Survey: Crypto Traders Predict Ethereum’s ROI to ‘Crush’ Bitcoin’s 2021 Year-End Return

Bitcoin and a slew of digital assets have seen massive drops in value during the last few days, while the top two leading crypto assets bitcoin and ethereum have been battling for market supremacy. This week, bitcoin’s towering dominance over the crypto economy has dropped to a three-year low tapping 41.9%, while ethereum’s market cap has captured 18.6% of the crypto economy. Now a recently published Benzinga poll shows survey participants believe ethereum will “crush” bitcoin’s 2021 year-end return.

Over 80% of Traders Polled by Benzinga Believe Ethereum Will Outperform Bitcoin by the Year’s End

Benzinga, a fintech media and data company headquartered in Detroit, Michigan has published a report called “Ethereum Predicted to Crush Bitcoin’s ROI in 2021.” The survey has obtained data from 100 cryptocurrency traders and investors and many believe ethereum will soon be the top crypto asset.

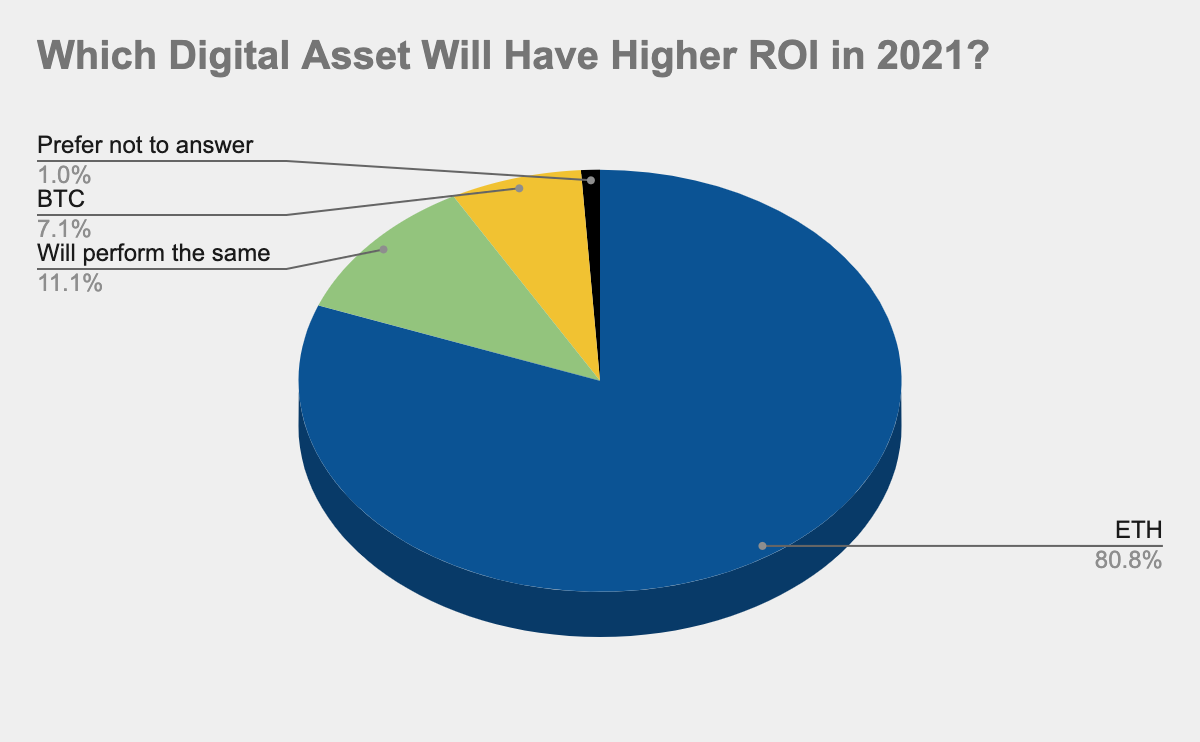

80.8% polled in Benzinga’s survey indicate that ETH will outperform BTC “through the end of 2021.” Benzinga further explains that ethereum is already commanding the return-on-investment (ROI) lead in 2021 so far.

