MGBX Review: Is It Safe to Buy & Sell Cryptos in 2025?

MGBX is a global cryptocurrency exchange that allows people to buy, sell, and trade major crypto assets. The exchange offers fast transactions, a user-friendly app, and strong security for traders worldwide. The best features of MGBX are spot trading, no-KYC trading, copy trading, competitive fees, futures trading, and C2C trading.

MGBX is a safe and legitimate exchange for buying and selling crypto, with robust security features like Google Authenticator, an insurance fund, IP binding, a risk control system, SSL encryption, and 24/7 monitoring.

In this MGBX review, you will learn what MGBX is, its pros and cons, and where it is available globally. You will also discover the best features of MGBX and understand the trading fees. In the end, you will get a step-by-step guide to open an account and start buying or selling crypto on MGBX.

MGBX Review: What Is It?

MGBX is a global cryptocurrency exchange platform that was officially launched when Megabit rebranded in April 2025. This rebrand came with a fresh website, new app interface, and global service upgrades. Users can buy, sell, and manage cryptocurrencies through various trading options on this platform.

The exchange offers several core services. It supports spot trading, contract trading, copy trading, and wealth management products, along with some advanced features, including AI-driven trading predictions and slippage compensation insurance. The exchange supports major cryptocurrencies, including BTC, ETH, and SOL, and more. It also uses a fast and secure matching engine, and VIP users can enjoy fee discounts. MGBX offers WebSocket-compatible trading APIs that enable automated orders and real-time market data.

MGBX is highly secure, with the majority of the funds stored in multi-signature protected cold wallets. It also has a $50 million safety fund and conducts frequent audits. The MGBX mobile app, available on Android and iOS, is fast and straightforward for trading, deposits, and withdrawals. Additionally, you can track markets, create alerts, and manage your account. MGBX provides live chat assistance via its website and app around the clock.

| Launched Date | 2025 |

| Supported Cryptocurrencies | Over 136 major coins (BTC, ETH, USDT, etc.) |

| Trading Fees | 0.1% Maker Fee / 0.1% Taker Fee |

| No-KYC Trading | Yes. You can trade and withdraw without ID verification |

| Withdrawal Limit Without KYC | Up to $100,000 USDT per day |

| Trading Features | Spot trading, Futures (Contracts), Copy trading, and C2C (Peer-to-peer) |

| Licensed Exchange | No official license disclosed |

| Insurance Fund | $50 million risk reserve fund for emergency protection |

| Security Measures | Google Authenticator, Cold Wallets, Anti-phishing code, IP binding, and more |

| U.S. Availability | No |

| Mobile App | Available on Android and iOS for trading on the go |

What Are the Pros of MGBX?

The pros of MGBX are a wide range of trading services, strong security, high privacy features, high-speed trading, copy trading, and $50 million risk fund.

- Wide Range of Trading Services: MGBX offers spot trading, contract trading, copy trading, and wealth‑management tools. Plus, it also has features like AI‑driven trade predictions and slippage insurance.

- Strong Security: The exchange has top-level security, as it uses a multi-layer system to keep user funds safe. Most funds are stored in cold wallets, disconnected from the Internet. Thus, this protects funds from online attacks.

- Privacy Features: MGBX protects user information with strong encryption, and this means that personal details and asset information are kept private and secure. Also, No-KYC trading enhances privacy, allowing withdrawals up to $100,000 USDT daily.

- High-Speed Trading: The platform is built for rapid trading. It has a low latency, so trades can be executed almost instantly.

- Copy Trading: The exchange has a smart copy trading feature to lets users automatically copy the trades of experienced traders. This enables new users to earn profits without managing trades themselves.” This is professional, specific, and avoids casual language.

- Risk Fund: MGBX has a risk fund of $50 million in USDT. The fund is primarily used to protect user assets and provide a safety net in emergencies.

What Are the Cons of MGBX?

The cons of MGBX are possible regulatory gaps, limited coin support, and limited transparency on independent audits.

- Possible regulatory gaps: There is no clear proof of formal regulation or licensing. Regulatory clarity is limited for global users.

- Limited Coin Support: The exchange supports around 136 cryptocurrencies for trading. So, you won’t find newly launched altcoins.

- Limited transparency on independent audits: Even though security audits are claimed, we didn’t find any independent third‑party audit reports published. Hence, limiting full transparency.

What Are the MGBX Restricted Countries?

MGBX restricted countries are Hong Kong, Cuba, Iran, North Korea, Crimea, Sudan, Malaysia, Syria, the United States, Puerto Rico, American Samoa, Guam, or the Northern Mariana Islands. You cannot open a position or enter into a contract if you are a resident of these regions.

What Are the MGBX Supported Countries?

MGBX is a global crypto exchange that supports users from 100+ countries, and it allows trading without mandatory KYC, meaning you can trade and withdraw up to 100,000 USDT daily without verifying your identity. So, this makes it accessible for people in many regions who prefer privacy or quick setup.

