Binance Trading Bot Review (2025): Types, Fees, Security, and Profitability

Binance trading bots are automated trading tools that execute trades for users based on predefined strategies. These bots operate 24/7 and are designed to make crypto trading more efficient, reduce emotional decision-making, and take advantage of market opportunities that traders may miss while inactive or during manual trading.

To ensure precision, Binance automated trading bots can collect market data, analyze it, and execute trades based on preset strategies and collated data within milliseconds. As the name implies, these bots are provided by Binance, a global cryptocurrency exchange that allows investors to buy, hold, sell, and trade crypto coins and non-fungible tokens (NFTs) in one place.

On Binance, traders can access eight crypto bots designed to execute different trading strategies automatically. Keep reading this Binance crypto trading bot review to learn more about trading bots for Binance, the fees for using Binance bots, and how to set up a trading bot on Binance.

What is Binance Trading Bot?

Binance trading bots are advanced tools that help investors trade cryptocurrencies automatically on the Binance exchange. These bots use preset rules to analyze market trends, monitor prices, and place buy or sell orders without human supervision. Binance offers eight trading bots, each designed to suit a particular strategy or market condition.

Instead of placing every trade yourself or managing many positions simultaneaously, a Binance trading bot can carry out tasks like buying low and selling high (grid bots), maintaining a specific investment ratio (rebalancing bots), executing large trades over time (TWAP or VP bots), or even gradually building a position over time (DCA bots).

These bots are built directly into the Binance platform, which means users don’t need third-party software or coding skills to get started. Once configured, the bot follows the rules the user sets and trades continuously, even when the trader is offline.

Set up a bot trading account on Binance and receive $100 plus up to total 30% discount on spot and trading fees.

What Are the Pros and Cons of Binance Trading Bot?

The pros of the Binance trading bot are listed below:

- 24/7 Trading: Like other crypto bots, Binance trading bots do not need rest. These advanced trading tools are designed to keep watching the market, open positions, and manage trades around the clock, so you won’t miss any opportunities when you are away from your screen.

- No Emotional Trading: Often, emotions like fear, greed, impatience, or excitement lead to poor trading decisions. Bots strictly follow programmed logic, which means they don’t panic during sudden price drops or get greedy during rallies. This helps maintain discipline and stick to your initial trading strategy.

- Faster Trade Execution: One major reason traders deploy bots for seamless crypto trading experience is the execution speed. Bots can open positions, modify, and cancel orders faster than humans. They can monitor dozens of trading pairs simultaneously and execute multiple trades within seconds.

- Backtesting Trading Strategies: Many bots let you backtest your strategy using historical data. This means you can see how it would have performed in the past before risking your funds.

- Customization Options: Binance bots offer a range of strategies tailored to different market conditions. Whether you’re trying to place simple buy and sell orders and profit from price fluctuations or reduce entry risk over time, there’s a bot for nearly every trading style. This gives you control over how the bot trades, based on your goals and risk level.

The cons of the Binance trading bot are listed below:

- Not Beginner-Friendly: Even though you don’t need to code or be an advanced trader, a basic understanding of trading concepts like stop-loss, leverage, volatility, and risk management is necessary. You could risk more than intended if you don’t understand what the bot is doing.

- You Can Still Lose Money: Bots follow rules, but they don’t guarantee profits. If markets move against your strategy or you configure the bot poorly (e.g., wrong price range), you can suffer significant losses. Additionally, trading with leverage-based bots, like those for the futures market, is even riskier than spot-based bots.

- Requires Monitoring and Strategy Adjustments: Although bots are automated, you still need to monitor them, especially during sudden market crashes, exchange issues, or liquidity changes. If you completely ignore the Binance trading bots, they could keep executing trades based on outdated parameters.

What Are the Types of Binance Automated Trading Bots?

