$BEPRO: How an ambitous team with an unfulfillable goal made millions off the backs of uninformed investors. An ongoing case study into the current status of the cryptcurrency space.

|

Acknowledgements:

TL;DR BEPRO team has profited over 10s of millions in USD by selling tokens into the hands of their starry-eyed investors since January 2021. This was not the result of ill-intentions or scummy marketing, but the fanaticism, and accompanied gnorance, that plagues many cryptocurrencies. **Skip to section 4. The Dump if you are only interested in seeing the proof of the dumping. 1. IntroThe goal of this post is to inform investors of the potential dangers of buying into any given cryptocurrency even if there appears to be substantial potential in a project. We believe BEPRO's team did not intend for this to be a pump & dump; infact, we believe that they may still be working hard to execute their roadmap. However, the combination of their actions, and lackthereof, suggest an unsavoury story that is about to unfold. Briefly, this post will outline what BEPRO was supposed to be, what it is, how it caught fire, and where it is likely going. 2.1 What BEPRO appears to be:BEPRO is marketed as the future of decentralized finance gambling (You will see this used interchangeably with "gaming"). But what do they intend to offer?

They've promoted themselves as a code-as-a-service protocol. This means that if you wanted to setup a website that offers e-sports betting, you would simply purchase BEPRO tokens on subscription, and they would provide you the entire code as a product. 2.2 What BEPRO really is:

This is because of the way the BEPRO token is designed. BEPRO tokens are not used as currency, but to gain access to the code that businesses will use to setup their betting platforms. In return, businesses generate profit from the betting platform. Essentially, BEPRO tokens are like a key that allow businesses to unlock products. BEPRO tokens have no use cases for regular crypto users, and is really only a speculative asset for them to sell to businesses. If the price begins to rise, then wouldn't it become prohibitively expensive for businesses to pay their subscription fees? Well the CEO said they would scale the prices and offer clients prices on a case-by-case basis. This will not bode well for investors, because the only way for the price of the tokens to rise, is if the demand for each token increases. But this won't happen, because if the price goes up by a specific %, then they will simply ask for fewer tokens, mitigating the buying demand for BEPRO tokens. But why can't BEPRO deliver? How are we confident that they won't execute? From what we have seen in the past 3 months, very little work has been done. Here are our reasons:

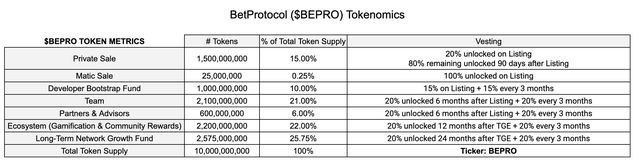

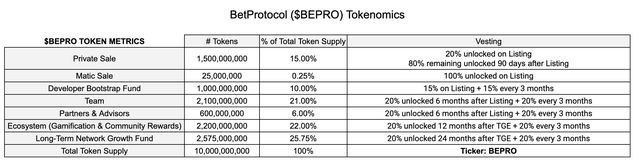

So if the product and the team seem to be idle, then what heck is driving the price up? 3. What is happening:Fanaticism, greed, and bad actors. BEPRO seems like a great company at first glance. The price is attractive and the circulating supply seems nice at 1.8b, wait or is it 4.5b? For a company that has been around since 2018, it seems a bit underhanded for them to have not had their circulating supply updated on these websites. Regardless, many investors saw the price and potential as indicators for a good place to bet (no pun intended) their money. As more and more investors joined, people started asking more questions. This is where it began. When you have a group of investors high on hopium in one telegram chat, you will find the majority are looking for confirmation bias, and see anything otherwise as FUD. Sadly, because BEPRO's website and blogs have few real answers, many users began supplying their own fabricated answers. This creates a self-reinforcing echo chamber, where many investors became unable to separate what was fact or opinion. To make matters worse, the telegram chats were moderated by a biased triumvirate. Any dissenting opinion, genuine concern, or question was labelled as FUD. Plenty of people, including my partners, got banned from asking good questions in the chat. Armed with their inaccurate knowledge, these well-intentioned investors began pushing and marketing BEPRO of their own accord. They were not incentivized by BEPRO nor were they coerced. They had simply spent so much of their time in a censored space that they truly believed BEPRO was going to be the next big thing. The sad part was that none of them are aware that they have just been pushing a pump and dump. 4. The DumpBEPRO has published a post on their Tokenomics. But the only thing legitimate about the post is the the release schedule. The "uses" for each "fund" they allocated has been mostly been used to dump on the public. Figure 1. The proposed tokenomics of BEPRO. Figure 2. Wallet of the original 10 billion supply. This is now the Long-term Network Growth Fund. So far so good, the only discrepancies being the Private sales likely included the matic sale and some of the developer bootstrap fund. Fine by us. So we decided to take a look at the money trail, see if any big clients were beind landed. Instead what we found surprised us. We investigated the Ecosystem Rewards wallet first:All outgoing recent transactions to KuCoin as a sale. Notice how they happened in waves since the rise in BEPRO price. The sales total 910 million to KuCoin, Uniswap, and Bitxmax. This is just 1 page of transactions, you can take a look at the rest yourselves. The real purpose of this fund, verbatim from BEPRO: Figure 4. BEPRO's statement on Ecosystem rewards wallet. Well, from what we gather, it seems more like a rewards wallet for the developers. Welps. Onto the next. 2. Partners & Advisors Wallet Figure 5. Partners & Advisors Fund Interestingly, we didn't see any external transactions to any partners and advisors except the 193 million dispersal. What we did find was that the wallet was empty, and 210 million was sold on KuCoin. 3. Team Fund (x3) Figure 6. Team #1 Wallet. 284 million bepro tokens sold to KuCoin minimum in last month. Figure 8. Team Wallet #3 734 million tokens sold to KuCoin or Bitmax. One of my partners began to take a closer look at the timestamps of the sales to time them with the volatility of the market. She mentions that the team tends to time the sales following news of some announcement and not during. We suppose that is somewhat courteous of them. The Private sale wallet was emptied earlier on, we assume to early investors as private placements and to exchanges (Totalling 1.8 billion). The developer fund is nearly empty, with some selling and some actual transfers to other wallets. But within the last 2 and a half months, the team has sold to exchanges a total 2.37 billion bepro tokens. If we were to assume that they sold at an average price of at least half a cent, that is equivalent to over 11 million dollars conservatively. There is also no tax in Portugal, where the team is located. So congratulations on that too. 5. Where is it going?Why the sells? Maybe it is profit-taking after a long journey of over 3 years. Maybe they are slowing ebbing away, trickling out a breadcrumb trail of hopium for investors. No one knows for sure. But our take on it is that the team had a very strong drive early on. Now, they're reached a point where there is a lot of work ahead and it doesn't seem like the juice is worth the squeeze anymore. They've decided to take their profits and likely move on to other things. Thanks for reading if you have made it this far and please reply your thoughts if you have any concerns. This was written in haste to get the message out as fast as possible. If the creators of BEPRO want to get in touch and respond, please feel free to reply or DM me. I would be happy to admit anything we are wrong about. submitted by /u/A_Venger |