Bitcoin’s Rollercoaster Ride Won’t Derail VanEck’s $180K View

Bitcoin’s price action this month has left traders watching closely as big players double down on bullish calls. According to VanEck’s research, the investment firm has reaffirmed a $180,000 year-end target even after Bitcoin slid from a recent high, a sign that some institutional buyers are not backing away despite a pullback.

Institutional Buying Remains Heavy

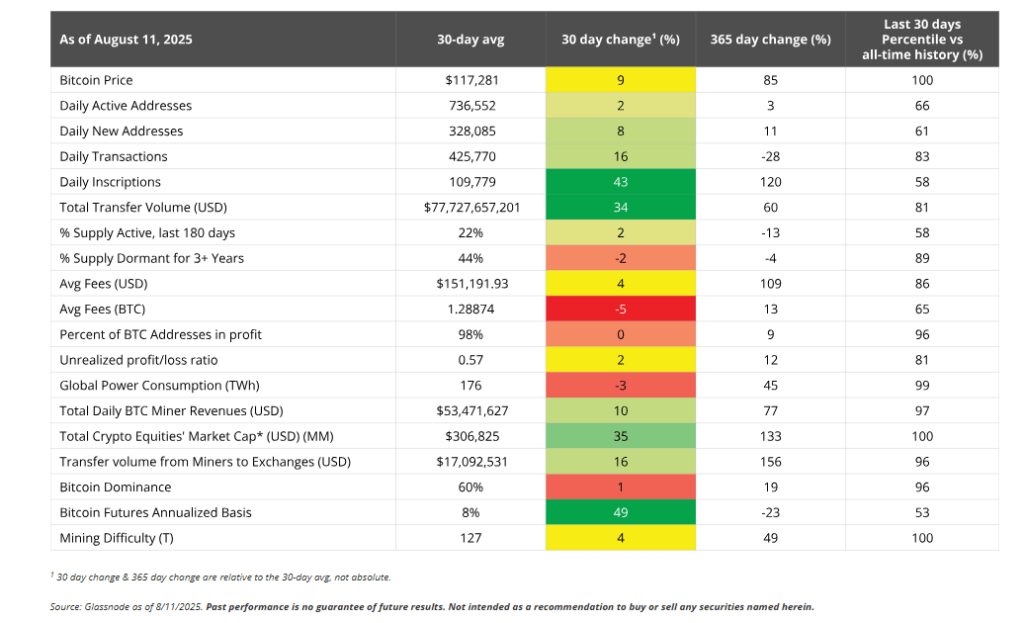

Reports have disclosed heavy accumulation in July. Exchange-traded products bought 54,000 BTC while Digital Asset Treasuries added 72,000 BTC, giving clear evidence that large holders continue to pile in.

VanEck first laid out its bullish view in November 2024 when Bitcoin traded around $88,000. At the same time, US-listed miners now account for 31% of global Bitcoin hashrate, up from roughly 30% earlier this year, even as equity index fell 4% when excluding Applied Digital’s 50% jump.

Price Moves Show Volatility And Quick Recovery

Bitcoin slid to $112,000 in early August before jumping back to $124,000 on August 13. That move set a new all-time high above July’s $123,838.

At the time of writing, Bitcoin trades close to $115K, roughly 8% below that recent peak. Traders describe the pullback as a repositioning after a run-up, not an obvious breakdown.