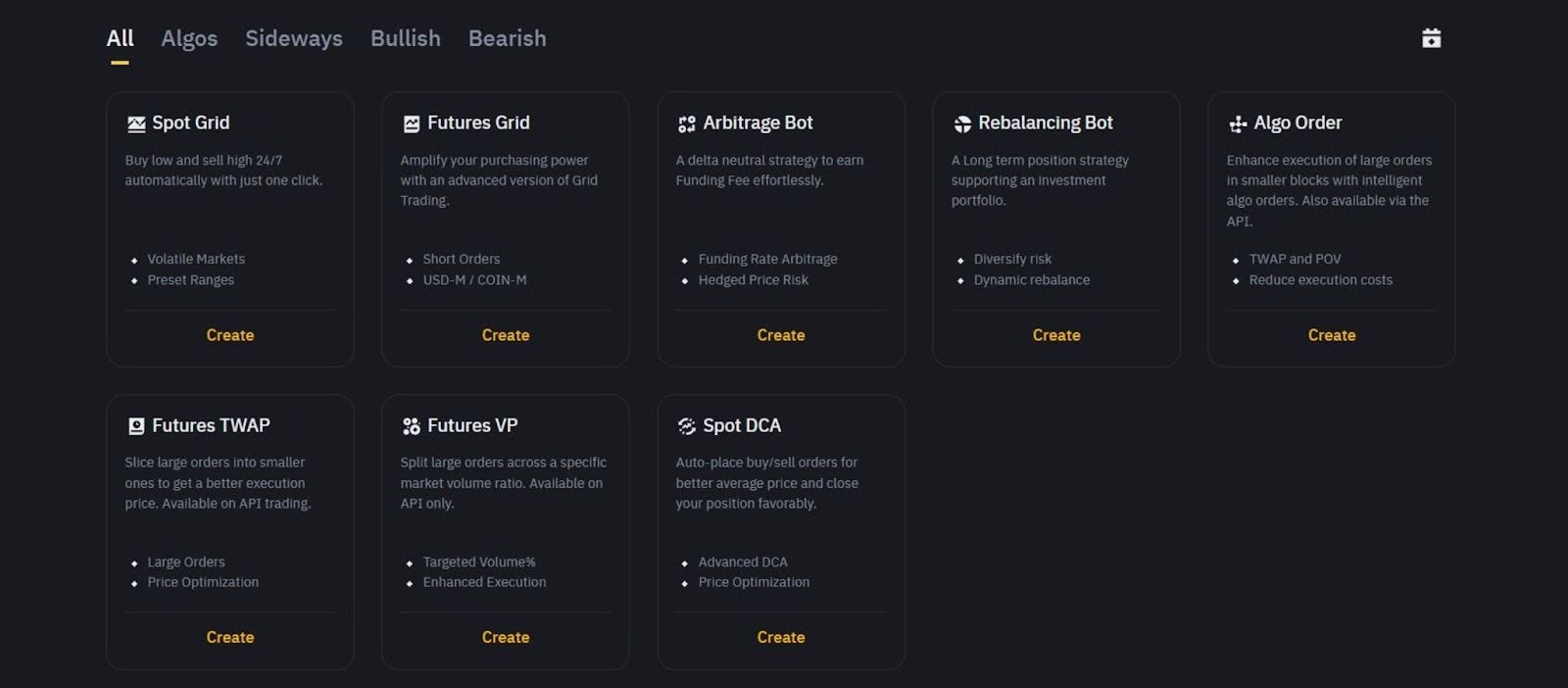

The types of Binance automated trading bots are Spot Grid, Futures Grid, Arbitrage bot, Rebalancing bot, Algo Order, Futures TWAP, Futures VP, and Spot DCA. Here is a breakdown of the different trading strategies these advanced trading tools execute.

- Spot Grid

The Spot Grid automates trading in the spot market by placing a series of buy and sell orders at predefined price intervals. This grid bot is built for market conditions where prices move sideways within a specific range instead of up and down. The goal is to buy an asset at lower levels and sell it when it moves higher, making small profits from market fluctuations.

