Analyst Says Dogecoin’s Parabolic Run Is Inevitable – Historical Pattern Point To Another Breakout

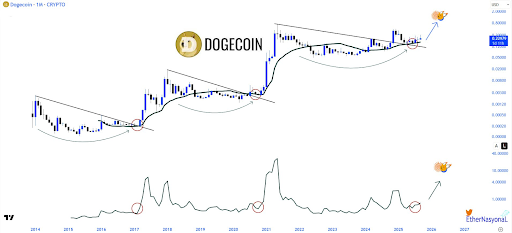

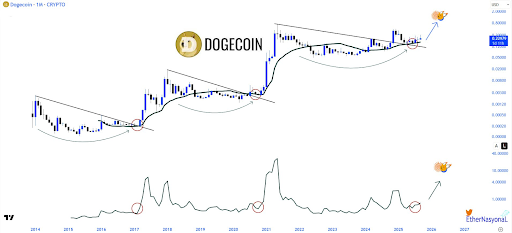

Dogecoin has yet to deliver the kind of rally many expect in the current market cycle, but one analyst believes that is only a matter of time. Posting on the social platform X, the analyst with the handle @EtherNasyonaL described a parabolic run for Dogecoin as inevitable, pointing to recurring chart structures that preceded Dogecoin’s explosive rallies in 2017 and 2021.

Dogecoin’s price movement in this cycle has largely been characterized by short-lived bursts of momentum followed by lengthy stretches of sideways consolidation or gradual retracements. Yet, there is a strong conviction among the most bullish Dogecoin proponents that the true rally for this cycle has not yet taken place. To them, Dogecoin is still in the build-up stage for a strong rally.

Dogecoin Hasn’t Pumped Yet This Cycle

One such example is a recent analysis that was posted on the social media platform X, where the analyst noted that Dogecoin hasn’t actually pumped up in the current cycle yet.

Related Reading: Dogecoin Is Sitting On A Powder Keg: Here’s The Explosion That Will Send Price To $1.3

The chart posted by the analyst draws attention to a series of descending trendlines that Dogecoin has historically broken through and gone on exponential rallies shortly after. These periods often lasted years, with prices moving sideways and testing investor patience before then going on a rapid pump.

Particularly, the analyst highlighted the 2017 breakout, where Dogecoin climbed out of a multi-year base, retested the moving average, and then rallied in the months after. As well as the 2021 rally, where the meme coin broke above the multi-year base and retested the moving average again before finally soaring to its current all-time high of $0.7316.

The current setup shows Dogecoin in a similar position. Having broken above the resistance trendline months back, the Dogecoin price went back to retest the monthly moving average again, as shown by the red circle in the chart below.

Now, it seems Dogecoin is trying to extend a rally, as evidenced by the price action in the past two months above $0.22. If history repeats, the present stage may be laying the groundwork for yet another multi-month price surge.

The Current Cycle Looks Different

Dogecoin’s current price cycle presents unique dynamics compared to past rallies. Unlike in 2017 or 2021, which were mostly based on meme coin hype, Dogecoin is now trading in a crypto market with higher liquidity and greater institutional investments. As such, the factors for any projected rally at this point will depend on the amount of institutional inflows that come into Dogecoin.

Discussions around Spot Dogecoin ETFs have added a new dimension to how capital could flow into the asset. If such products gain regulatory approval, they could open up Dogecoin to institutional inflows, much like what has already been seen with Bitcoin and Ethereum ETFs.

Nonetheless, Dogecoin’s on-chain data and trading metrics have begun to reflect behavior consistent with accumulation phases seen ahead of past breakouts. September, in particular, has been highlighted by multiple whale purchases. For example, DOGE whales added 2.08 billion DOGE to their holdings during the most recent price pullback below $0.23.

At the time of writing, Dogecoin is trading at $0.231.