Also, residents of regulated countries like the U.S., U.K., or Canada must comply with local crypto laws, as MGBX lacks compliance. Hence, you must not use the platform, even though it offers no-KYC access. Always respect local laws.

How Many Cryptocurrencies Are Available on MGBX?

MGBX offers around 136 popular cryptocurrencies, focusing mainly on popular and liquid tokens such as Bitcoin (BTC), Ethereum (ETH), and Solana (SOL).

It avoids listing low‑liquidity altcoins or obscure tokens, and you will find major trading pairs like BTC/USDT, ETH/USDT, SOL/USDT, and well‑established stablecoins (USDT, USDC). MGBX typically adds popular coins based on user demand and market trends.

What Are the Best Features of MGBX?

The best features of MGBX are spot trading, copy trading, contract trading with 200x leverage, and C2C trading.

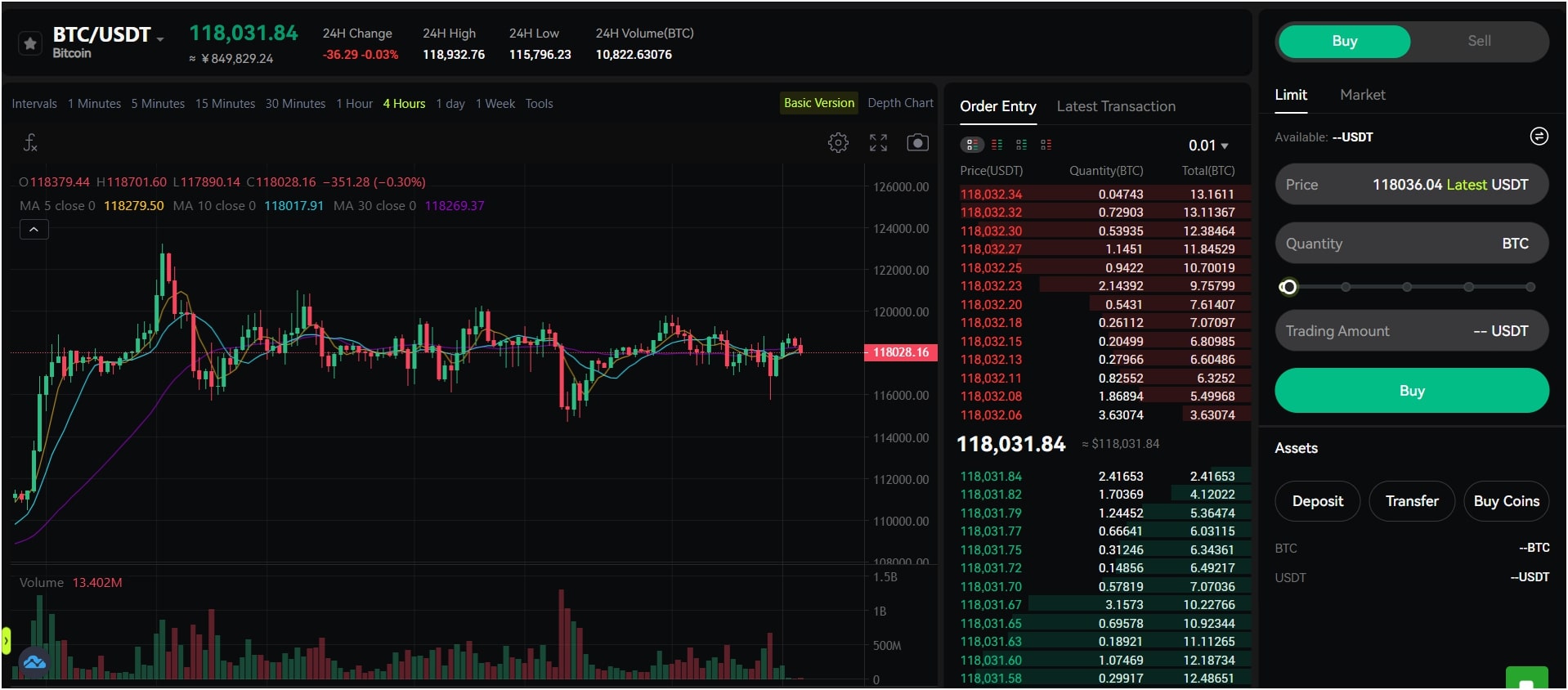

MGBX Spot Trading

Spot trading on MGBX is real-time buying and selling of crypto using your own funds. You generally need to move assets like USDT or BTC into the spot account, choose a trading pair such as BTC/USDT or ETH/USDT, then place either a market order that executes immediately at the best available price or a limit order where you set the price you want.