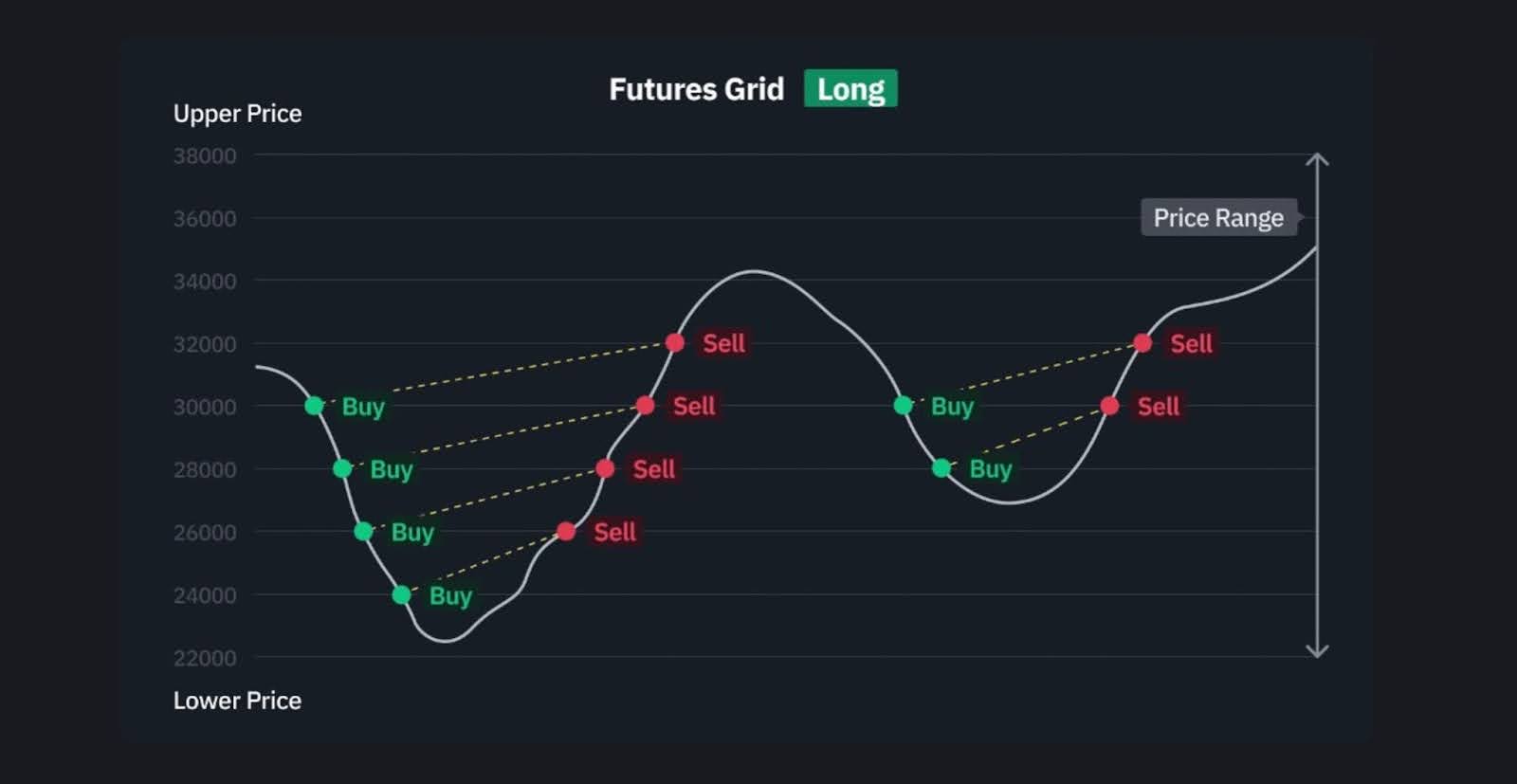

- Futures Grid

This bot is similar to Spot Grid but is applied to the futures market instead of the spot market. It allows traders to go long or short and even apply leverage. The Futures Grid is perfect for traders who want to profit from price movements in both directions while taking advantage of up to 125x leverage to potentially increase their returns.

- Arbitrage Bot (Futures Funding Rate Arbitrage)

The Arbitrage Bot takes advantage of price differences between trading pairs or across different markets (spot and futures) to profit from funding fees. Simply put, the Arbitrage bot allows traders to hedge their positions in the futures market by taking an opposite position for the same trading pair in the spot market.

If you decide to use this bot, you will be opening both long and short positions in different markets to profit from either market and collect funding rates. If you incur a loss on the open position in the futures market, you can offset it with the profit you make in the spot market and vice versa.

- Rebalancing Bot

The Rebalancing Bot automatically adjusts your portfolio position in your selected token combination to ensure you maintain the same ratio among a group of selected assets. For example, if you want to keep a 50/50 balance between Bitcoin and Ethereum, the Rebalancing Bot will monitor price changes and adjust the holdings automatically by buying or selling to maintain that ratio.

Institutional and long-term traders often use this not for portfolio management, but for active trading. It manages risks by spreading your capital across various cryptos, helps you stick to your crypto trading goals, and potentially increases returns by selling overvalued assets and buying undervalued ones.

Join Binance today and get an additional 20% discount on all your trading fees.

