Bitcoin Bull Market Is Over? Analyst Calls 50% Crash To $60,000

In a post shared on TradingView, crypto analyst Xanrox argues that the current bullish cycle is nearly over, pointing to a potential downtrend that would see the Bitcoin price crash to $60,000. This analysis comes as Bitcoin is trading within a very quiet phase, prompting many crypto traders and crypto analysts to start reassessing its next direction.

Xanrox Predicts Bitcoin Top At $122,000 And Crash To $60,000

The world’s largest cryptocurrency has been hovering just above the $118,000 price level for several days now, struggling to break decisively above this zone but also showing no major signs of a breakdown. Despite this consolidation, market sentiment remains upbeat.

The crypto fear and greed index continues to flash “greed,” and most analysts still argue that Bitcoin is setting up for another leg upward. However, an interesting technical outlook challenges this bullish consensus and issues a crash warning.

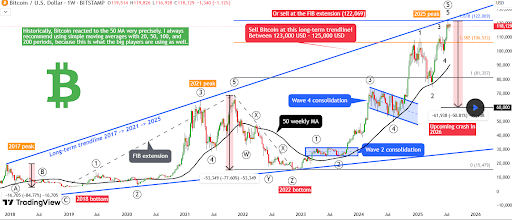

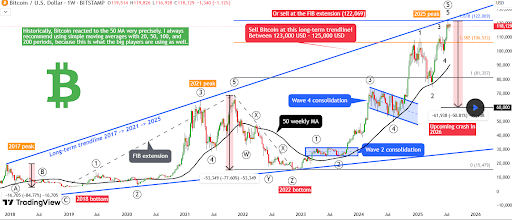

Notably, crypto analyst Xanrox identified a sell signal on the weekly candlestick timeframe chart after Bitcoin reached the 1.618 Fibonacci extension and touched the long-term 2017–2021–2025 trendline, with the latest touch of the trendline aligning to Bitcoin’s recent all-time high at $122,800.

According to him, the most recent touch of this trendline might be the top of the current cycle. Furthermore, he noted that the Elliott Wave structure has now completed Wave 5 of a rising wedge and a larger Wave 5 impulse move. As such, a corrective phase is about to start.

What’s Next For Bitcoin?

As shown in the chart below, the next major move could be at least a 50% decline, with Bitcoin dropping to around $60,000 by 2026. This projection is based on previous price action, where Bitcoin embarked on 84% and 77% price crashes after touching the trendline in 2017 and 2021, respectively.

The technical setup also aligns with statistical data that shows August and September historically bring increased selling pressure. Xanrox noted that while traders can wait for further confirmation, such as a break below the 50-week moving average, he personally believes the top is already in. Large institutions and professional investors pay close attention to the 20, 50, 100, and 200-period moving averages.

Related Reading: Bitcoin Short Squeeze Incoming As Market Makers Set Trap To Go Above $123,000

Xanrox’s outlook is a sharp contrast to the prevailing sentiment among crypto investors. Bitcoin’s current structure is still showing strength on higher timeframes, and several other analysts see the recent consolidation between $117,000 and $119,000 as a base for continuation toward $130,000 and beyond.

The lack of major sell-side volume, the firm hold above the $118,000 price level and the 50-week moving average, and bullish indicators across altcoins like Ethereum are on-chain signals that the Bitcoin price still has more room to run before it reaches a peak price this cycle.