Market orders ensure execution but may face slippage, while limit orders offer price control but may not fill due to insufficient liquidity. You pay standard fees of 0.1% for both maker and taker trades. Spot orders are always matched quickly using a high‑speed matching engine, and charts, depth data, order history, and K‑line visuals help you manage trades, and everything works 24/7 in-app or on desktop.

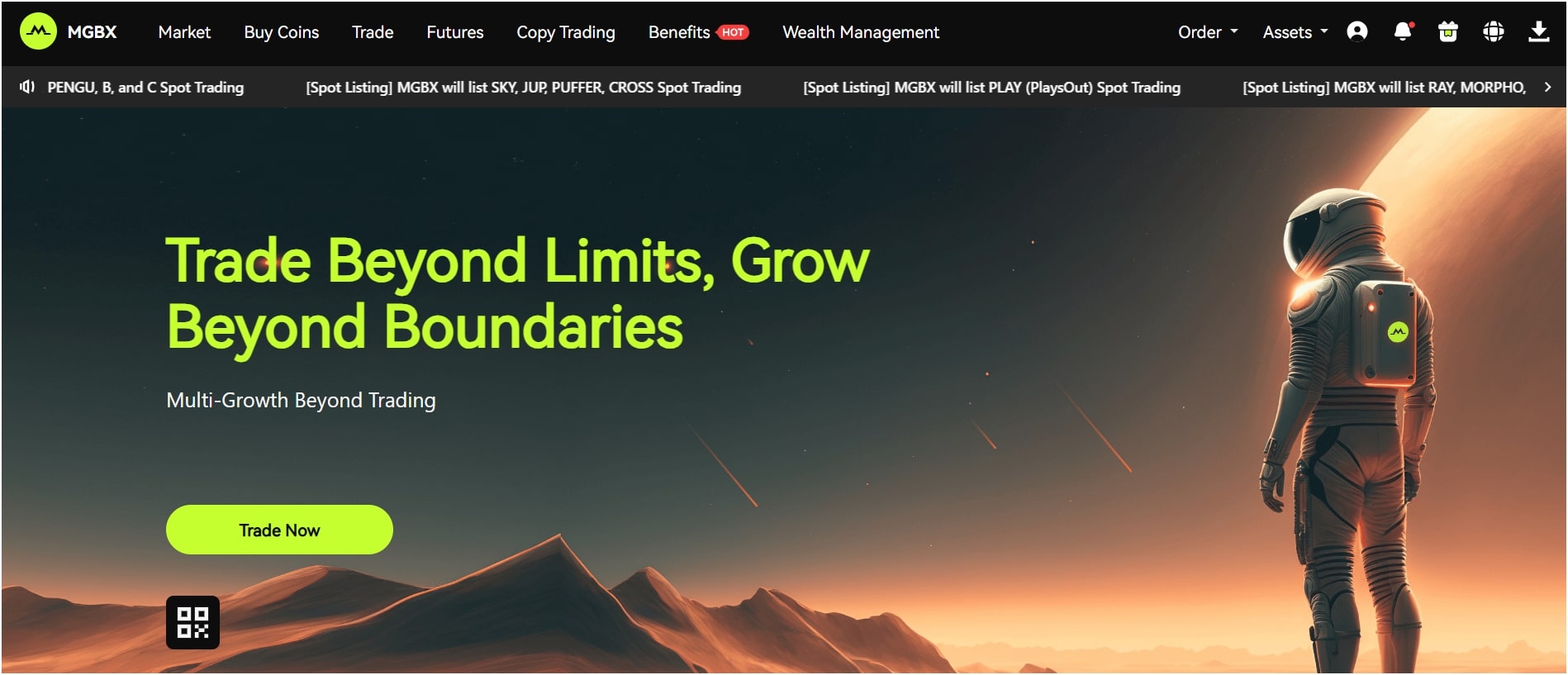

MGBX Copy Trading

MGBX offers a simple and beginner-friendly copy trading feature. Copy trading enables you to automatically replicate professional traders’ strategies, ideal for beginners. You do not need to make trading decisions yourself. All you need to do is choose a trader from the MGBX leaderboard and set your copy amount, and then, you can copy using a fixed margin (like $100 per trade) or a fixed percentage of your total balance. The system places the same trades in your account as the trader you follow, without any manual work. Additionally, you can stop copying at any time, and your funds remain under your control.

This feature benefits beginners, those with limited time, or users unfamiliar with trading strategies. MGBX only charges a fee if your copy trades make a profit, and if no profit is made, no fee is charged. You can copy one or more traders and select which coins to include. It works 24/7, even if your device is offline.

Copy trading carries risks: if the trader you follow incurs losses, so will you. Some traders may use high-risk strategies, such as leverage. So, you should check their past performance and trading style before copying.