- Algo Order (TWAP & POV Strategies)

The Spot Algo Order helps traders execute large orders and potentially illiquid trades without significantly impacting the market. Instead of placing one massive order that could cause slippage or unfavourable price movements, this bot breaks the order into smaller parts and spreads them out over time based on a selected automated trading algorithm.

Binance offers two types of algorithmic orders: Time-weighted Average Price (TWAP) and Percentage of Volume (POV). TWAP is a time-based algo bot that monitors the order book and executes small portions of the total order at regular intervals throughout the specified duration to minimize market impact and reduce slippage.

Meanwhile, the POV algo bot is percentage-based, executing trades based on a specified percentage of the total market trading volume. The execution rate of a POV algo order depends on market volume or activity. When market activity is high, the order executes faster; when volume decreases, execution slows down, maintaining a consistent participation rate.

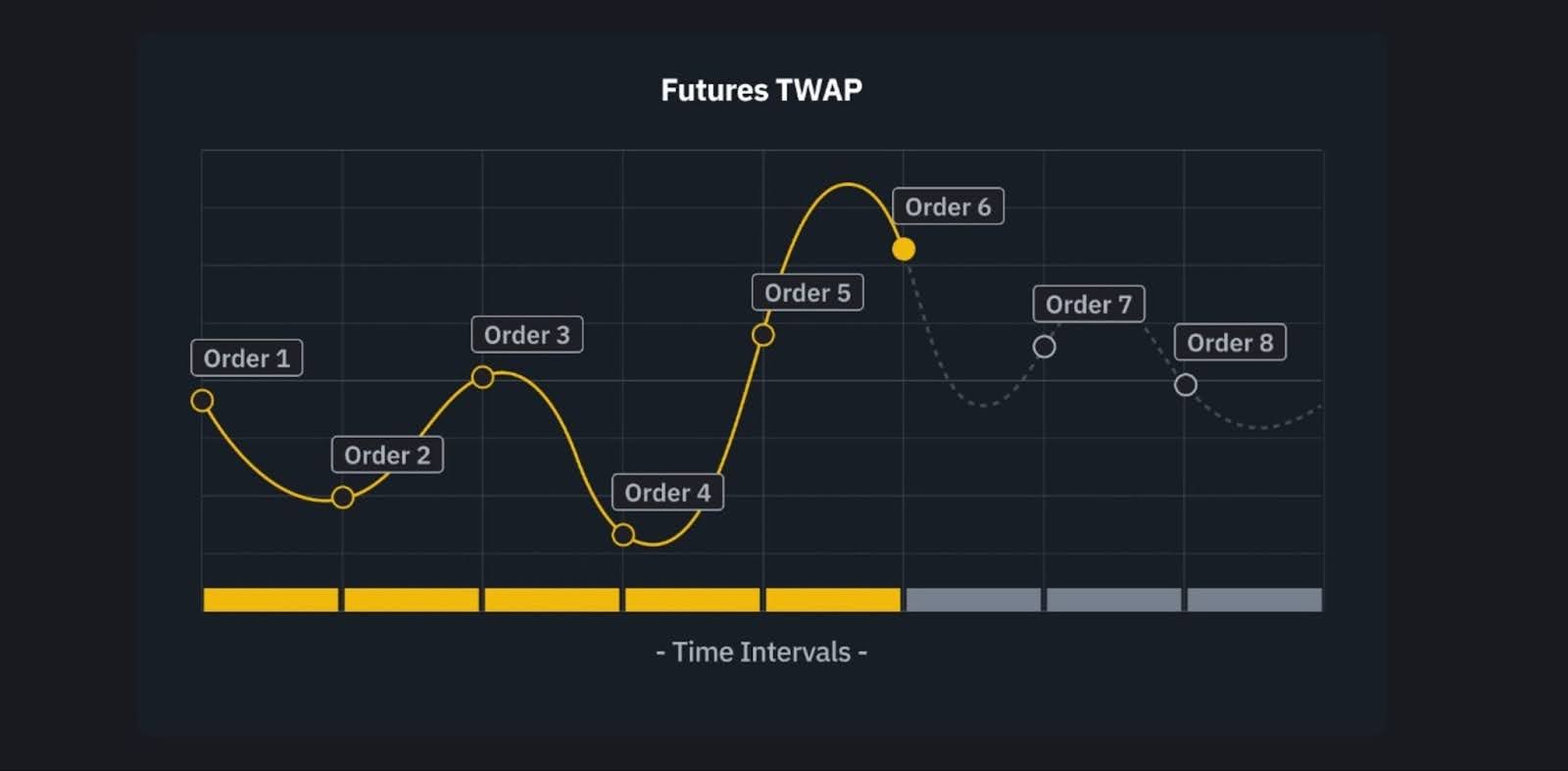

- Futures TWAP

The Futures TWAP bot disperses large futures orders into smaller quantities and places them gradually over a set period to get better execution prices. This bot aims to achieve an average execution price that reflects the time-based average of market prices specified by the trader.

