$1B Mysteriously Moves from “Black Hole Address”, What’s Going On with Tether?

Key Takeaways:

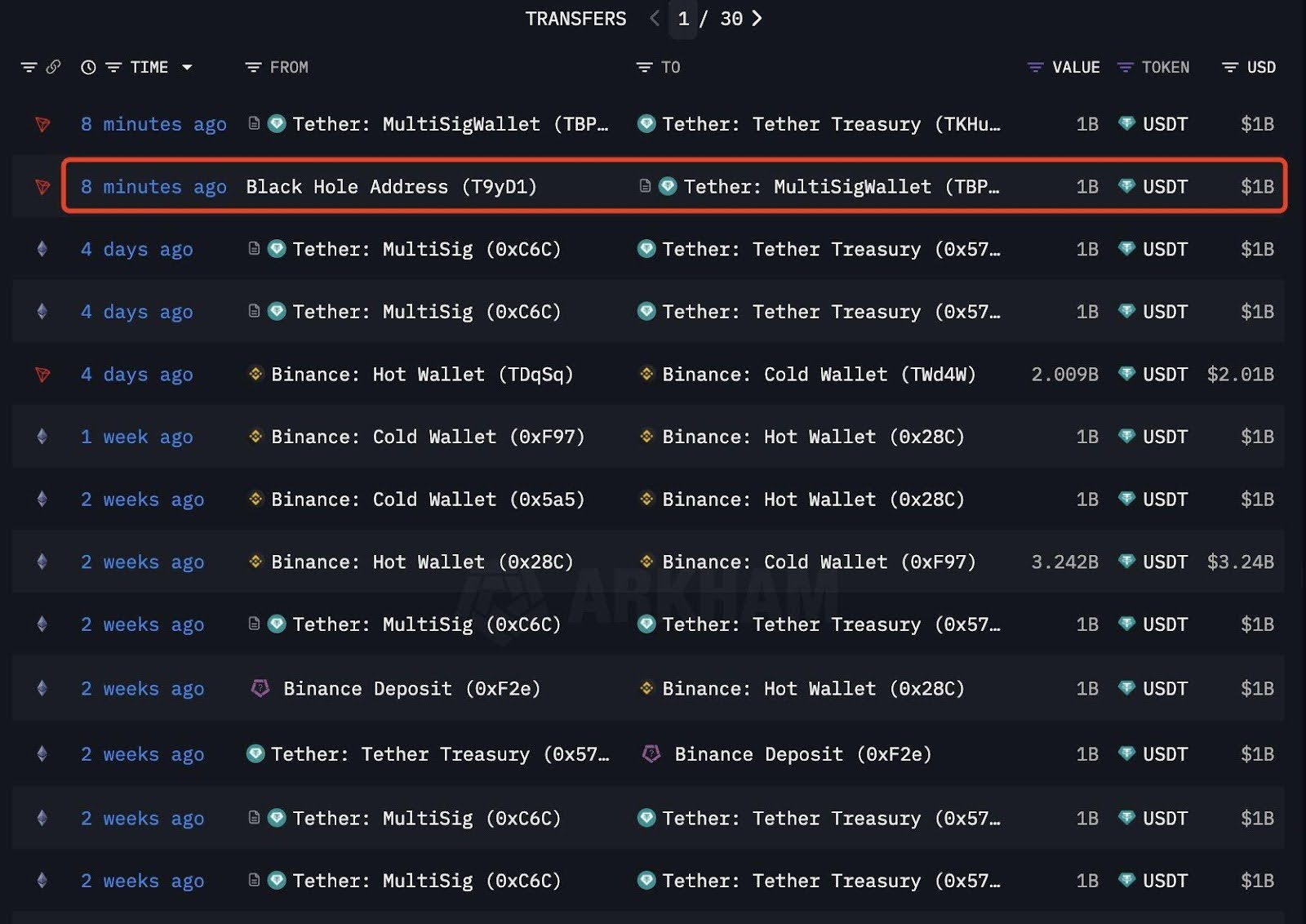

- $1 billion USDT was transferred from a known “Black Hole Address” to Tether’s multisig wallet just few minutes ago.

- Tether has minted $8 billion USDT since July 1, raising concerns about market manipulation or preparation for massive liquidity events.

- Speculation surges as analysts’ debate whether this activity signals institutional demand, arbitrage preparation, or internal rebalancing.

A sudden $1 billion USDT transfer from an address labeled as a “Black Hole” has shaken the crypto community just minutes ago. With no official explanation and mounting recent minting activity, the move raises more questions than answers and could have significant implications for stablecoin dynamics and Bitcoin’s near-term price action.