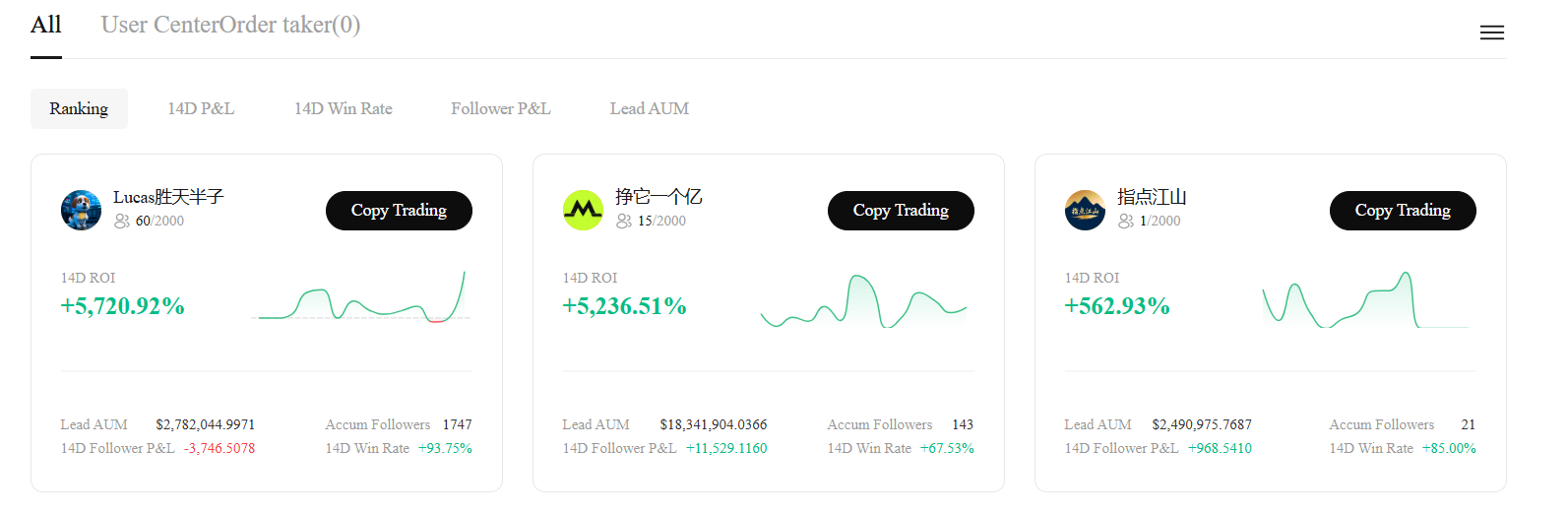

MGBX Contract Trading

MGBX contract trading lets you trade cryptocurrency with leverage using perpetual contracts. These contracts do not have any expiry date, and you can even hold them as long as you want. You can open both long and short positions, which means you can make a profit whether the market goes up or down, and the platform supports leverage up to 200×.

You can trade top cryptocurrencies like BTC and ETH using this feature, and MGBX also offers tools like stop-loss, take-profit, and conditional orders to help you manage risks and lock in profits. For futures trading, MGBX supports two margin modes, including isolated and cross margin:

- In Isolated Margin Mode, each position has its own margin. So, if that trade performs badly, only the margin for that trade is at risk, and other positions stay safe and are not affected.

- In Cross Margin Mode, all your funds in the contract account are shared across your open positions. Hence, if one position is losing money, it can use the remaining margin from your balance to avoid liquidation.

