Paxos Mints 300 Trillion PYUSD By Error – Here’s What Happened

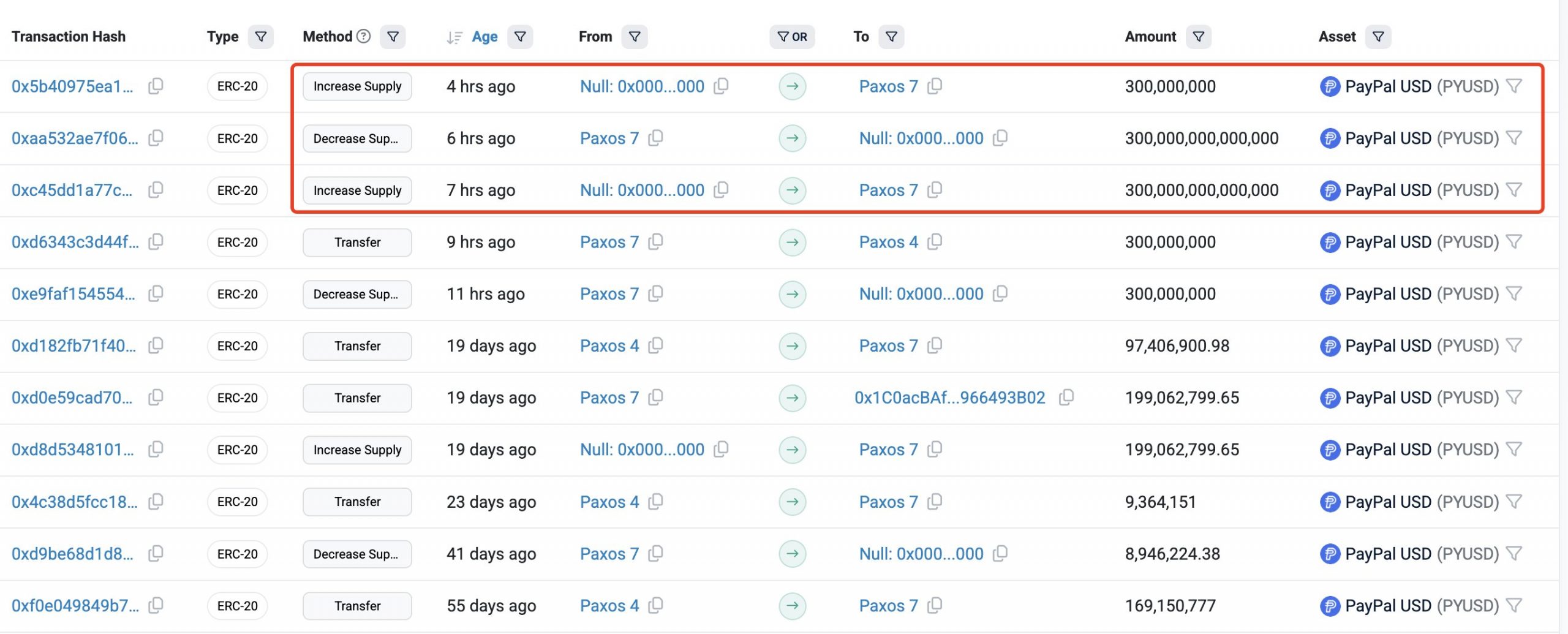

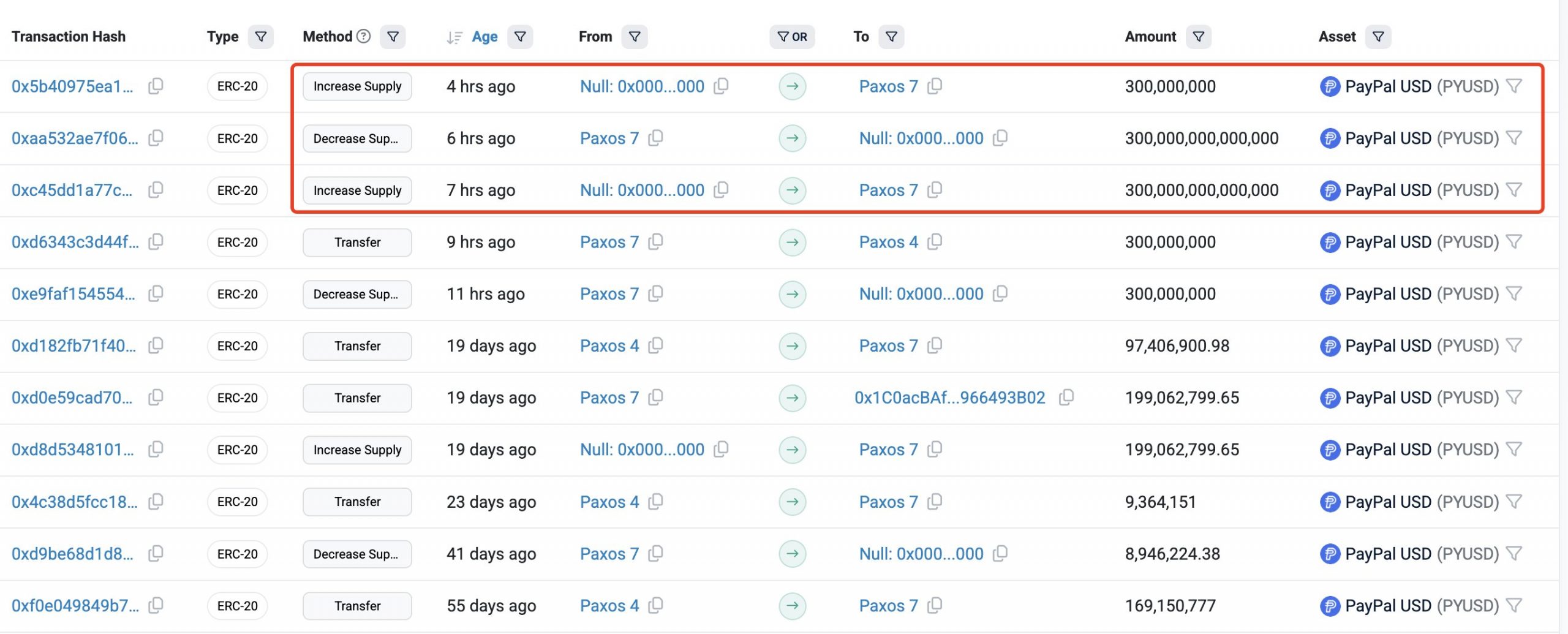

In an unexpected and almost surreal incident, Paxos, the issuer behind PayPal’s PYUSD stablecoin, mistakenly minted 300 trillion PYUSD — yes, with a “T” — earlier today after adding six extra zeros to the intended transaction. The blunder was swiftly corrected as Paxos burned the excess tokens and reissued the correct amount of 300 million PYUSD, but not before the crypto community noticed the jaw-dropping figure.

To put the scale of the mistake into perspective, 300 trillion PYUSD would have exceeded the entire US money supply (M2) — currently around $21 trillion — by nearly 14 times. In global terms, it would represent almost three times the total estimated global M2, roughly $100 trillion. In other words, for a brief moment, Paxos had “created” enough digital dollars to buy nearly every publicly traded company in the world.

The situation sparked a wave of disbelief and humor across social media, with traders and analysts mocking what could have been the largest minting error in crypto history. While Paxos acted quickly to reverse the error and confirmed that no funds were affected, the event has reignited discussions about smart contract precision, stablecoin risk management, and the potential consequences of such errors in large-scale financial systems.

Paxos Responds to Minting Error, Sparks Debate on Stablecoin Oversight

On Wednesday afternoon, Paxos addressed the situation directly on X, confirming that the minting of 300 trillion PYUSD was the result of an internal mistake during a routine transfer. The company stated:

“At 3:12 PM EST, Paxos mistakenly minted excess PYUSD as part of an internal transfer. Paxos immediately identified the error and burned the excess PYUSD. This was an internal technical error. There is no security breach. Customer funds are safe. We have addressed the root cause.”

The acknowledgment calmed immediate fears of a security breach or loss of funds, but the incident quickly became the subject of widespread jokes and criticism across the crypto community. Traders and developers mocked the idea that a few misplaced zeros could momentarily inflate global liquidity by trillions of dollars — a stark reminder of how even the most regulated issuers can make human or technical errors.