Read More: Tether Invests in Crystal Intelligence to Combat Illicit Crypto Activity

Unpacking the $1B “Black Hole” Transaction

At approximately 8 minutes before the time of capture, blockchain tracking tool Arkham Intelligence recorded a stunning move: $1 billion USDT was transferred from a wallet labeled “Black Hole Address (T9yD1)” to a Tether Multisig Wallet (TBP…). The phrase “Black Hole Address” typically implies an inaccessible wallet either used for burns or holding unrecoverable assets.

So why did this supposedly inactive or inaccessible address suddenly move a massive $1 billion in USDT?

The Black Hole Mystery

There are three primary interpretations circulating in the community:

- Technical Mislabeling: The address may have been inaccurately labeled a black hole. This isn’t uncommon as third-party blockchain trackers like Arkham or Etherscan sometimes auto-label based on user input or wallet behavior.

- Asset Repatriation: It’s possible this was a strategic retrieval of idle funds held off-market to be repurposed for exchange liquidity.

- Internal Shuffling: Tether may be rebalancing internal wallets to optimize fund deployment across centralized and decentralized exchanges.

Regardless of motive, such a high-value move within minutes of ongoing Tether minting activity (8B USDT in July alone) fuels speculation.

Tether’s Massive July: 8 Billion USDT Minted in 4 Weeks

While today’s $1B movement caught the spotlight, it’s part of a larger trend: Tether has minted 8 billion USDT just since July 1. This is one of the fastest minting sprees in recent memory.

Minting activity spiked mid-July, with Lookonchain and Whale Alert reporting at least four individual $1 billion USDT issuances within a 3-week span. Some of these tokens were held in Tether’s treasury, while others quickly moved to exchanges or market-making entities.

This scale of minting suggests either:

- Anticipation of increased trading demand

- Preparation for new institutional inflows

- Redeployment of reserves to support USDT across DeFi/CeFi bridges

Read More: $110B Shock: Tether Cuts Off Five Major Blockchains in Unexpected Strategic Shift

What Happens After Minting?

It is important to mention: minting is not the process of circulation. The newly created USDT can be held in Tether treasury wallet and not effect markets until the time when it is actually issued.

However, when they do so as today $1B shift, then it is usually an indication that action is about to take place.

Liquidity Expansion or Risk Signal?

Why This Might Be Bullish:

- Institutional Accumulation: These large mints and transfers may signal that major institutions are entering or scaling up positions. Stablecoins like USDT are often a precursor to BTC, ETH, or altcoin purchases.

- Reduced Slippage on CEXs: Deploying stablecoins to exchanges allows for tighter spreads and deeper order books, improving trade execution quality.

- DeFi Market-Making: Large USDT positions are also used to seed liquidity pools on DEXs and L2s, which can drive DeFi activity and yield farming.

But Here’s the Bearish Side:

- Transparency Concerns: The transfer of funds from a wallet with the self-explanatory description of “Black Hole” raises the same preconceived notions of Tether transparency and regulations.

- Regulatory Risks: Regulators especially those in the U.S and the EU have been critical on the issuers of stablecoins. Excess billion-dollar transfers cannot be ignored when they are sudden and unaccounted and more so when they lack corresponding disclosures to the society.

- No Proof of Deployment Yet: There is no proof of deployment yet, which can also be seen on the on-chain data as the funds were moved to a multisig wallet as opposed to directly to exchanges. This may imply that USDT will be idle.

USDT Market Role: Too Big to Ignore

USDT’s dominance in the stablecoin sector gives it immense influence on the broader crypto market. Currently accounting for over 66% of global stablecoin volume, any shift in USDT supply or flow can lead to liquidity shocks, price volatility, or market rallies.

Tether remains the bridge between fiat and digital assets, facilitating:

- Cross-border payments

- DeFi collateral

- Exchange settlement

- OTC trading

Yet, concerns over its reserve audits, particularly after court cases and regulatory heat in 2022–2023, continue to trail the company. Despite publishing quarterly attestations, calls for full public audits remain unanswered.

Strategic Possibilities Behind the Move

So what could today’s $1B transfer mean?

1. Institutional Readiness

Large OTC desks may be preparing for multi-billion dollar trades, often using USDT as collateral or a trading intermediary.

2. Exchange Liquidity Refill

If Binance, Coinbase, or OKX requested more stablecoin float for client withdrawals or trading, Tether may have responded via this route.

3. Arbitrage Preparation

Market makers could be gearing up for arbitrage opportunities across centralized and decentralized platforms, especially if volatility spikes.

4. Network Bridging

The transfer may be linked to a planned L2 bridge deployment or a move across blockchain networks (e.g., TRON to Ethereum), requiring interim holding in a multisig.

The post $1B Mysteriously Moves from “Black Hole Address”, What’s Going On with Tether? appeared first on CryptoNinjas.