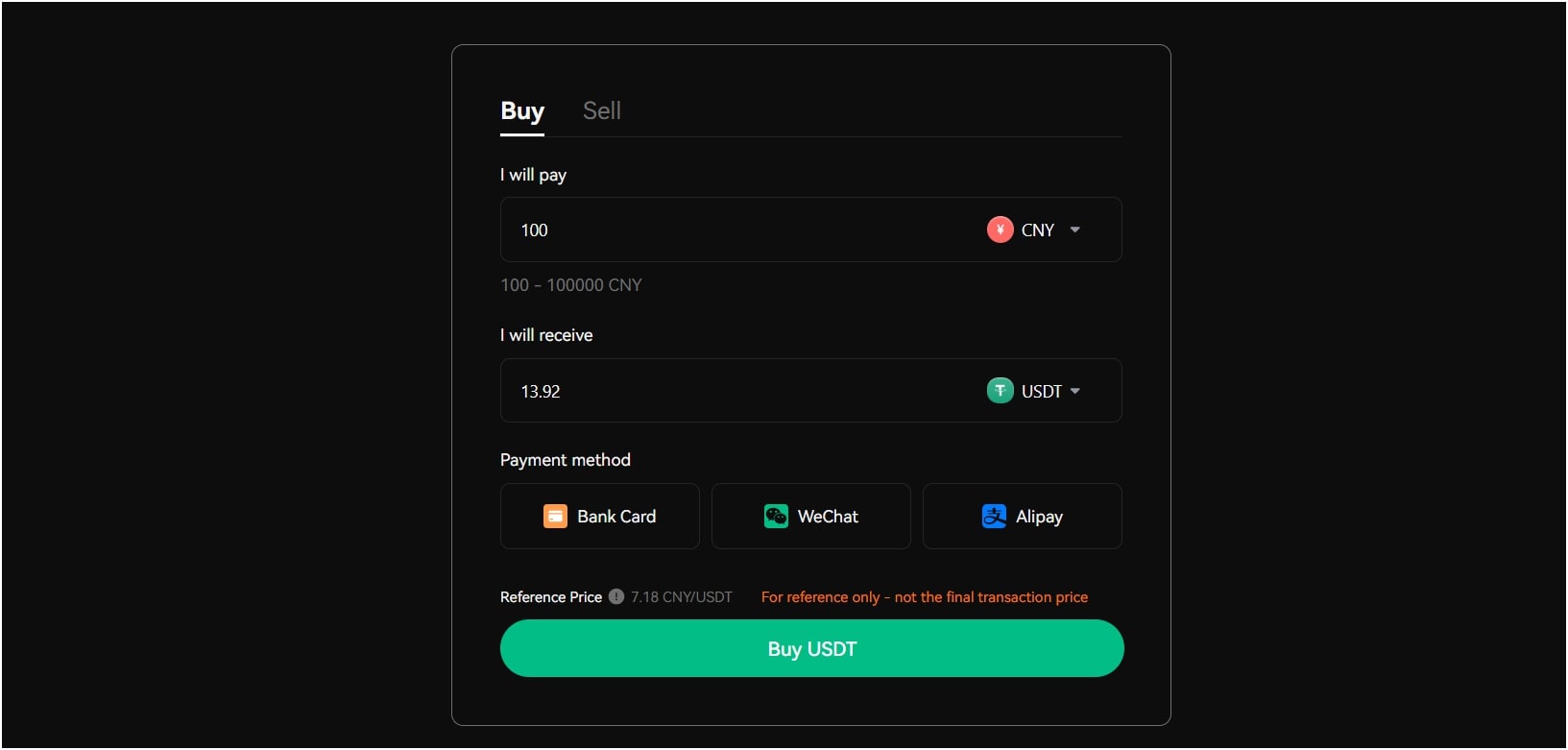

MGBX C2C Trading

C2C trading on MGBX is peer‑to‑peer crypto trading between users and verified merchants. Users can buy or sell crypto directly through merchant advertisements. To become a merchant, KYC is required, deposit a security bond, accept strict rules on pricing, order handling, and dispute resolution, and maintain account quality.

To start using C2C trading, you need to select an advertisement, pay the merchant outside the platform (via bank transfer, etc.), and then confirm so the merchant releases the crypto. Merchants must complete orders within minutes of payment, or failure to comply results in penalties or deposit forfeiture.

What Are Trading Fees on MGBX?

The trading fees on MGBX follow clear and consistent rules. For spot trading, both maker orders (those that add liquidity) and taker orders (those that remove liquidity) are charged at 0.1% of the trade amount. That means whether you set a limit order or take a current market order, you will pay the same 0.1% fee when your order executes. MGBX does not offer maker‑taker discounts, and there are no tiered fee reductions based on volume. All spot trading pairs follow this fee rate without exception.

For perpetual contract trading, fees are lower. There is a maker fee of 0.03% and a taker fee of 0.05%. MGBX also charges a funding fee periodically (usually every eight hours) to align the perpetual contract price with the spot price; this fee is paid directly between traders and not collected by MGBX itself.

Also, the Deposit of crypto assets is generally free, though network transaction costs apply depending on the blockchain used. Withdrawal fees depend on the network: for USDT, the platform charges 1 USDT via TRC‑20, 3.5 USDT via ERC‑20, and 0.5 USDT via BEP‑20 per transaction.

How to Open a New Account to Buy and Sell Crypto on MGBX?

To open a new account to buy and sell crypto on MGBX, you need to register an account using email, secure it with 2FA, deposit funds, and start trading crypto.

