Is The Bitcoin Bull Run Over? Fed Chair Powell Just Killed QE Hopes

In his testimony on Tuesday, Federal Reserve Chair Jerome Powell dampened hopes for another round of quantitative easing (QE), reiterating that “QE is a tool we only use when rates are already at zero” and that the Fed remains “a long ways away from ending QT.” This stance challenges the notion that a quick pivot to aggressive easing might buoy Bitcoin and the entire crypto market as it did in past cycles.

End Of The Bull Run For Bitcoin And Altcoins?

Macro analyst Alex Krüger posted on X that “we are ages away from QE,” stressing that some market participants needed to hear Powell’s stance clearly. Another commentator, Tagoo, noted there is “no need for QE, only for discontinuation of QT,” prompting Krüger to respond that it may take “a few more months” for QT to wind down.

Felix Jauvin, the host of the On the Margin podcast, commented via X: “For the QE is coming soon dreamers, I hope you just heard what powell said “QE is a tool we only use when rates are already at zero”. You don’t want zero rates and QE. That means a LOT of pain has to happen in the interim. QE isn’t coming to save your overleveraged alt bags anytime soon.”

Jauvin believes the US economy has shifted from a period of stagnation to a more fundamental growth phase. According to him, “we can still see bull markets and a bid in risk assets without these monetary plumbing tricks,” since he views this as a healthier, productivity-led environment—one he calls “an economic golden age.”

Dan McArdle reminded followers that markets can remain risk-on “with a decent economy and some credit expansion.” He cautioned the crypto community against anchoring expectations solely to zero-interest-rate policies and QE, suggesting that a steady economy could still support Bitcoin’s upside.

Julien Bittel, Head of Macro Research at Global Macro Investor (GMI), framed Powell’s comments within “The Everything Code,” contending that QE is only one part of the global liquidity picture. While the Fed might not pivot to QE soon, Bittel pointed out that other factors, such as actions by the People’s Bank of China, private credit creation, or shifts in the Treasury General Account, can also inject liquidity into markets. “The Fed’s got other tools, and they’ve been working with the Treasury since Covid to smooth out the QT impact through the TGA and RRP,” Bittel remarked.

He reminded traders that “it’s not just the Fed in this equation” and noted that Chinese rates heading toward zero heightens the possibility of China rolling out some form of QE. “Back in 2017, the Fed was a small player in the liquidity game. In fact, the Fed was doing QT and hiking rates all year, yet risk assets still flourished and Bitcoin did a 23x following the sharp but short 28% correction in January,” he added.

Crypto analyst Kevin also argues that Bitcoin may not strictly require QE to thrive. However, he pointed out that “we have also never seen a macro cycle top in BTC Dominance” during active QT, casting doubt on the likelihood of a robust altcoin season anytime soon. “I still believe my analysis tells me sometime in Q2 it will end but if we take Powell at face value then altcoins season callers everyday for the last 2 years will continue to look more lost and wrong then they already are and have been,” Kevin stated.

