Bitcoin Hyper Best Crypto to Buy Now as Short Squeeze Brewing and U.S. Inflation Data Looms

What to Know:

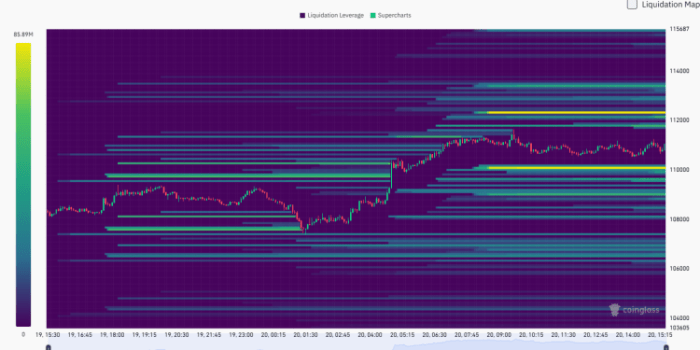

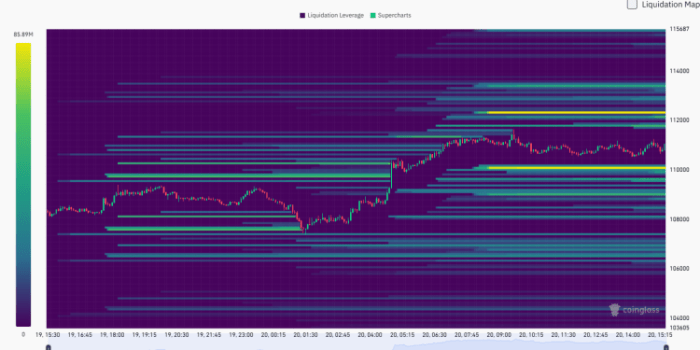

- There is a large concentration of liquidity above the current $BTC price, suggesting a short squeeze could be in the making.

- The “Coinbase premium” for Bitcoin (the premium or differential of Bitcoin’s price on the U.S. exchange Coinbase relative to global exchanges) is rising – signifying stronger U.S. institutional and retail demand.

- A $BTC short squeeze could make Bitcoin Hyper the best crypto to buy with its Layer 2 upgrade.

With Bitcoin (BTC) hovering around $110K, a perfect storm of technical signals and macro tailwinds is building — potentially priming the world’s largest cryptocurrency for a powerful upward breakout.

A significant short squeeze could be underway – and a key inflation reading from the United States this week could serve as the spark. Will both factors combine to send Bitcoin surging, and make the Bitcoin Hyper ($HYPER) Layer 2 the best crypto to buy now?

What’s a Short Squeeze? Why Should Crypto Investors Care?

A ‘short squeeze’ happens when a large number of market participants have bet on a price decline. If price instead rises, these traders may be forced to buy back their positions, adding further upward pressure.

Fresh data from Coinglass reveals a heavy cluster of liquidity sitting above Bitcoin’s current price. With stop-losses and orders stacked at higher levels, the setup points to an upward move as the market hunts for that liquidity.

Markets naturally gravitate toward areas with stacked liquidity. When heavy short positions sit above the price and momentum pushes higher, forced liquidations can trigger a cascade of buy orders — the textbook recipe for a rapid short squeeze.

Institutional Accumulation: The Coinbase Premium Tells a Story

Retail traders still matter, but one of the defining shifts in Bitcoin’s 2025 market has been the surge in institutional participation. A key gauge is the “Coinbase Premium” — the price gap between Bitcoin on U.S.-based Coinbase and other global exchanges — often used as a proxy for institutional demand.

A climbing U.S. premium is a classic sign of growing demand from institutions and large investors. In recent weeks, that premium has spiked — pointing to steady accumulation beneath the surface. This hidden bid could provide a solid price floor for Bitcoin and potentially ignite the next leg higher.

And there’s some demand for Bitcoin that never changes; Michael Saylor just announced Strategy’s latest $BTC acquisition.

The Macro Wild Card: U.S. CPI Release Amid Government Shutdown

The U.S. Consumer Price Index (CPI) drops this Friday, even as the government shutdown drags on. A softer inflation print could strengthen the case for a dovish Fed, raising confidence in more rate cuts or at least a pause.

But if inflation surprises higher, markets may quickly price in tighter policy — a potential headwind for risk assets.

Traders are already betting big: futures markets show a 98% chance of at least a 25-basis-point cut in the near term. That makes this CPI release a critical catalyst, with the power to spark Bitcoin’s next breakout move.

And when Bitcoin moves, keep an eye on Bitcoin Hyper ($HYPER) — momentum there often follows fast.

Bitcoin Hyper ($HYPER) – Critical Bitcoin Layer 2 Upgrade Sets Up Bitcoin’s Continued Growth

Blockchain Layer 2 solutions – like Bitcoin Hyper ($HYPER) – aren’t intended to take away from the base layer’s utility. Typically, they add to it in some way.

In Bitcoin Hyper’s case, that means adding lightning-fast transaction speeds and low-cost transactions for wrapped $BTC on the Hyper Layer 2, solving two problems that have plagued Bitcoin in recent years.

The Bitcoin Hyper solution works by incorporating a Bitcoin Canonical Bridge on the Solana Virtual Machine, leveraging the SVM’s native speed and scalability. It’s a hybrid architecture that keeps final settlement on the native Bitcoin Layer 1, preserving Bitcoin’s stability and security.

With Hyper, $BTC microtransactions are finally feasible, opening the door for Bitcoin to be used as more than just a store of value. Learn how to buy $HYPER and see why our price prediction shows the token could reach $0.08625 by 2026, setting up 556% gains from its current $0.013145.

If the setup plays out, a successful short squeeze could propel Bitcoin higher, especially if driven by both institutional demand and a favorable macro shock. That would certainly boost $HYPER as well, setting it up for success in the next year.

Do your own research, as always. This isn’t financial advice.

Authored by Aaron Walker on NewsBTC — https://www.newsbtc.com/news/bitcoin-short-squeeze-bullish-hyper-best-crypto-buy