Ethereum’s December ‘Fusaka’ Upgrade: 8× L2 Scale, 60M Gas Default, 16.7M Tx Cap

Key Takeaways:

- PeerDAS shifts blob data to sampling so each full node stores ~1/8 of L2 blob data, enabling a theoretical 8× scale for rollups without heavier hardware.

- Blob-Only Parameter (BPO) forks let clients raise blob targets between major hard forks, and a blob base-fee floor keeps the L2 fee market responsive during EL congestion.

- L1 gets guardrails: 16,777,216 gas per transaction, 10 MiB RLP block-size ceiling, MODEXP input limits and repricing, plus a default gas target near 60M under coordinated client releases.

Ethereum will ship the Fusaka network upgrade in December (Q4 2025), a roadmap step focused on practical scaling, predictable fees for rollups, and tighter DoS boundaries without compromising decentralization. Here’s what changes on day one and what it means for users, builders, and validators.

Read More: Ethereum Dominates 2025 Developer Landscape with Over 16K New Builders

What Changes on Day One

PeerDAS (data availability sampling) for blobs

Before Fusaka, full nodes downloaded every blob that rollups posted to L1. As L2 throughput rose, this burden pushed disk and bandwidth toward centralizing hardware. With PeerDAS, blob data is split and uniformly distributed across the network; a typical full node custodies ~1/8 of total blob data and samples the rest. Any 50% subset can reconstruct the whole, driving error chances to cryptographically negligible levels (~10⁻²⁰–10⁻²⁴). The result is lower per-node load and room for L2 throughput growth.

Blob-Only Parameter (BPO) forks for faster capacity tuning

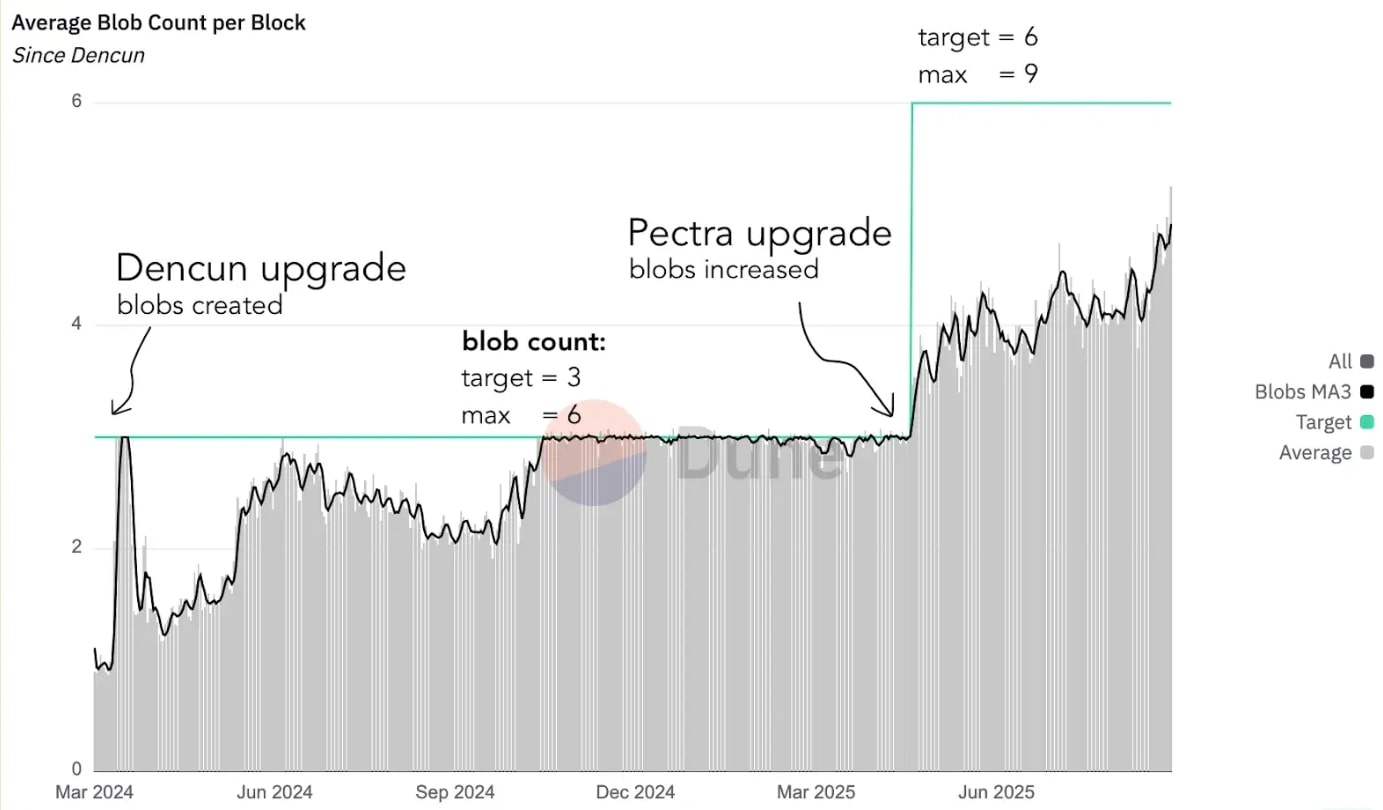

Hard forks take months to coordinate and test. After Fusaka, clients can agree to raise blob targets/max blobs (e.g., 6→9→15→21) between major forks, similar to how gas limits are coordinated. Operators update configs; L2s get blob space when demand arrives, not only at big-bang upgrades.

Blob base-fee bounded by execution costs

When execution gas spikes, the blob auction could drift to 1 wei, breaking price signals. Fusaka pins a proportional reserve under blob fees, ensuring the blob market continues to react to congestion, and that L2s pay a meaningful share of execution they impose on nodes.

L1 Hardening for Predictable Scaling

Transaction gas limit cap: 2²⁴ = 16,777,216 gas

Bounding the worst-case single transaction keeps validation/propagation modelable as block limits rise, avoiding pathological txs that starve a block.

RLP execution block size cap: 10 MiB (with ~2 MiB safety margin)

Execution-layer block payloads over this limit are rejected, aligning with consensus gossip behavior and cutting reorg/DoS risk from oversized blocks.

MODEXP input ceiling and repricing

Inputs to the modular exponentiation precompile are capped at 8192 bits. Gas pricing rises for longer exponents and larger base/modulus values, so one MODEXP call can’t monopolize block time. This change clears a known bottleneck to raising block gas further.

History expiry and simpler receipts operationalized

Clients commit to dropping very old history (e.g., pre-Merge) to keep disk growth practical. It doesn’t change contract behavior; it keeps node costs sane long-term.

Default gas limit guidance ≈ 60M

Client teams coordinate around ~60M gas defaults in Fusaka releases (stress-tested on devnets), paired with the tx cap to ensure no single tx dominates. Research indicates block-size pathologies remain far away from these levels.

Read More: Bhutan Migrates National Digital Identity to Ethereum in Major Blockchain Milestone

The post Ethereum’s December ‘Fusaka’ Upgrade: 8× L2 Scale, 60M Gas Default, 16.7M Tx Cap appeared first on CryptoNinjas.