Ethereum Claims Address Dominance With 43% Lead—Will It Keep Rising?

Ethereum missed out on this week’s crazy price movements. For the last couple of days, Bitcoin has dominated the bigger crypto market, making gigantic strides almost crossing the $73,500 mark for its best in recent months. Other altcoins have also followed that trajectory as SOL and DOGE trail Bitcoin.

As Bitcoin retests a new high this October, Ethereum lags, even touching a low of $2,322 last October 3rd. Since then, Ether has slowly inched its way up the price charts, reaching as high as $2,721, before re-tracing the $2,500 level.

Crypto Network Dynamics: Analyzing Address Activity, Transaction Volume, and Market Dominance Trends.

1/4: Ethereum leads in active addresses with 43%, reflecting strong network activity. Tron follows at 21%, signaling its growing user base, with Tether and Toncoin also… pic.twitter.com/zjyjQlqXBL

— IT Tech (@IT_Tech_PL) October 30, 2024

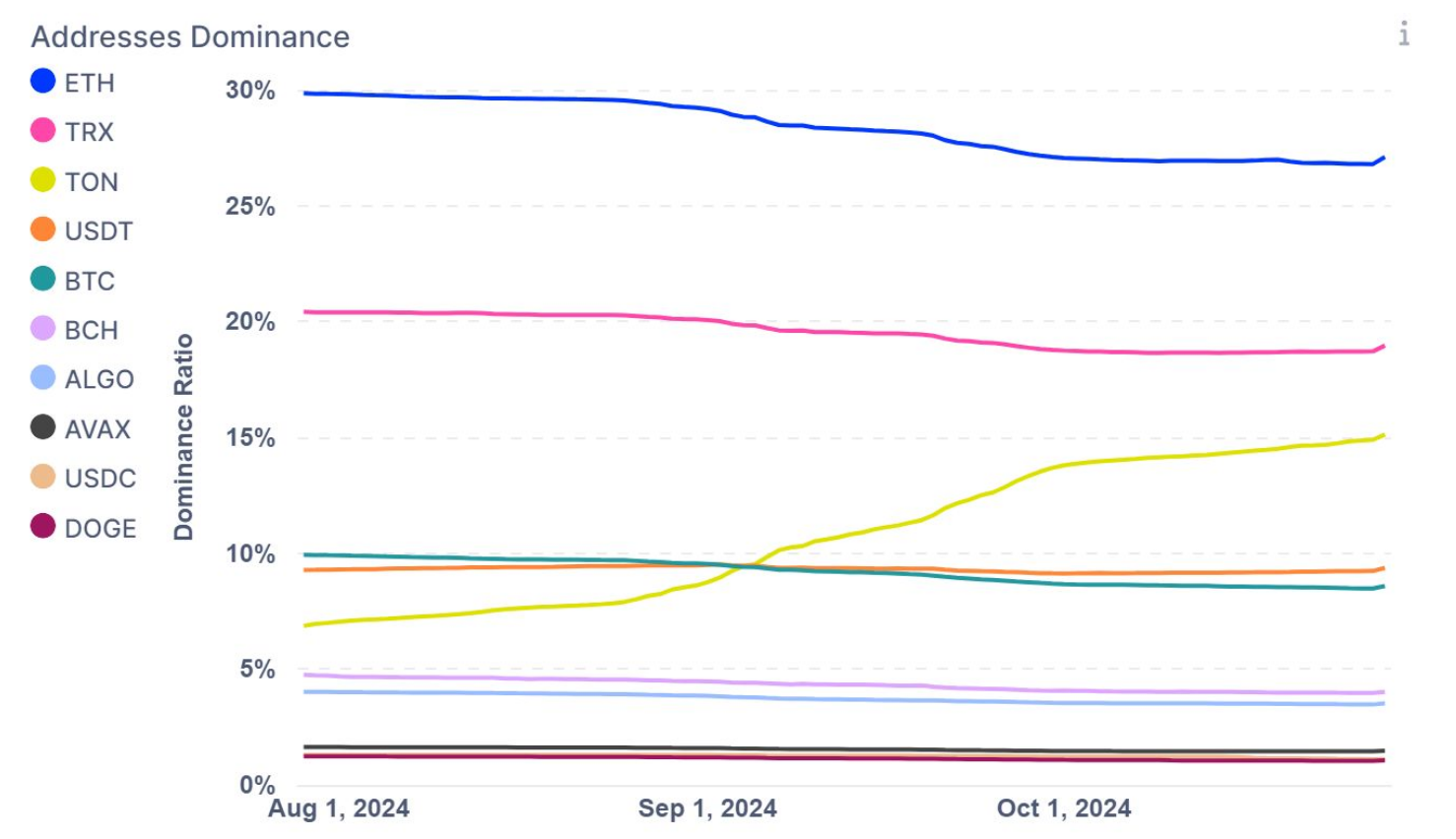

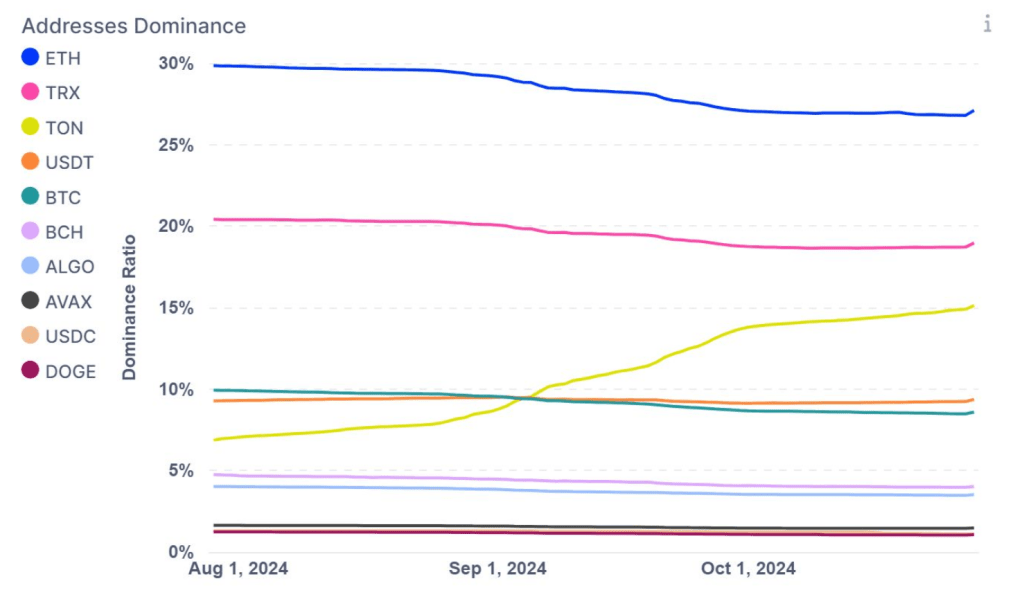

Analysts say Ether’s recent move is due to increased on-chain activities. Based on IntoTheBlock data, Ethereum’s blockchain has seen an increase in addresses, beating other ecosystems. The blockchain accounts for 43% of all active addresses, leading other popular blockchain projects like BTC, TRX, TON, and USDT.

Ethereum Addresses Dominate