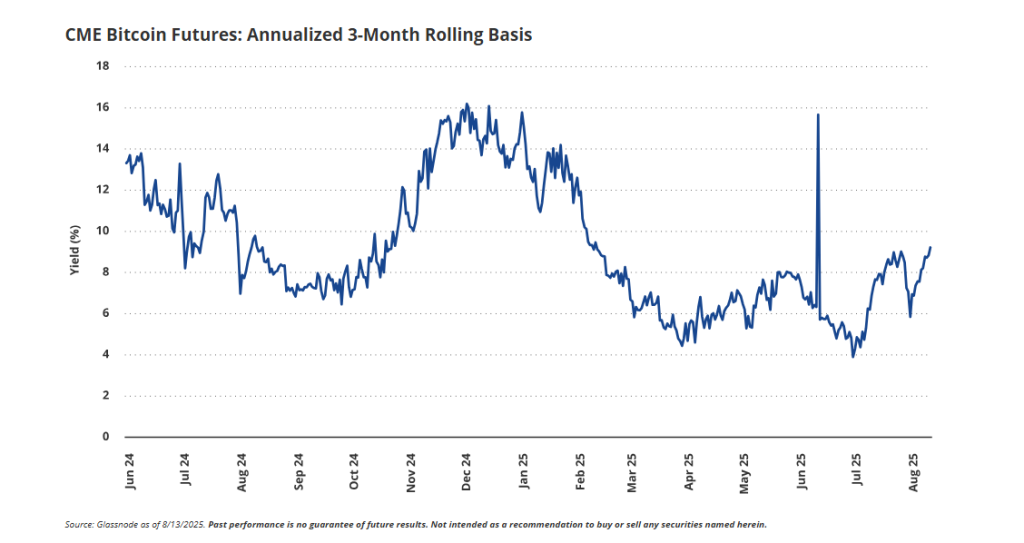

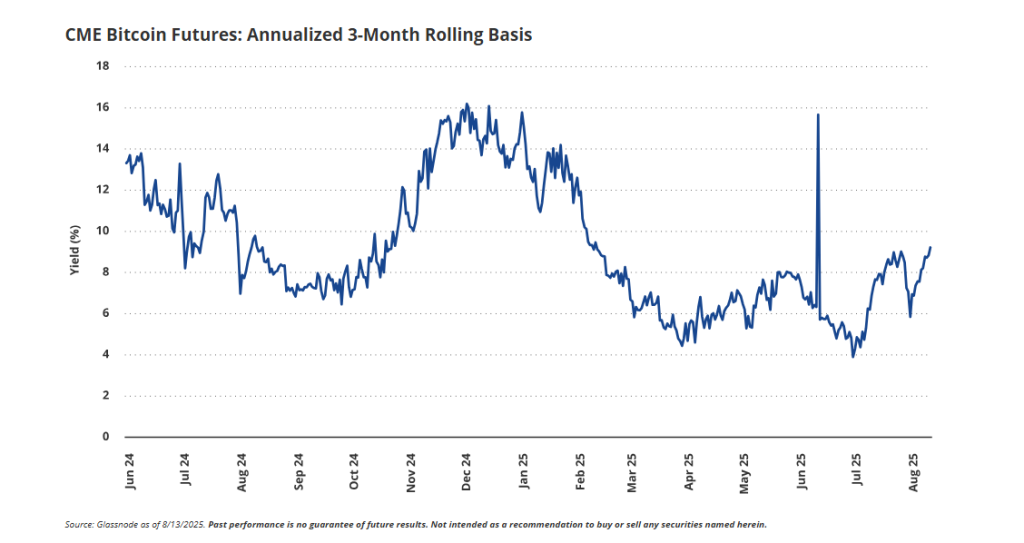

Derivatives metrics back the picture of rising speculative interest. CME basis funding rates have surged to 10%, the highest level since February 2025.

Options markets show call/put ratios hitting 3.21x, the strongest since June 2024, with investors spending $792 million on call premiums.

Yet implied volatility has compressed to 32%, well under the one-year average of 50%, which makes options cheaper for buyers.

On the other hand, futures open interest sits over $6 billion, though a $2.3 billion unwind in open interest during recent corrections ranks among the larger single-session moves.

Voices Split On How High Bitcoin Could Go

Executives and analysts disagree on the pace and peak of the rally. Coinbase CEO Brian Armstrong joined figures such as Jack Dorsey and Cathie Wood in suggesting Bitcoin could reach $1 million by 2030, citing clearer rules and wider institutional adoption.

Galaxy Digital’s Mike Novogratz warned that a million-dollar level would more likely reflect severe US economic stress than normal market strength.

Preston Pysh flagged concerns about how Wall Street’s growing role might change Bitcoin’s use and culture.

Support Levels And Technical

Technically, many market watchers view the $100,000-$110,000 range as key support. A decisive break below $112,000 could push prices toward $110,000 and, in a deeper move, $105,000.

For now, the story is mixed. Institutional demand and speculative derivatives flows are pushing price pressure higher, while cheap options and compressed volatility make bullish bets less costly.

Whether that combination lifts Bitcoin to VanEck’s $180,000 target will depend on continued inflows and whether key support holds.

Featured image from Meta, chart from TradingView