Bitcoin’s Rollercoaster: Inflation Cools, But Trade War Fears Keep Markets on Edge

Key Takeaways:

- Bitcoin briefly touched $82,056 after the U.S. CPI report that showed cooling inflation, sparking expectations of rate cuts.

- The rally was short-lived, though, as investor enthusiasm was tempered by escalating trade war tensions between the U.S. and China.

- BNB and Dogecoin outperformed Bitcoin, rising over 5% as money poured into altcoins.

- Bitcoin’s future move depends on a host of factors, such as upcoming Federal Reserve calls, global trade developments, and investor sentiment.

Bitcoin enjoyed a spectacular run above $83,300 this week following weaker-than-expected U.S. inflation numbers, only to fall short of steam as fears of global trade tensions returned. The initial rally had been sparked by hopes that the Federal Reserve would cut interest rates sooner than expected, which would boost risk assets. But as fears of an intensifying U.S.-China trade war set in, Bitcoin’s price met resistance, highlighting the complex macroeconomic forces driving the crypto market.

Despite Bitcoin weakness, altcoins like BNB and Dogecoin surged over 5%, helped by restored investor interest in the broader crypto market. The divergence suggests that while Bitcoin remains exposed to global economic trends, risk appetite for crypto traders still remains.

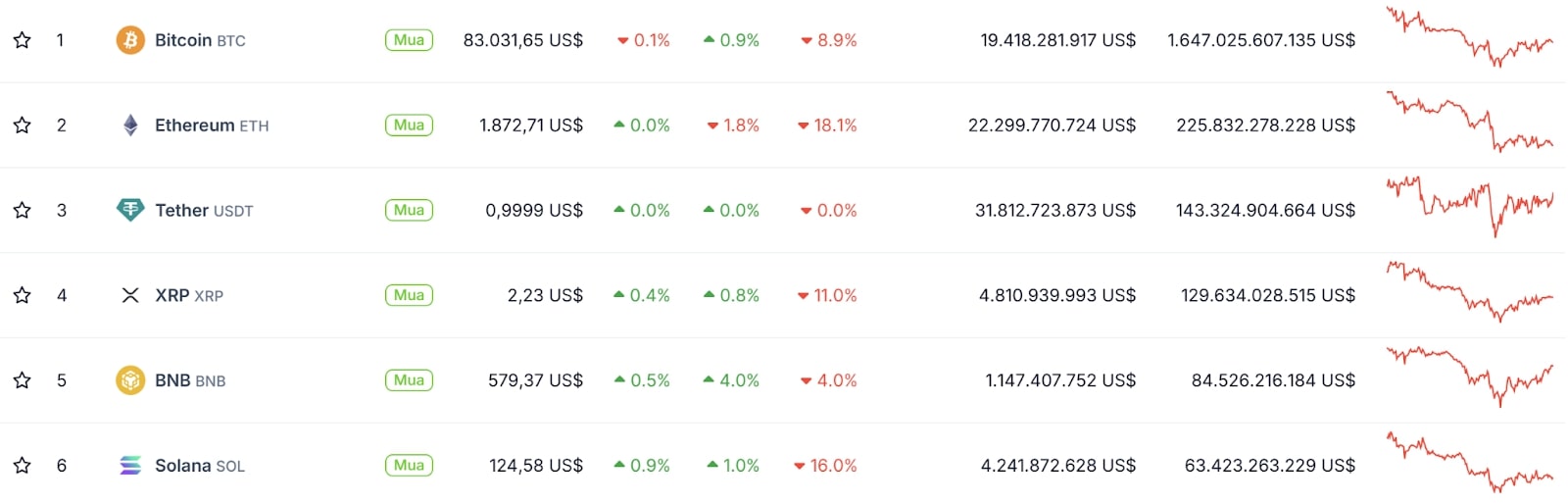

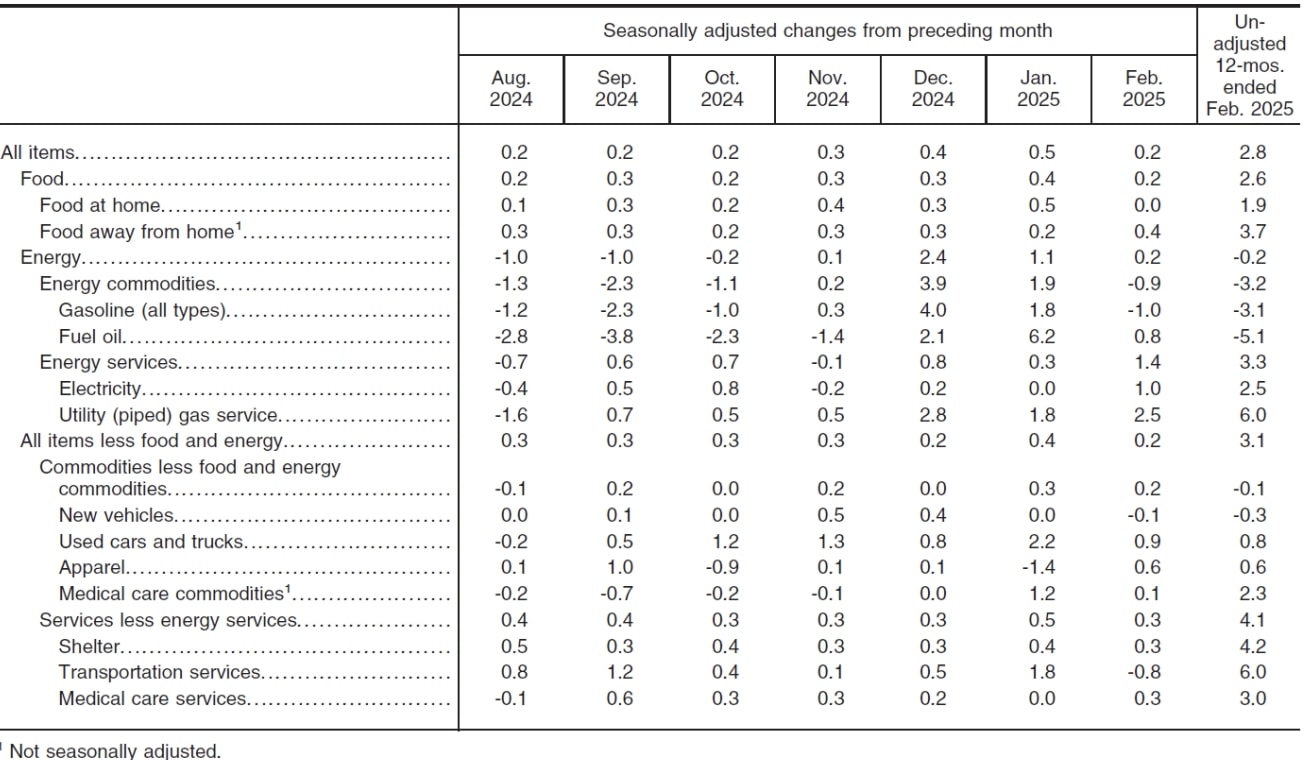

Crypto Currencies Market Capitalization

Inflation Data Triggers Bitcoin Rally

The February U.S. Consumer Price Index (CPI) report showed slower inflation than economists had forecast. This promptly triggered optimism across financial markets as investors interpreted the data as a sign that the Federal Reserve might be forced to pivot to rate cuts sooner than expected.

Bitcoin, which is widely perceived as an inflation hedge and a risky asset that benefits from lower interest rates, surged over $83,300, one of its strongest performances in weeks. Stock markets also reacted positively, with broad indexes like the S&P 500 and Nasdaq surging as traders poured into risk assets.

One of the primary catalysts for Bitcoin’s recent rally was the growing anticipation that rate cuts could happen sooner rather than later than mid-2025, which is the timeline Fed officials previously stated. Low interest rates tend to devalue the dollar and drive liquidity into alternative assets, including cryptocurrencies, making Bitcoin an attractive investment.

