I graphed whether the top 100 coins from 2016 increased/decreased in value and break down what happened if you invested in the top 5/10/25/50/100 or bottom 50 coins [Graphs + Data + Discussion + tl;dr]

![I graphed whether the top 100 coins from 2016 increased/decreased in value and break down what happened if you invested in the top 5/10/25/50/100 or bottom 50 coins [Graphs + Data + Discussion + tl;dr] I graphed whether the top 100 coins from 2016 increased/decreased in value and break down what happened if you invested in the top 5/10/25/50/100 or bottom 50 coins [Graphs + Data + Discussion + tl;dr]](https://darkfibermines.com/wp-content/uploads/2021/08/z-S4wd2tqQPzAjujKMhJlFx2ZlSGg1KysAkkXpG5ZU0.jpg) |

My other recent graph/data crypto posts:

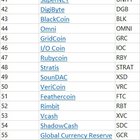

Please check these posts out if you want some easy to read graphs and data; I plan to continue making these for the foreseeable future. Without further ado: What did the top 100 cryptocurrencies by market cap look like in 2016?As a note, I collected these data/rankings from a CoinMarketCap historical snapshot, and I found these coin's current prices on CMC first, or CoinGecko if I couldn't find them on CMC. If they showed up on neither website, I assumed the coin was worthless. Fig. 1 – Top 100 coins by market cap in 2016. Have you even heard of most of these coins? For real, I recognize maybe 25% of them, and I have been in the crypto realm since 2017. Bitcoin, at the top, had a market cap of around $10 B, while the #100 coin, Infinitecoin, had a market cap of around $420,000. For reference, a coin with a market cap of $420,000 today would be roughly rank #1,950 (BEER is that coin, if you're curious). Now, let's see how many coins lost value and how many coins gained value in the last five years. Fig. 2 – How many of the top 100 coins from 2016 increased or decreased in value in 2021. I really like this second figure, as it illustrates your odds of being profitable if you had only bought a single coin in 2016 and didn't sell it until today. You had a 53% chance of picking a coin that went up in value and a 46% chance of picking a coin that went down in value. Also, a 1% chance to pick Tether. So, a single pick would have been risky. I didn't graph these data, but I'll note that 9 of the top 10 coins from 2016 went up in value by today, with only STEEM losing 60% of its value. Now, let's look at how many coins increased in value in bins. This will give us a better idea of how much you'd increase your investment depending on if you had a profitable coin or not. So, the first bin, ranging from 0% to 100%, had 47 coins. This is the same as the orange slice of the pie chart above plus Tether (which was flat, having exactly 100% of its value from 2016 in 2021). The other 46 coins in that first bin lost anywhere from 1% to 100% of their value in the last five years. To write out the above: 7 coins increased in value by 1%-100%, 6 coins increased in value by 101-200%, 1 coin increased in value by 300-400% (Peercoin, 311%, for those curious)… and what's really interesting is that 39 coins increased by at least 400%. What this means is that if you bought only one coin in 2016 and sold it today, you had a 47% chance to breakeven or lose money, you had a 14% chance to make a 1% to 300% profit, and you had a 39% chance to gain at least a 400% profit. This is basically a massive example of feast or famine, where you either lost your money or you made a 4x or greater gain with very little in-between. Now, let's say you're a wise person that doesn't YOLO into a single coin, but rather, divides up your investment based on arbitrary cutoffs and not emotional decisions. How would your money look today? This is my favorite figure. Imagine this: you had X number of dollars in 2016 and you decided to split all that money up evenly across the top 5 coins only… you would be up 12,726% today. Top 10 only? 8,448% gain Top 25? 11,027% gain The BOTTOM 50 coins? You'd still be up 2,133%. That's more than a 20x increase if you'd evenly invested into the bottom 50 coins and didn't sell until today. For comparison, I added an S&P500 index fund investment over the same 5 years – you'd be up a very respectable (by stock market standards) 105% in only 5 years… which very, very much beats the average rate of return for the S&P500 on a long-term historical basis. That still pales in comparison to even the worst-case investment of throwing money at the 50 bottom coins in my above example, returning less than 5% of what you would get with that bottom 50 investment plan. Keep in mind: past performance neither guarantees or predicts future returns. If you invested in any of the above subsets right now and held for 5 years, you may or may not see similar results – I would only recommend people never invest more than they can afford to lose when it comes to cryptocurrencies. tl;dr: the top 100 coins on average did quite well, especially if you invested in more of them evenly rather than trying to pick 1-2 (although 9 of the top 10 increased dramatically). submitted by /u/SoupaSoka |