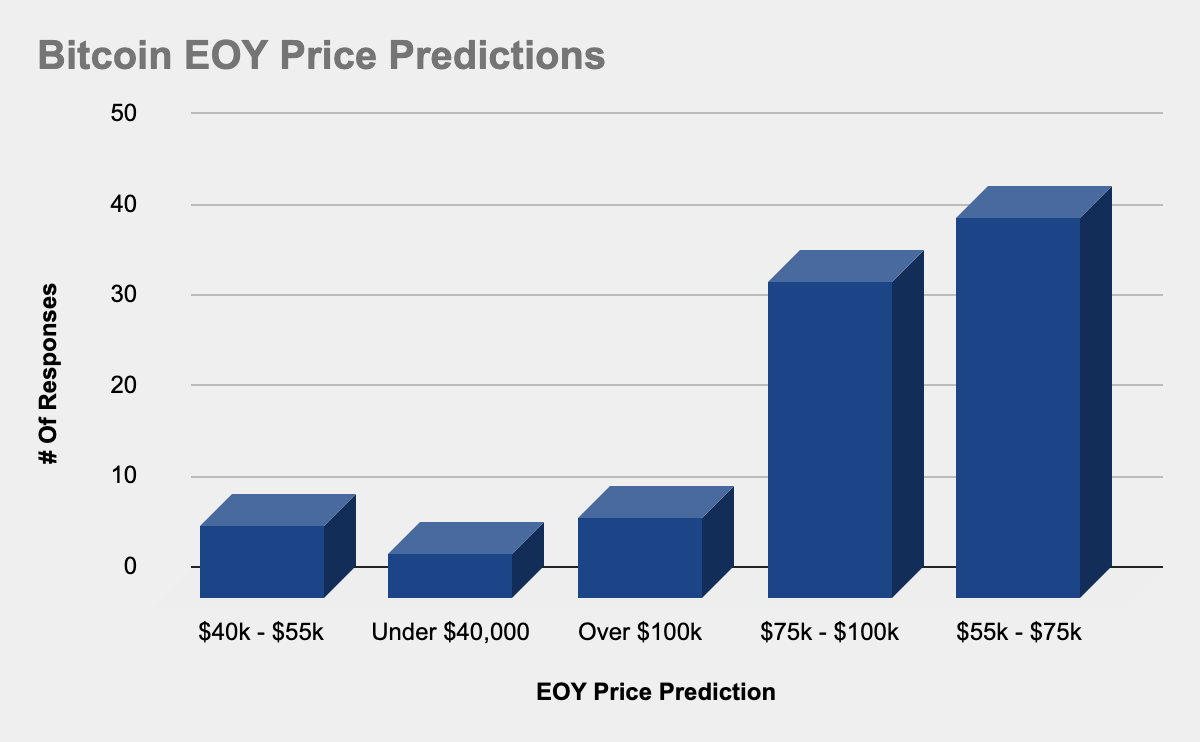

Despite the favoritism toward ethereum over bitcoin, Benzinga participants are still “bullish on bitcoin,” according to the company’s latest poll. “Only 12.8% of respondents believe that Bitcoin will close the year below the $55k mark,” the Benzinga content creator Logan Ross details.

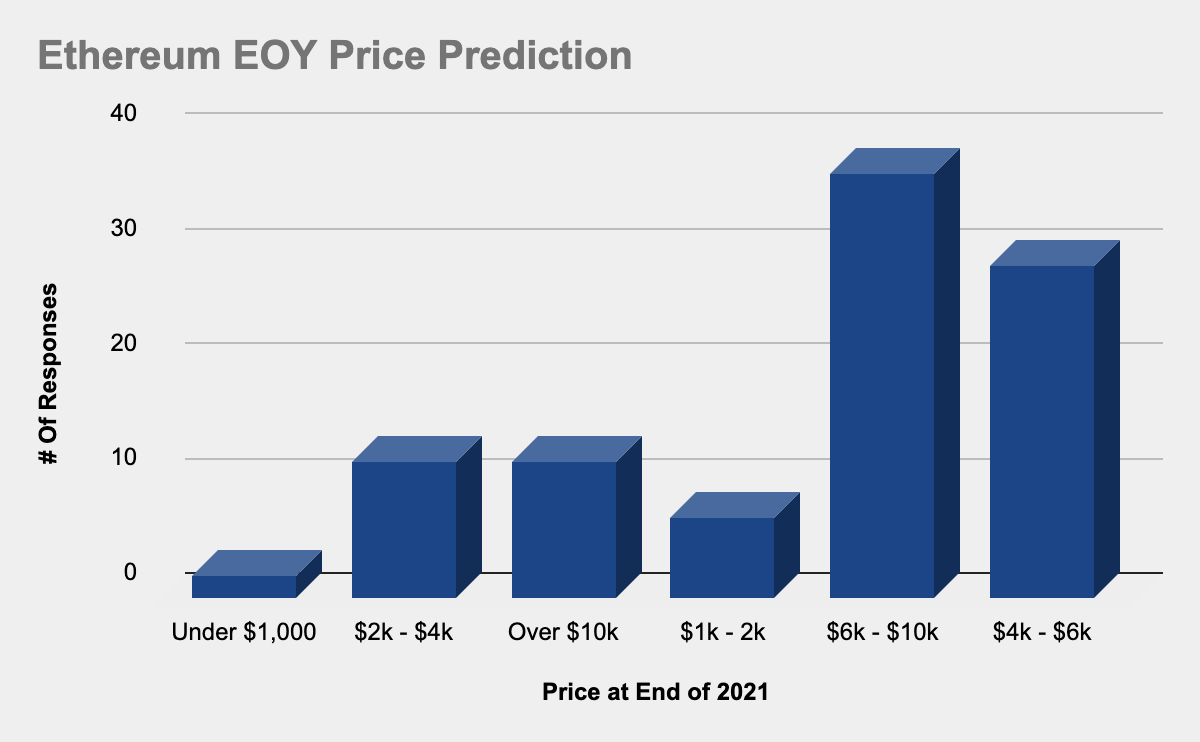

Ethereum predictions were more positive, as far as the survey’s price targets were concerned.