The futures TWAP bot is useful when trying to enter or exit a position without causing noticeable price disruption, especially in less liquid markets. If you are considering using the futures TWAP bot, Binance supports it on USD-M Futures contracts via API and through the futures trading bots interface.

- Futures VP

The Futures Volume Participation (VP) bot is designed to execute trades based on the level of market activity. Instead of fixed time intervals like with TWAP, VP executes orders proportionally to the current market trading volume. When market volume is high, the order executes faster; when volume is low, execution slows down. This helps maintain a steady market participation rate and reduces the risk of moving the market price.

- Spot DCA

The Spot DCA (Dollar-Cost Averaging) bot helps investors buy or sell a fixed amount of cryptocurrency assets at regular intervals or when the price changes by a predetermined percentage.

The bot buys more of the asset when the market price falls below your initial purchase price, aiming to lower your average buy cost. It continues buying until the price rises above your preset take-profit percentage, at which point it sells the asset to lock in profits.

Claim a free $100 trading fee credit to begin your crypto bot trading journey on Binance.

How do Binance Trading Bots Work?

Binance trading bots work by following predefined strategies and parameters to automatically execute trades on the Binance platform. Users configure the bot with specific rules such as price ranges, order sizes, price deviation percentages, take-profit targets, and order frequency.

The bot then automatically places buy or sell orders according to these settings. Once activated, the bot continuously monitors the market and executes trades according to the strategy, whether it is grid trading, dollar-cost averaging (DCA), arbitrage, or other supported strategies.

This automation ensures your trades happen promptly and consistently, even when you are offline. Another standout feature of Binance bot trading is that the Bot Marketplace allows users to discover and replicate top bot strategies created by experienced traders, making it easier for beginners to start automated trading without creating strategies from scratch.

What Are the Rules For Automated Binance Trading Bots?

The rules for automated Binance trading bots are explained below:

- API Access & Permissions: To use a bot on Binance, you need to create an API key directly from your account settings. This Binance API key allows the bot to interact with your account and carry out trades on your behalf. You can decide the bot’s permissions, whether reading your data or actively placing trades. For security reasons, it’s best to turn withdrawal permissions off.

- Technical and Trading Limits: To maintain system stability, Binance sets technical limits, such as rate limits on order submissions (e.g., a maximum of 10 orders per second on Binance Futures). It also limits how many times your bot can make API calls within a specific time frame.

If your bot sends too many requests too quickly, Binance might temporarily block it. This helps keep the system fair and stable for everyone using the platform. So, ensure your bot is programmed to stay within the allowed rate limits.

- Security Compliance: Never share your API key with anyone, and avoid storing it in places that aren’t secure. Hackers often target bots with poor security setups, so it’s important to protect your trading credentials. Even if your bot is reliable, one security breach can wipe out your funds. Always use two-factor authentication and regularly check your bot’s access settings.

- KYC & Regional Restrictions: Before you start Binance bot trading, you must complete Binance’s KYC verification process. This ensures that all users are identified and meet local compliance rules. Also, if you’re in a region where the Binance global platform can’t operate, including the US, you cannot bypass restrictions and use the bot.

- Compliance with Terms of Use: All automated trading activity must follow Binance’s terms of use and any other policies they update over time. If your bot violates any terms, the exchange reserves the right to freeze and restrict your account, which will affect your Binance bot trading account.

What Are the Fees for Using Trading Bot on Binance?

When using Binance’s trading bots, there is no extra fee specifically for the bot itself; the service is built-in at no additional cost. This means you can take advantage of automated strategies using a Binance trading bot free of charge without paying anything extra beyond your usual trading expenses.

However, you still incur the normal trading fees when transactions are executed. For example, on the Spot market, the cost is around 0.1% for makers and takers, so you must pay the standard trading fees. For Futures trading, the fees are about 0.02% for makers and 0.04% for takers. Fortunately, these fees can drop to 0.075% if you use BNB for fee payments or reach a higher VIP level with a higher 30-day trading volume.