While the issue was resolved within minutes, it reignited debate over stablecoin minting procedures and the need for real-time transparency and safeguards. Some industry observers argued that such incidents underscore why stablecoin issuance should face stricter regulatory standards, especially when tied to large institutions like PayPal. Others countered that blockchain’s transparency worked as intended — the mistake was instantly visible, verifiable, and corrected without harm.

Ultimately, the event highlights a deeper tension within the stablecoin sector: how to balance innovation and automation with the level of oversight and accountability expected from entities that effectively issue digital representations of real-world money.

Stablecoin Dominance Shows Growing Market Caution

The chart shows that stablecoin market dominance has climbed back to 8.49%, signaling a notable shift toward risk aversion following the sharp market correction last Friday. Historically, rising stablecoin dominance reflects traders rotating capital into safety — holding stablecoins like USDT, USDC, or DAI rather than volatile assets like Bitcoin or altcoins.

After dipping below 7.5% in late September, dominance rebounded sharply during last week’s crash, even briefly spiking near 9.5%, the highest level since early June. This surge aligns with the massive minting activity reported by Tether and Circle, which together issued over $4.5 billion in new stablecoins after the sell-off. The move suggests that large players and institutions are preparing liquidity reserves for potential market re-entry or risk management amid ongoing uncertainty.

If dominance continues to consolidate around 8–9%, it may indicate that investors are still hesitant to redeploy capital into crypto assets, waiting for confirmation of a market bottom. Conversely, a sustained decline below 8% could mark renewed confidence and inflows into Bitcoin and altcoins. For now, the chart points to a cautious but liquid market, where participants are ready to act once volatility stabilizes.

Featured image from ChatGPT, chart from TradingView.com