Gemini and SEC Ask for 60-Day Lawsuit Pause to Investigate Possible Resolution

Key Takeaways:

- The SEC and Gemini have together asked for a 60-day halt in their litigation regarding the Gemini Earn program.

- Allegations that Gemini and Genesis Global Capital sold unregistered securities give rise to the legal conflict.

- Recent SEC activities point to a change in crypto regulatory enforcement under the Trump administration.

The SEC and cryptocurrency exchange Gemini have petitioned to temporarily halt their legal dispute. The complaint targets Gemini’s Earn program as part of the SEC’s bitcoin crackdown. If approved, the postponement will allow both sides to find a compromise, suggesting a turning moment in digital asset platform regulation..

Read More: SEC Officially Drops XRP Lawsuit, Ripple Celebrates Landmark Victory

Gemini and SEC Ask for Temporary Lawsuit Pause

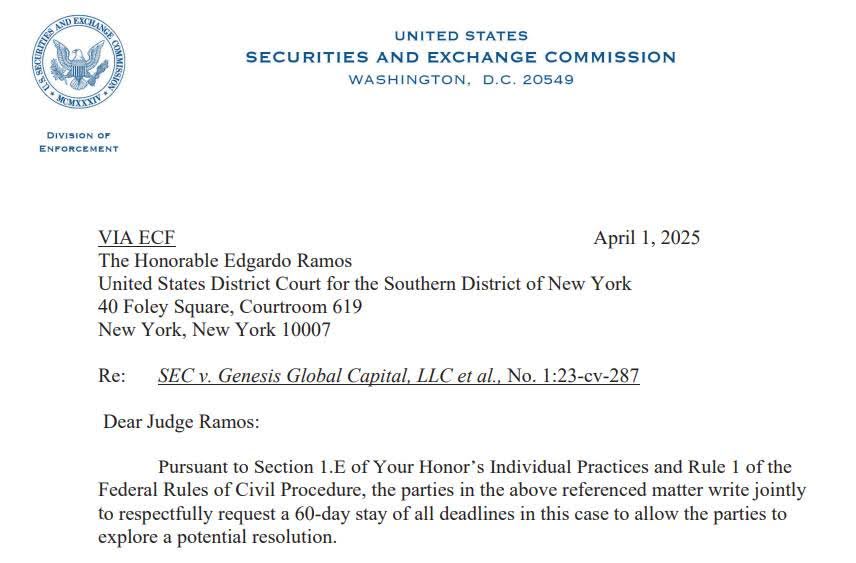

Legal officials for the SEC and Gemini filed a formal petition to Judge Edgardo Ramos of the U.S. District Court for the Southern District of New York in a letter dated April 1. The application suggests a 60-day halt on all legal actions connected to the dispute.

According to the letter, both sides believe the hiatus benefits them and the court. It claims that suspending the action will allow parties to seek a settlement, saving judicial resources and possibly avoiding lengthy litigation. According to the stay, a joint status report is due 60 days later.

The January 2023 complaint says Gemini and Genesis Global Capital managed the Gemini Earn program as an unregistered securities offering. The SEC claims the companies gathered billions by violating regulations.

History of the Legal Conflict

SEC Claims and the Gemini Earn Program

Consumers might lend bitcoin and earn money with Gemini Earn. Genesis Global Capital managed program payments and interest. Gemini charged promotion participants at 4.29%.

Genesis halted withdrawals in November 2022 due to the financial crisis and FTX decline. Genesis declared bankruptcy two months later, freezing $900 million in user assets and 340,000 Gemini Earn users.

The SEC said Genesis and Gemini violated investor protection disclosure rules. Genesis settled for $21 million in March 2024 without admitting guilt; Gemini denies securities law violation.

Changing Crypto Regulatory Scene Trump’s administration

SEC’s Evolving Position on Crypto Enforcement

Under Biden, the SEC aggressively prosecuted crypto companies. The agency seemed calm after Trump’s January 2024 win.

Major challenges resolved or dismissed include Kraken, Ripple, and Coinbase. SEC investigated and closed OpenSea, Crypto.com, and Uniswap. People regard this as part of the new government’s industry-friendly laws.

Cameron Winklevoss discussed SEC’s impact on bitcoin companies. His February 2024 criticism of the government stated that Gemini lost productivity and creativity and incurred “tens of millions of dollars in legal bills.” The Winklevoss twins donated $844,600 to Trump’s 2024 presidential campaign, the maximum allowed by law, supporting his regulatory position.

Read More: SEC Issues Guidance on Proof-of-Work Mining and Securities Regulation

Effects of the 60-Day Pause

Possible Results of the Case

The letter submitted by Gemini and the SEC omits any mention of what a possible solution could involve. Possible results could be:

- A financial settlement allowing Gemini to run with changed compliance policies.

- The SEC dropping the case entirely, akin to its recent withdrawals from other crypto-related lawsuits.

- An agreement changing regulatory requirements for future similar crypto-lending programs.

Should the court allow the stay, both sides will update their talks in two months’ time. The result of this case could set a precedent for how future regulatory actions against crypto companies are handled given the SEC’s recent change in enforcement priorities.

Wider Effects on Crypto Rules

Cryptocurrency investors are closely following this case, which shows U.S. authorities’ evolving stance on digital assets. A Gemini win might signal a more forgiving regulatory atmosphere, encouraging industry innovation and investment. However, a strict SEC may support stricter compliance standards for U.S. crypto platforms.

However, Gemini has already reached a deal with New York regulators to reimburse at least $1.1 billion to affected consumers. Many saw this measure as a proactive attempt to alleviate legal risks and restore user confidence.

Looking Forward

The SEC’s call for a 60-day halt in its case against Gemini underlines the continuing change in crypto rules under the Trump administration. Whether this indicates a long-term change in enforcement priorities or a transient change has to be seen. The result will be widely watched by the sector since it could influence future regulatory policies on investment products and Bitcoin lending.

The post Gemini and SEC Ask for 60-Day Lawsuit Pause to Investigate Possible Resolution appeared first on CryptoNinjas.