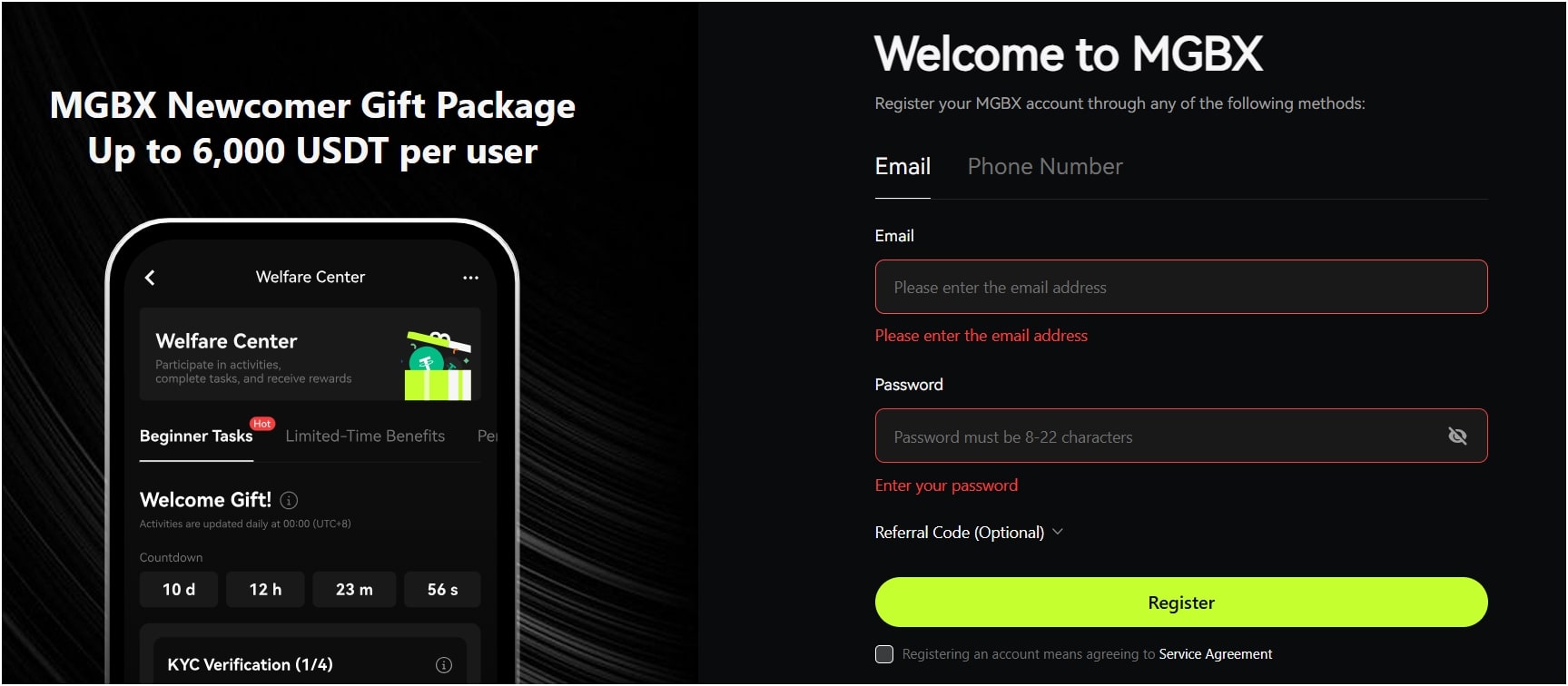

Step 1: Create a New MGBX Account

To begin, go to the official MGBX website. On the homepage, click the “Register” button in the top right corner. You can register using your email address or mobile number, and after entering your details, create a strong password and agree to the user agreement and privacy policy. Here, you can add our MGBX referral code “MmevcCzN” to get a free crypto sign-up bonus.

Once done, you will receive a verification code by email or SMS. Enter the code to confirm your registration. Now, after this, your new MGBX account will be successfully created and ready for use. Also, if you are looking for more sign-up bonuses from crypto exchanges, you can check out our Bitget referral code.