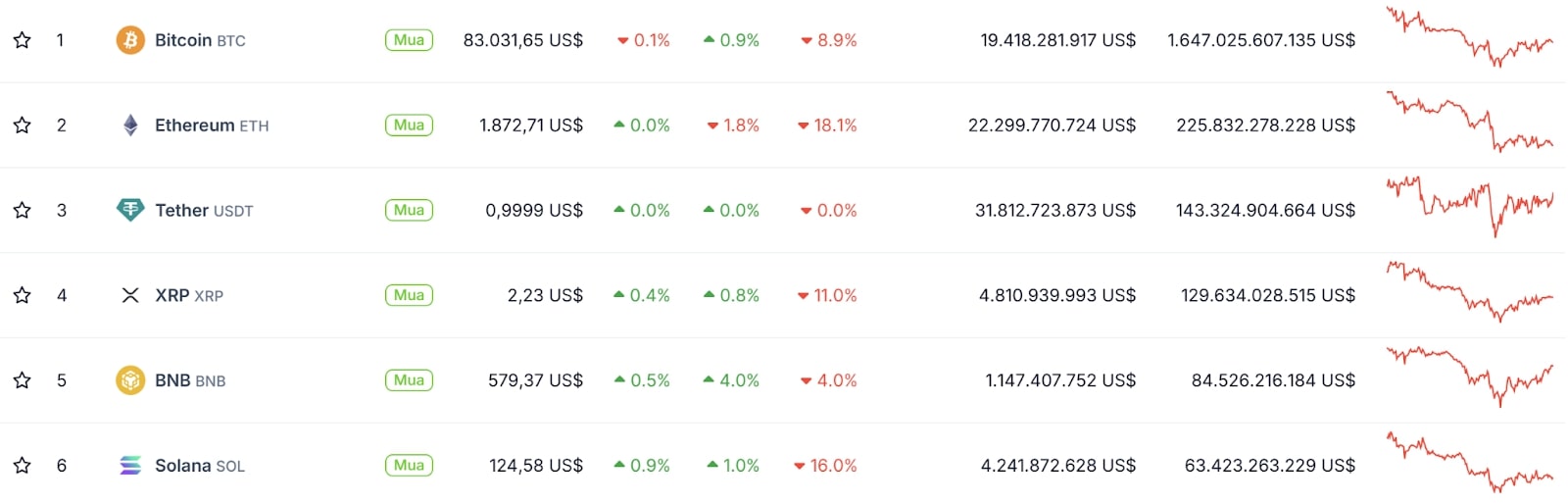

Percent changes in CPI for All Urban Consumers (CPI-U): U.S. city average

Trade War Fears Cast a Shadow Over the Market

However, Bitcoin’s revival proved brief as geopolitical concerns took center stage. There were reports that the U.S. was preparing for additional tariffs and trade restrictions on China, rekindling fears of escalating trade tensions between the world’s two largest economies.

For traditional markets, the threat of a prolonged trade war generally brings economic slowdown and market volatility. As Bitcoin became increasingly correlated with macro trends, these developments ignited uncertainty amongst traders, triggering profit-taking and withdrawal from the highs.

Additionally, geopolitical tension elsewhere in the world, including Europe and the Middle East, also helped fuel market nervousness. Most investors chose to reduce exposure to risky assets, including Bitcoin, prompting a cooldown phase after the initial inflationary rally.

Altcoins Outperform Bitcoin

As Bitcoin was unable to hold its strength, the altcoin market saw unforeseen resilience. BNB and Dogecoin were the biggest winners, with both posting over 5% gains as investors rotated funds into alternative digital assets.

This rotation suggests that investors are not so much exiting the crypto market, but rotating internally, diversifying their portfolios. The recent outperformance of Ethereum-based projects and layer-2 solutions also suggests renewed interest in decentralized finance (DeFi) and blockchain ecosystems beyond Bitcoin.

Some analysts believe that this altcoin rotation is a sign of growing confidence in sector-specific narratives, such as Ethereum’s scalability enhancements and improvements in blockchain-based payments.

What’s Next for Bitcoin?

As Bitcoin continues trading at key resistance levels, analysts are divided on its short-term trajectory. Several factors will determine whether the crypto market will see another breakout or consolidate:

Federal Reserve Decisions

The Fed’s policy meeting that is coming up will play a key role in shaping market expectations. Policymakers signaling an earlier-than-expected rate cut can witness Bitcoin regaining bullish traction. On the other hand, if the Fed remains hawkish, markets can come under renewed pressure.

Global Trade Developments

Any further escalation of the trade tension between China and the U.S. may impact financial markets, including Bitcoin. If tensions continue to escalate, investors may become even more risk-off, reducing exposure to volatile assets.

More News: Bitcoin Crashes Below $80k But Top Traders Eye Dip Buys Before Run to $150k

The post Bitcoin’s Rollercoaster: Inflation Cools, But Trade War Fears Keep Markets on Edge appeared first on CryptoNinjas.