Rate Cuts Could Ignite Massive Rallies: Why Context Might Turn This Cycle Into Another 1995 Or 2019, According To Goldman Sachs

|

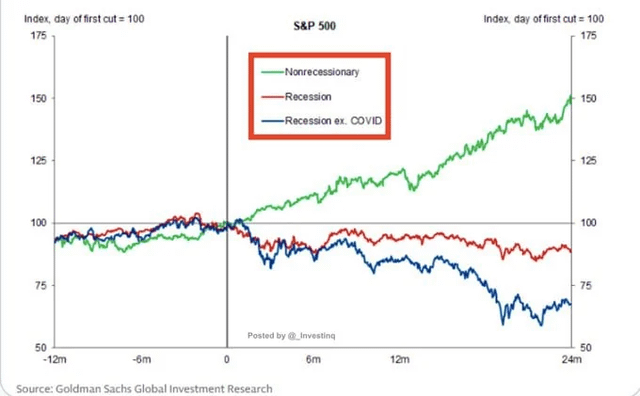

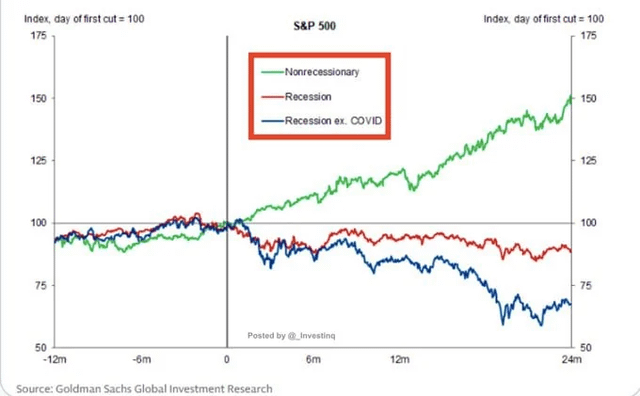

As she states and taking in count Goldman Sachs Global Investment Research data, when the Federal Reserve cuts interest rates, many investors instinctively assume that it is bullish for the stock and crypto market (me included when I forget about this). But reality is different, it is important in what context it happens and usually the context matters more than the cut itself. According to some historical data that shows the Goldman Sachs research, when the Fed reduces rates outside of a recession, the S&P 500 (probably crypto too now) has historically delivered impressive results with gaining around 50% within two years of the first rate cut. This happens when inflation is cooling, growth remain stable and monetary policy is shifting from restrictive to supportive. Market understands these moves as a green light for risk assets (crypto). However the story changes dramatically when rate cuts happen during a recession. In those cases the S&P 500 tends to fall, around 20%-30% because economic weakness overshadows the impact of lower borrowing costs. In this case COVID era cuts were an exception. In summary

Currently the US economy is not in a recession and inflation continues to cool, meaning that this cycle could look more like 1995 or 2019 periods that brought us strong market rallies rather than painful downturns like in 2001 and 2008. Rate cuts are powerful, but only in the right economic environment. Source: submitted by /u/kirtash93 |