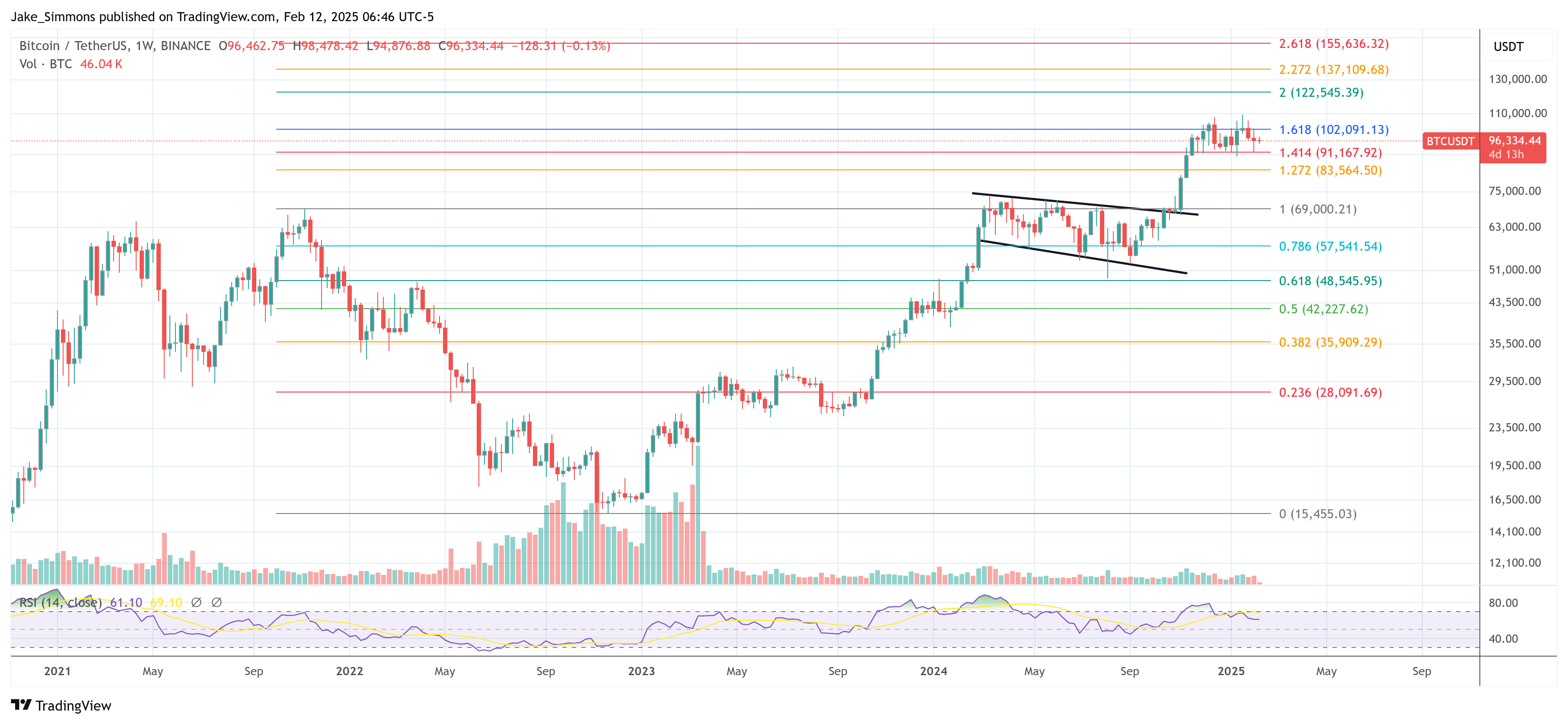

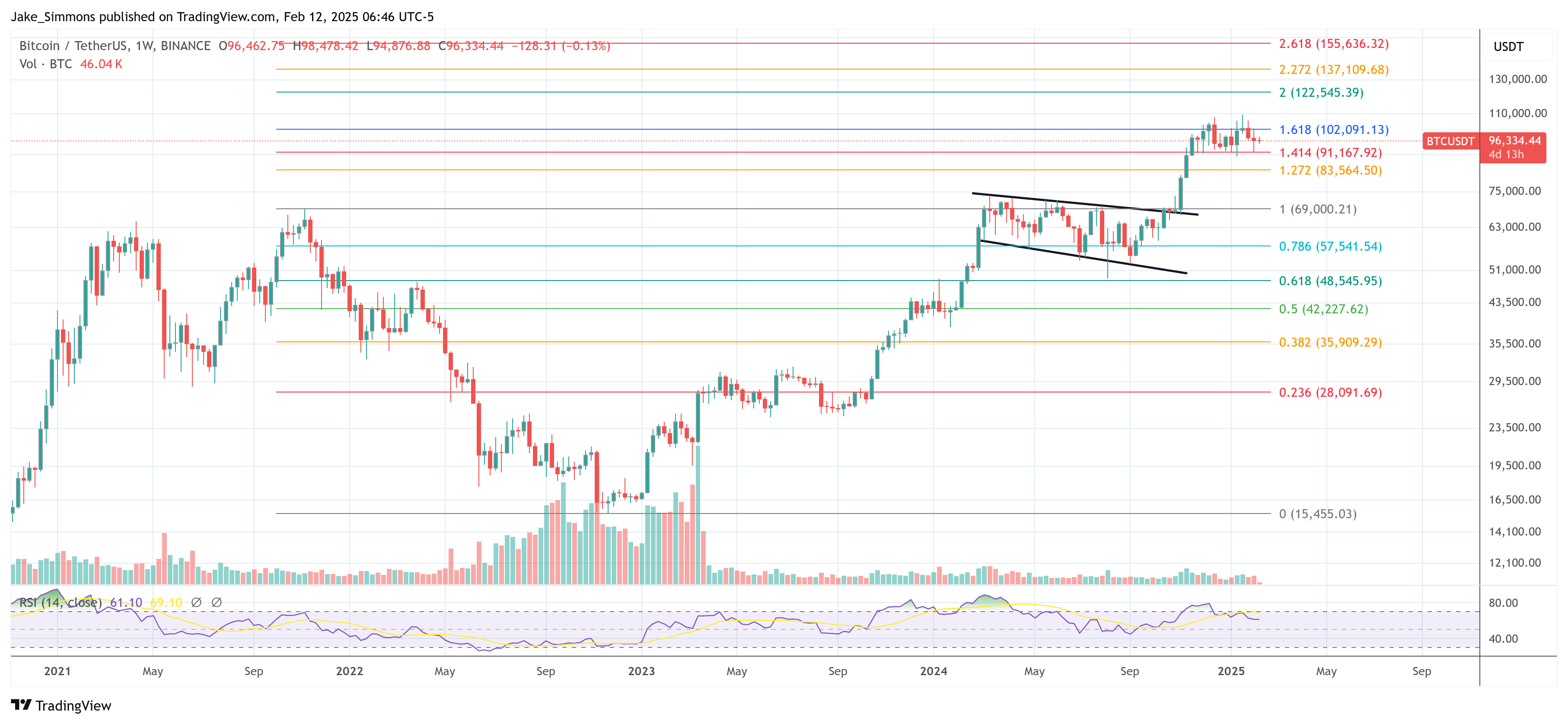

At press time, BTC traded at $96,334.