How to Set up a Trading Bot on Binance?

To set up a trading bot on Binance, you’ll first need to create a Binance account and fund it. Step 1: Visit the Binance official website, provide the information required, add a current Binance referral code to be eligible for bonuses, and complete the KYC verification process. Read this Binance review to find a step-by-step guide on how to register and set up a new trading account on Binance.

Get 100 USDT for free and other exclusive rewards in welcome bonuses to fund your bot trades.

Step 2: Once you’ve registered, log in to your Binance account, go to the (Trade) menu, and then go to (Trading Bots). Read the terms carefully. If you agree, check the box and then click “Confirm” to continue.

Step 3: Next, you will see the trading bot landing page. Click “Trade Now,” and the system will take you to the trading page.

Step 4: You will find different trading bots at the top. Choose the one you wish to create and set your parameters. You will need details like the trading pair, your order type, the amount you wish to trade, etc. After setting the parameters, click Start. The bot will automatically place buy and sell orders within the specified range.

Is Binance Trading Bot Profitable?

Yes, Binance trading bots can be profitable, but it depends on how you use them. Their success comes down to your trading strategy, setting the bot up correctly, and how well you monitor the bot’s performance. If you’re exploring options beyond Binance, you might also want to check out some of the best crypto trading bots available on the market.

Does Binance Have a Trading Bot?

Yes, Binance has about eight trading bots that automate your trades. These bots are designed for different traders and strategies, but they generally allow you to set up strategies for spot trading, futures, and algorithmic trading. Once set, the bots carry out trades based on the conditions you define. This helps you manage your investments without being active all the time.

Are Binance Trading Bots Safe and Legal?

Binance trading bots are safe and legal. Using Binance trading bots can only become illegal if you use them against the company’s terms and conditions or in countries where Binance is banned.

Binance itself is a trusted exchange licensed in many countries. The trading platform also implements strong security measures, such as cold storage for users’ funds, a separate fund to reimburse victims of security breaches, and a bug bounty program to help catch vulnerabilities early.

What are the Risks of Using Binance Automated Trading Bots?

Binance automated trading bots can make trading easier and profitable, but they also come with risks. It is essential to understand these products before using them. The risks of using Binance automated trading bots are technical issues, market volatility, overtrading, dependency on strategy, regulatory concerns, lack of human oversight, and over-reliance.

- Technical Issues: Bots can experience glitches or connection problems, leading to missed trades or incorrect actions. If the bot’s code isn’t well-written, it can result in unexpected behaviour, which can cause significant losses if you’re not monitoring its performance.

- Market Volatility: Bots don’t have the flexibility to adjust to changes in market sentiment. They are programmed with fixed strategies that can’t adapt quickly to sudden market shifts. They might make trades based on outdated signals in volatile markets, leading to losses.

- Overtrading: Some bots, like the Grid bots, are set to execute trades frequently, which can lead to excessive transaction fees. If the bot isn’t programmed to avoid overtrading, it might take on more risk than you intended.

- Dependency on Strategy: Bots follow a set strategy, which might not be effective in all market conditions. If the strategy becomes outdated or isn’t suited to current trends, the bot will struggle because it can’t improvise or adjust to unforeseen circumstances.

- Regulatory Risks: Different countries have laws regarding cryptocurrency trading, and bots can sometimes fall into grey areas. Using an automated bot without considering local regulations could lead to legal issues. You could face fines or account restrictions if a bot violates your country’s rules.

- Lack of Human Oversight: Bots operate 24/7 without human intervention. If something goes wrong, you might not catch it immediately, leading to substantial losses. Without oversight, it’s easy to miss key changes in the market.

- Over-reliance on Bots: Relying solely on bots can prevent you from gaining valuable experience as a trader. Bots follow predefined strategies and don’t help you learn to read the market. Over time, you might lose the skills needed to trade effectively on your own. So, it is essential to balance using bots and learning how to trade manually.

Do Binance Trading Bots Guarantee Profits?

No, Binance trading bots do not guarantee profits. While they can help traders earn profit, they automate trades based on predefined strategies. Therefore, the bot cannot be profitable if the trader’s strategy or instructions are flawed or the markets go against them.

The post Binance Trading Bot Review (2025): Types, Fees, Security, and Profitability appeared first on CryptoNinjas.