The ‘Insanely Bullish’ Dogecoin Setup That Will Trigger A 600% Rally To $1

Dogecoin has spent the past few days struggling to regain momentum after a series of pullbacks dragged the price back toward the mid-$0.16 region. The broader market has also been unstable, adding pressure to Dogecoin.

Despite this stretch of bearish price action, a deeper look at the higher-timeframe chart shows a structure that has not been invalidated by the recent decline. This is where a technical analysis from XForceGlobal comes in, as he argues that Dogecoin is sitting inside an “insanely bullish” long-term formation that is unfolding beneath the surface.

The 5-Wave Structure Behind Dogecoin’s Bullish Setup

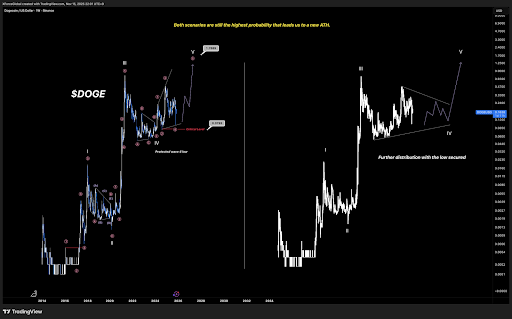

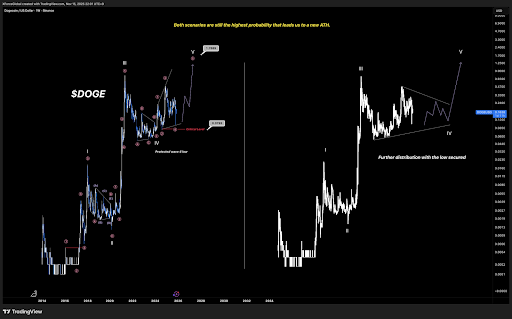

A detailed technical analysis shared by XForceGlobal on the social media platform X argues that Dogecoin is nearing the final stages of an Elliott Wave formation. His interpretation points to cycle targets well above $1 and frames the ongoing price action as part of a developing fifth impulse wave.

The chart shared by XForceGlobal outlines an idealized Elliott Wave cycle that stretches back almost a decade. Dogecoin has already completed the first four major waves on the macro level.

The technical analysis shows the fifth wave technically began months ago, with the fourth wave bottom forming sometime between late 2023 and early 2024. However, the prolonged pullbacks of the past few months introduce the possibility that the fourth wave may still be playing out, instead of the fifth wave.

Despite the choppy price action, the analysis shows that the fourth wave low is protected, and the current price action is still the fifth wave. The chart also shows how Dogecoin has been distributing within a narrowing structure, but the lows have consistently held.

Both of the scenarios visualized on Dogecoin’s price chart still lead to a new all-time high once the rally resumes for another strong push.

Why The Next Dogecoin Wave Points Toward $1

XForceGlobal noted that “cycle targets are still $1+,” a projection supported by the geometry of the fifth wave. The structure resembles the same formations that highlighted Dogecoin’s massive expansions in earlier bull cycles, particularly in 2017 and 2021. Nonetheless, it’s important to note that there’s still room for more distribution.

The current resistance zones sit far below his projected fifth-wave target zone, and the broader market structure shows no violation of the wave-4 levels that must hold for the setup to still be valid.

The chart highlights a potential path that first moves through the $0.33-$0.47 zone before clearing the psychological $0.50 threshold and finally breaking above its current all-time highs at $0.731 and further up into the $1 region.

A full extension of the fifth wave from present levels implies a price target around $1.768. At the time of writing, Dogecoin is trading at $0.1618.