“Only 20.5% of crypto investors believe that Ethereum will close the year below $4k, while 11.8% said that Ethereum will end the year over $10k,” Ross’s report highlights. “The majority believe that ETH will end the year between $6-10k.”

When Ross asked the 100 participants what the most interesting project built on top of the Ethereum network was to them, respondents spoke about ETH 2.0 staking.

“The incoming ETH 2, staking is open which will cause many to buy and unable to sell if they stake to promote the new blockchain, (including myself),” a participant told Benzinga. “I believe this will drive the price higher until ETH 2 is released, then a huge sell-off creating a perfect opportunity to ‘buy the dip.’”

if (!window.GrowJs) { (function () { var s = document.createElement(‘script’); s.async = true; s.type = ‘text/javascript’; s.src = ‘https://bitcoinads.growadvertising.com/adserve/app’; var n = document.getElementsByTagName(“script”)[0]; n.parentNode.insertBefore(s, n); }()); } var GrowJs = GrowJs || {}; GrowJs.ads = GrowJs.ads || []; GrowJs.ads.push({ node: document.currentScript.parentElement, handler: function (node) { var banner = GrowJs.createBanner(node, 31, [300, 250], null, []); GrowJs.showBanner(banner.index); } });

The Flippening Watch

Benzinga’s report comes at a time when bitcoin (BTC) has been threatened by ethereum (ETH) in recent months. Bitcoin.com News reported earlier this week that BTC was getting its market dominance siphoned by ETH and a number of other digital assets.

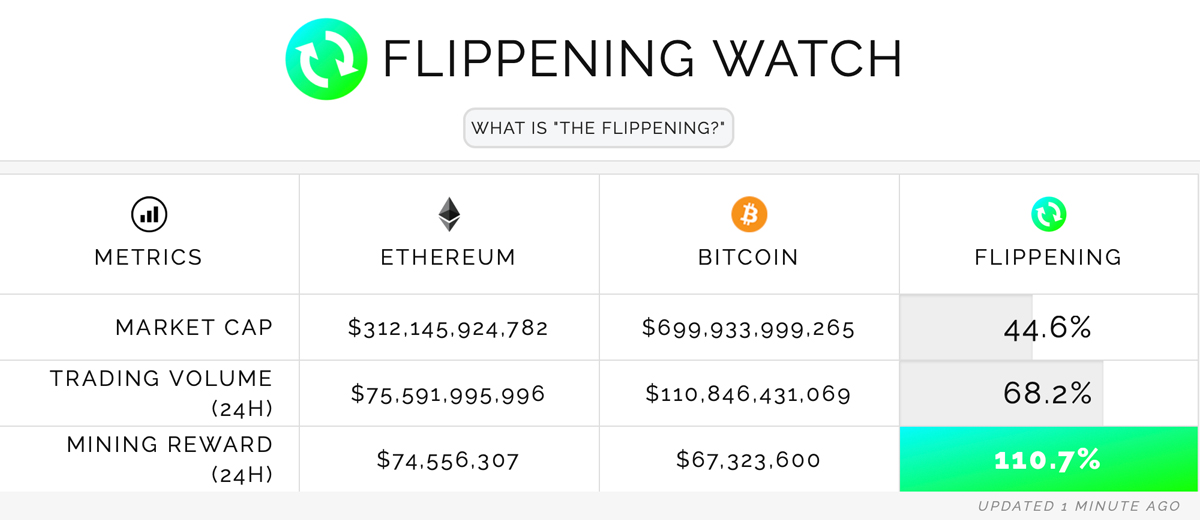

The website called “The Flippening Watch” has been gathering data in real-time as well in order to record the event if it comes to fruition. As far as data from daily mining rewards are concerned, ETH has already beat BTC in this arena.

There are two other metrics ethereum is gunning for which include overall market valuations and 24-hour trade volumes. At the time of publication, BTC still commands these positions, but ETH is getting awfully close to flipping the leading crypto asset. Currently, ETH captures 68.2% of BTC’s daily trade volume today, and 44.6% of BTC’s overall market cap. If ETH outperforms BTC in 2021 and captures a higher market valuation, then a flippening will unfold before the crypto community’s eyes.

What do you think about the Benzinga recent survey with 100 crypto traders? Let us know what you think about this subject in the comments section below.