The active addresses in a blockchain are an important metric that analysts check to gauge the blockchain’s popularity. According to InTheBlock tracking, the Ethereum blockchain remains the leader, accounting for 43% of all active addresses.

Tron comes in second, with a 27% share of all active addresses. TON by Telegram is also in the Top 5 list of InTheBlock as of October 1st, and it offers an interesting picture of an increasing user base.

Other tokens making significant inroads in active addresses are USDT by Tether and Toncoin. Analysts say this data indicates Ethereum’s dominance, particularly in adoption and network activity.

Can We Expect An ETH Price Rally Soon?

Recent data from active addresses reveal that currently, Ethereum is the most active blockchain. The strength of demand and interest for DeFi projects, dApps, and even NFTs can be ascribed to activity in its ecosystem.

As some blockchain analysts note, improving network activity and adoption often increases prices. ETH can surprise with increased active addresses and prevailing market conditions. Other on-chain data support the blockchain. For example, its Exchange Supply Ratio is down to 0.141 from 0.145, increasing accumulation.

What To Expect From Ethereum In The Next Few Days

Currently, ETH trades at $2,516, which has a weekly gain of 3.74%. There are also an increasing number of active addresses and strong uptrend. Analysts predict ETH to retest the mark of $2,800 in the coming weeks or months.

Featured image from Bankrate, chart from TradingView