My thesis for memecoins and why I allocated in a big way

|

Despite what many in this sub think, I see the opportunity to participate in the growth of authentic, bottom-up, on-chain communities (memecoins imo is a misnomer) as the deepest value bet of this crypto cycle. As crazy as this sounds, I see this is actually investing in mini emerging Network States of the future. For context, this is my third cycle and I've been angel investing in web3/defi since 2020 so my opinion comes from following the public crypto scene but also from seeing quite some dynamics behind the curtains. Why tokenized communitiesThe distribution of money inflows towards alternative crypto assets (i.e. everything outside of BTC, ETH and the other majors) has been imo structurally different this cycle from past ones. This comes down to several factors:

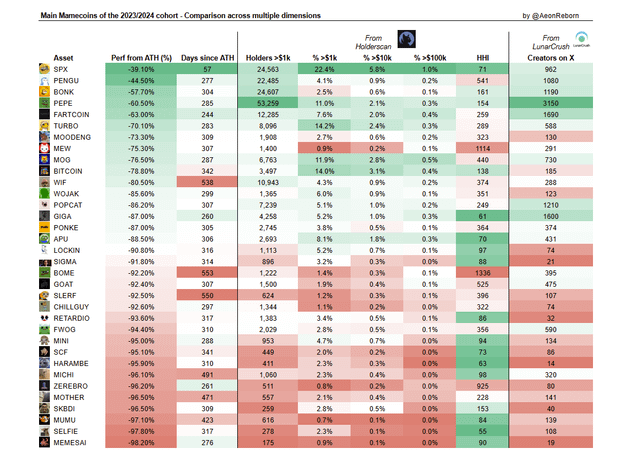

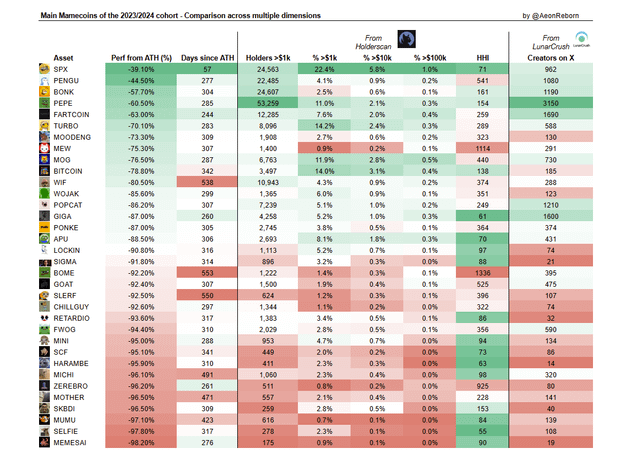

The above has led to the development – especially in 2023-24 – of new “tokenized communities”, i.e. global online groups – each with their own identity, culture, lore and purpose – which use the token as their banner and as their collective Schelling point to gather around. Also labeled memecoins, the best ones are organically distributed among hundreds of thousands of holders, are very decentralized, the supply is fully circulating (no unlocks) and have very strong, active and passionate communities which exist independently of the financial incentives that the token provides. While some criticize memecoins for having “no utility”, I believe that the marginal value for the average holder and participant is non-zero and possibly even greater than for tech-alts. It lies in the purpose, the belonging, the adventure, the mission, the meaning, the connections and the network that participants develop by being part of this collective, akin to being part of the same guild in that MMORPG (massively multiplayer online role-playing game) that is crypto. In a context where the growth of most altcoins has been muted so far, top organic memecoins have been the real outperformers, representing 6 out of the 10 top performing tokens of 2024. As people come to realize that “the best products don’t need a token, and the best tokens don’t need a product”, memecoins are stealing the narrative and speculative premia away from altcoins valuations. Historically, the top performing categories of year 3 of the cycle (in this case 2024) have continued to outperform in year 4 (2025). As a result, I see in this category the greatest potential as we approach the last 6-10 months where most price action has historically been concentrated. For a deeper understanding of memecoins I'd recommend you this video from Token 2049 in October ‘24. How I look at each community comparativelyWithin the memecoin category, I believe that those launched in 2023/24 are actually showing the deepest value. Ultimately I believe you need a "landing strip" equevalent of time for the community to really form, consolidate and take off. I call this at least 1-2 years in which ideally the community has been battle-tested and survived multiple -80% drawdowns. So I'm not talking about the "flavor or the day" pump-fun garbage here. Being completely unlocked, all holders dynamics are visible on-chain and so it is possible to look at each of these emerging tokenized groups quantitatively. Some of the most interesting and objective factors to look at are

The main image of this post shows a comparative analysis of the main memecoins of the 2023-24 vintage updated as of today. Why nowWhile the past 3 cycles were almost 4 years to the dot, I wouldn't be surprised if this present cycle extends a little longer. Imo the business cycle (especially in US) hasn't played out yet, the story of lower interests rates has just begun and the overall pessimism in most participants make me inclined to believe that we are still not yet close to a top. Plus retail is still not here. Of course I may be wrong, but I can personnally see 6-12 months of bullishness left. A few considerations supporting this view:

Note: take the analysts view with the pitch of salt, not for the exact numbers they cite but more for a broader directional idea. I think we are currently at a sweet spot for positioning in memecoins, and it can be a valuable opportunity for net new participants or those who remained sidelined in H1-25. Of course I'd love to know what you guys think. I suspect many here may have a lot more attachment to utility altcoins (totally understand, I've been there too and I spent years angel inveting in protocols) so I look forward to the discussion! ———————————————————- Edit: submitted by /u/yvthousands |