYPE’s mindshare has grown exponentially over the last few months.

This rising interest translated to a major surge in the platform’s trading volume over the last few weeks. Most notable were the billion-dollar bets placed by James Wynn, who has quickly risen to become the most popular crypto trader on Hyperliquid. His trades garnered the interest of thousands, putting more eyes on the platforms as onlookers stood by to see the outcome of his trades.

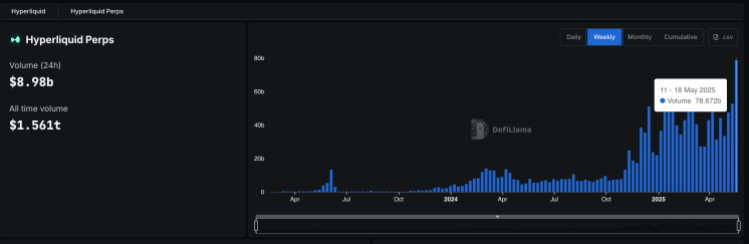

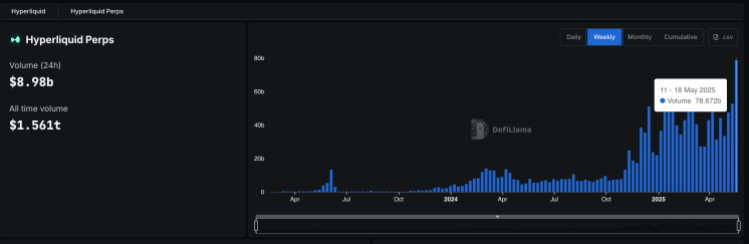

In particular, over the last week, the platform recorded its highest weekly volume since it was launched, reaching $78.672 billion in trading volume between May 11 and May 18, 2025. Daily trading volumes have also not been left out, consistently crossing the $2 billion mark daily.

Its highest daily trading volume yet was recorded on May 21, 2025, with $17.731 billion trade on the platform. Cumulatively, the Hyperliquid platform has reached $1.156 trillion in volume in three years of operation, DefiLlama data shows.

Other major developments that the platform has seen is the rise in the open interest. The platform celebrated a new all-time high after open interest crossed the $10.1 billion mark on the platform. The amount of USDC locked on the platform also climbed to $3.5 billion, with $5.6 million in fees generated in only a 24-hour period. In one week, the platform was able to generate over $22 million in fees alone.

On its own, the HYPE price is still showing a lot of bullish momentum despite already rising 50% in one week. Daily trading volumes crossed $460 million on May 26, according to data from CoinMarketCap. Crypto whales have been especially active during this time, as Lookonchain reported three whales spending $5.33 million to buy HYPE on Monday.

With volumes rising and prices going up, it suggests that a lot of the volume is actually from buyers. If this buying pressure continues, then it is likely that the price sees further upside before putting in a correction.