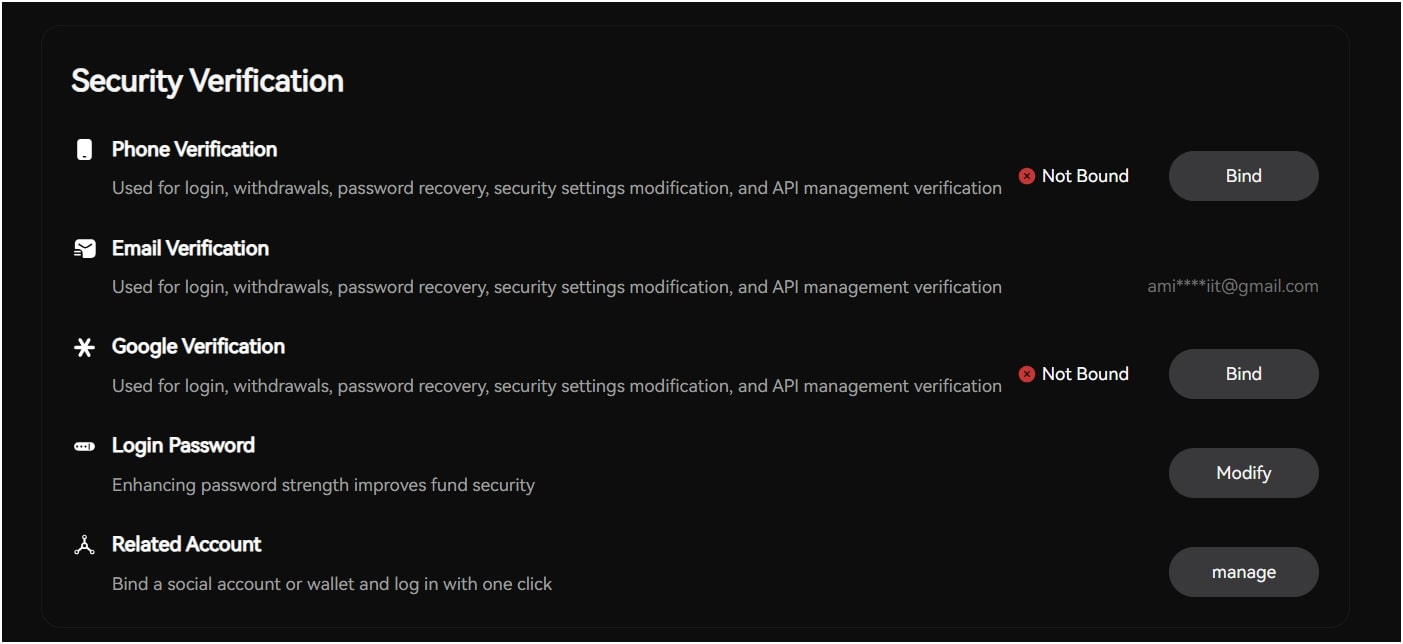

Step 2: Secure Your Account with 2FA

Go to your account settings, click “Security Center”, and set up Google Authenticator or another two-factor authentication (2FA) method. Now, with this 2FA enabled, every login or withdrawal will require a special code from your authentication app, and this step is very important to protect your crypto funds from unauthorized access.

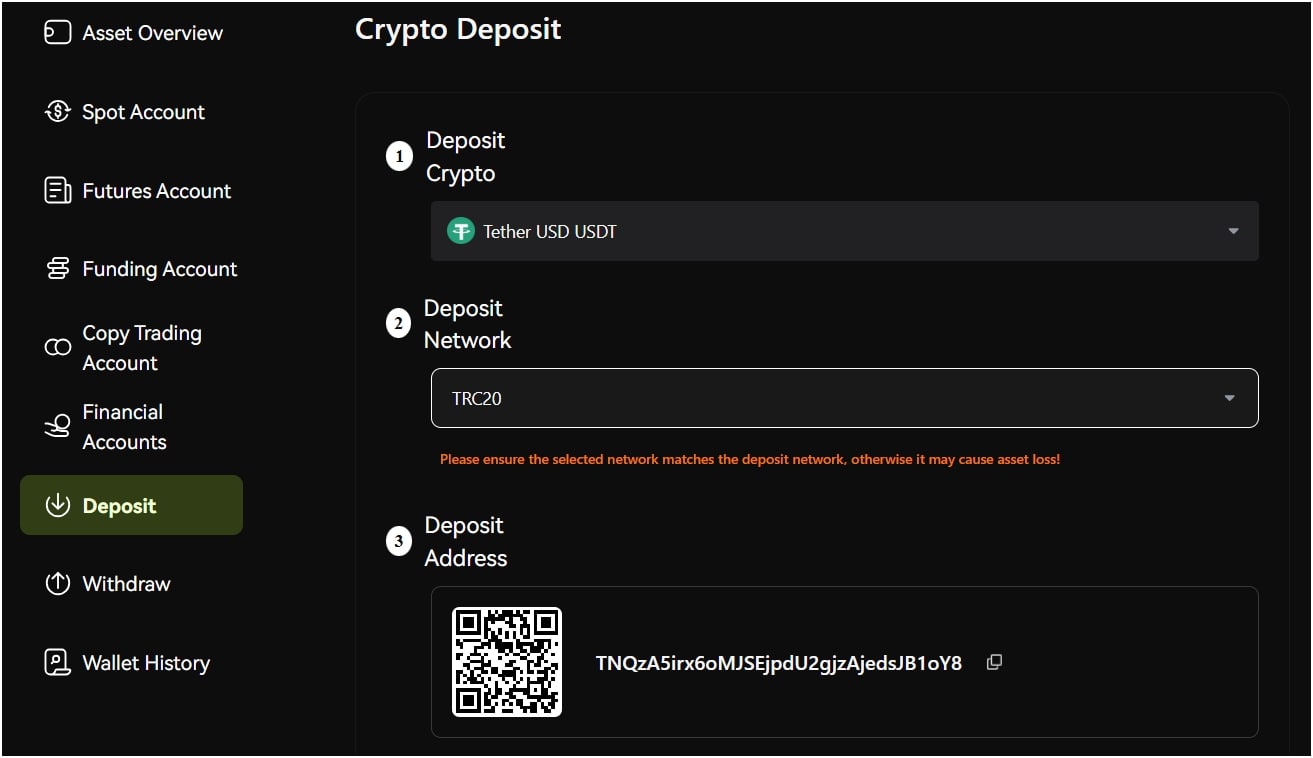

Step 3: Deposit Funds

Now that your account is active and secure, go to the “Assets” section and click on “Deposit.” Choose the cryptocurrency you want to deposit, such as USDT or BTC, and select the blockchain network (like TRC-20, ERC-20, or BEP-20). Now, you will receive a deposit address, and copy that address and send your crypto from your wallet or another exchange. Once confirmed on the blockchain, your funds will appear in your MGBX wallet.

