Bitcoin Outshines All In 2025, Official Report From Russian Central Bank Says

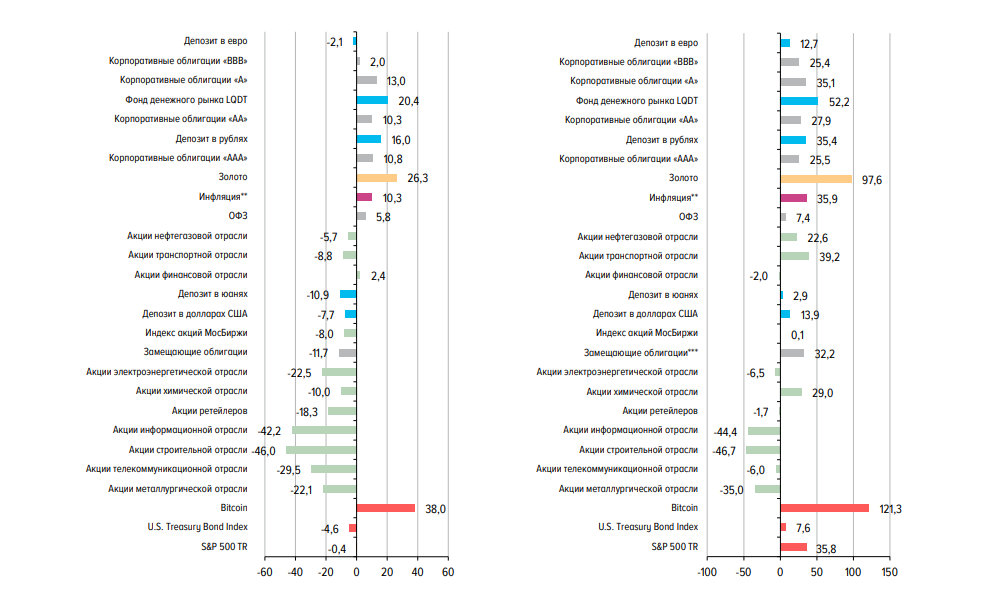

Russia’s Central Bank reports that Bitcoin has outpaced more traditional investments so far in 2025. Returns clocked in at nearly 40% over the past year. That makes it the top performer compared with gold, stocks and bonds. It’s a sign that more people in Moscow are warming up to cryptocurrencies for their daily money moves.

Bitcoin Leads 2025 Rally

According to the Central Bank of Russia, Bitcoin’s cumulative return since 2022 has reached 121%. That towers over any gains seen in gold or corporate bonds during the same period.

While gold managed only single‑digit increases, Bitcoin has nearly doubled its value in three years. That jump has grabbed the attention of investors who are used to slower returns from banks or stock funds.

Sharp Swings Test Investors

Based on reports from the central bank, Bitcoin’s price swung wildly in early 2025. The first four months brought nearly 20% drop. Many traders faced nerve‑racking weeks as prices slid. But April saw a strong comeback.

Bitcoin climbed more than 10% that month, easing worries among those who watched its dip. Those fast moves highlight just how far digital coins can swing in a short time.

ETFs And Adoption Drive Growth

The rise of spot Bitcoin exchange‑traded funds has made it easier for bigger investors to get in. In places like the United States and Hong Kong, new ETFs let people buy Bitcoin through their regular brokerage accounts.

That convenience has helped push demand higher. More folks don’t have to wrestle with crypto wallets or complex trading platforms anymore. They can tap Bitcoin through tools they already use for stocks and bonds.

Local And Global Factors Matter

Global uncertainty has driven some of this interest. Big swings in currency values and low yields on bank deposits have left people hunting for better returns. In Russia, a weaker ruble has nudged locals toward assets like Bitcoin that are priced in dollars.

At the same time, countries such as Kyrgyzstan and Ukraine are exploring crypto in their budgets. Even firms like Cantor Fitzgerald are looking at Bitcoin as a way to shield against market swings.

Profit Potential Meets Risk

Based on what the Central Bank found, Bitcoin paid off handsomely for investors who held through the drops. A 38% gain over a year can’t be matched by most safe havens. Yet anyone tracking the 19% fall in early 2025 knows it isn’t for the faint of heart.

Digital coins can zoom higher one month and skid lower the next. That volatility is why many experts still advise limiting how much of your portfolio is in crypto.

Featured image from Unsplash, chart from TradingView