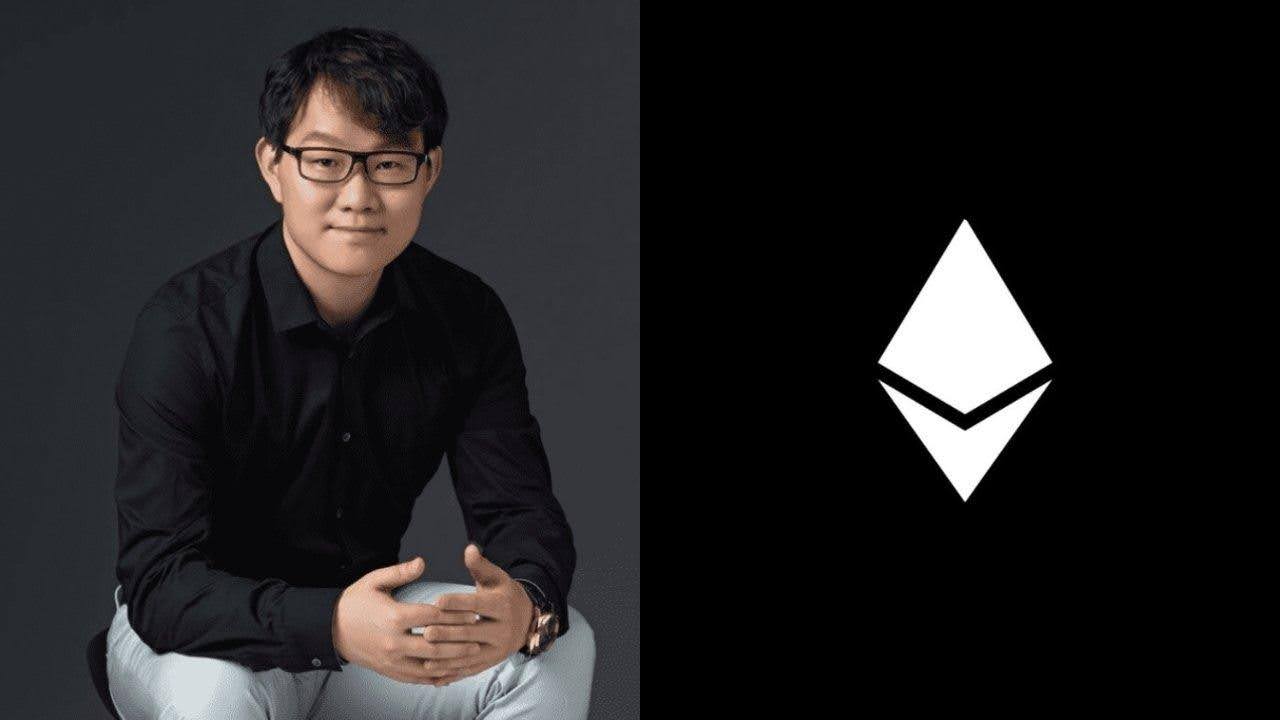

Huobi Founder Li Lin Launches $1B Ethereum Trust With Asia’s Top Crypto Backers

Key Takeaways:

- Li Lin, founder of Huobi and Avenir Capital, has raised $1 billion to launch a new Ether-focused digital asset trust alongside leading Asian crypto investors.

- Backed by HongShan Capital, Fenbushi Capital, HashKey Group, and Meitu founder Cai Wensheng, the trust aims to accumulate ETH and expand institutional exposure to Ethereum.

- The project will operate under a Nasdaq-listed structure, providing regulated access for large investors seeking exposure to Ethereum amid surging institutional demand.

One billion-dollar bet is being created around Ethereum. Li Lin, the founder of Huobi, is said to be planning a $1 billion Ether trust in collaboration with some of the earliest blockchain investors, which is an indication of increased confidence in the long-term use of Ethereum as the foundation of decentralized finance and tokenized economies.

Li Lin’s Billion-Dollar Ethereum Strategy

Li Lin, the founder of Huobi that was acquired in 2021 and grew to be one of the largest exchanges in the world, is currently leading a new project with his investment firm Avenir Capital. As per reports surrounding the issue, the fund will raise huge amounts of ETH through a controlled trust vehicle, which will appeal to both institutional and high-net-worth clients.

The trust, expected to be announced within weeks, already secured $1 billion in commitments, including:

- $500 million from HongShan Capital Group (formerly Sequoia China),

- $200 million from Avenir Capital, and

- Additional contributions from early Ethereum advocates Shen Bo (Fenbushi Capital), Xiao Feng (HashKey Group), and Cai Wensheng (Meitu Inc.).

People who are knowledgeable about the project indicated that the group would organize the trust in a Nasdaq-traded shell company and provide a regulated exposure vehicle comparable to U.S. spot crypto ETFs. This would be attractive to foreign investors who would wish to invest Ethereum in a transparent and compliant model.

Read More: Ethereum Dominates 2025 Developer Landscape with Over 16K New Builders

A High-Stakes Move by Asia’s Crypto Veterans

The founding team is a list of who’s who in the blockchain pioneers of Asia. Both of them have been influential in the initial crypto context:

- Shen Bo was also one of the earliest investors in Ethereum to finance it via Fenbushi Capital, which was one of the first blockchain venture funds in Asia.

- Xiao Feng of HashKey Group assisted in developing the regulation policy in Hong Kong on licensed digital asset exchange.

- Cai Wensheng, the tech founder of Meitu, has gained attention in 2021 when his company spent more than $100 million on the purchase of Bitcoin and Ethereum in its treasury.

They enjoy a joint track record, which avails them of financial influence and authority to the new Ether trust. Market analysts note that the partnership represents a strategic bet on Ethereum’s future as the settlement layer for institutional finance.

“This alliance of early builders and major investors signals a renewed institutional push into Ethereum,” said one Hong Kong-based fund strategist. “It’s less about speculation and more about positioning for the tokenization wave.”

Why the Timing Matters: Ethereum’s Institutional Moment

Ether is in the “institutional phase” as many players in the industry refer to. After the success of U.S. spot Bitcoin ETFs, there is market expectation to have approvals of spot Ether ETFs in key jurisdictions, like the U.S., Hong Kong, and Singapore.

Such confidence might place the team of Li Lin at the core of such momentum to provide a preliminary access point to controlled investors. Nansen data show that Ether was trading at around $3,857 at the time of writing, more than 9% higher than it was the previous week, as increased market enthusiasm toward Ethereum-based products began.

Read More: Bhutan Migrates National Digital Identity to Ethereum in Major Blockchain Milestone

Recent events give this hope:

- Ethereum’s staking yield remains stable around 3.5–4%, attracting institutional interest seeking yield-based diversification.

- BlackRock and Fidelity have already filed for Ether ETF approvals in the U.S., with analysts projecting billions in inflows once approved.

- In Asia, HashKey and OSL have obtained licenses to offer spot crypto trading to retail and institutional clients, expanding regulated access to ETH.

“Ethereum has become the preferred network for real-world asset tokenization, stablecoins, and on-chain finance,” said a report from Consensys at the Digital Asset Summit 2025. “Its next phase could drive trillions in tokenized assets.”

Li’s Avenir Capital has quietly grown into one of Asia’s most active digital asset investment firms. Beyond this new Ether trust, Avenir.

The post Huobi Founder Li Lin Launches $1B Ethereum Trust With Asia’s Top Crypto Backers appeared first on CryptoNinjas.