Step 4: Start Buying and Selling Crypto

Go to the “Trade” section. You can choose between spot trading and contract trading based on your needs, and pick a trading pair like BTC/USDT or ETH/USDT. You can place a market order if you want to buy or sell instantly at the current price, or choose a limit order to set your own price. When the trade is complete, your updated balance will show in your account, and you can then hold your crypto, trade again, or withdraw to your personal wallet whenever needed.

Is MGBX Safe and Legit to Buy and Sell Crypto in 2025?

Yes, MGBX is considered a safe and legit exchange to buy and sell crypto. The platform’s top security measures include an advanced risk control system, SSL encryption, withdrawal & transaction monitoring, an insurance fund, and 2FA.

- Advanced Risk Control System: MGBX uses a strict risk control system that can detect and block suspicious trading activities. It watches for things like wash trading, short holding times under 40 seconds, and hedge trading across multiple accounts. If such activity is detected, the system may cancel trades, freeze accounts, or report the incident.

- Data Protection and Encryption: The exchange protects user data using SSL encryption, firewalls, and access controls. Your personal information, trading history, and login activity are protected through multiple layers of digital security. This reduces the risk of hacking or data leaks via phishing or malware.” This specifies the subject and uses precise terminology.

- Withdrawal and Transaction Monitoring: MGBX tracks all deposits, trades, and withdrawals in real time, and if the system sees high‑risk patterns or fast fund movements that look abnormal, it can pause the withdrawal or limit account access to prevent theft or illegal transfers. This monitoring system runs 24/7.

- Insurance Fund: The exchange has a $50 million insurance fund to cover major losses during extreme market conditions or liquidation events, and the fund is set aside to protect users in case of sudden platform issues, crashes, or losses due to abnormal volatility.

- Google Authenticator (2FA): You are also strongly encouraged to enable Google Authenticator (2FA) on your account. Once set up, 2FA adds a second layer of protection for logins, withdrawals, and security changes.

Does MGBX Require KYC to Withdraw?

MGBX does not require KYC to withdraw funds from your account. This is because it is a no-KYC exchange, which means you can deposit, trade, and withdraw crypto without submitting ID or documents. You can open an account and start using the platform right away. However, if you want to increase limits or become a C2C merchant, KYC verification is required.

What Is the MGBX Withdrawal Limit Without KYC?

The MGBX withdrawal limit without KYC is up to $100,000 USDT per day. Hence, unverified users can move large amounts of crypto without uploading any ID or going through the full verification process, as the platform gives this high limit to make trading smooth and private for global users. This withdrawal cap applies across supported networks, including TRC-20, ERC-20, and BEP-20. Once the limit is reached, you must wait until the next 24-hour window resets.

What Are the Best Alternatives for MGBX?

The best alternatives to the MGBX crypto exchange include Binance, Bitget, and MEXC. These platforms offer advanced crypto trading tools, support more coins, and have strong global reputations. MGBX and MEXC both allow no-KYC trading with good withdrawal limits, but the others are more regulated, established, and widely trusted. You can also read our full MEXC review for more info. The top MGBX alternatives are summarized in the comparison table below:

| Criteria | MGBX | Binance | Bitget | MEXC |

| Launched Date | 2025 | 2017 | 2018 | 2018 |

| Supported Coins | 136+ | 450+ | 1,600+ | 3000+ |

| Trading Fees | 0.1% maker / 0.1% taker | 0.1% maker / 0.1% taker | 0.1% maker / 0.1% taker | 0% maker / 0.05% taker |

| No-KYC Trading | Yes | No | No | Yes |

| Withdrawal Limit (No-KYC) | $100,000 USDT/day | – | – | 10 BTC/day |

| Trading Features | Spot, Futures, Copy, C2C | Spot, Futures, Copy, Margin, Options trading, P2P | Spot, Futures, Copy, Margin, trading bots, P2P | Spot, Futures, Grid, Copy |

| Licensed | No | Yes (Multiple global licenses) | Yes | No |

| Insurance Fund | $50M Risk Reserve | SAFU Fund (Over $1 Billion) | $600M Protection Fund | Basic insurance available |

The post MGBX Review: Is It Safe to Buy & Sell Cryptos in 2025? appeared first on CryptoNinjas.